Introduction:

Image: wp.kopykitab.com

For those aspiring to embark on a lucrative career in the dynamic world of foreign exchange (forex), understanding the Union Bank of India’s Forex Officer Syllabus 2019 is crucial. This article will delve into the intricate details of the syllabus, highlighting its significance and guiding you through its essential elements. Whether you’re a fresh graduate or a seasoned professional seeking to elevate your skills, this comprehensive guide will equip you for success in the competitive field of forex.

The Significance of the Forex Officer Syllabus:

The Union Bank of India’s Forex Officer Syllabus 2019 serves as a comprehensive roadmap for individuals seeking to enter the forex industry. It outlines the fundamental knowledge and skills required to navigate the complex world of currencies and exchange rates. By mastering this syllabus, you’ll not only gain a deep understanding of forex operations but also enhance your career prospects.

Main Body:

I. Economics and Banking (30%):

- Principles of Macroeconomics and Microeconomics

- Banking Operations and Services

- International Banking and Finance

- Monetary Policy and Financial Markets

II. Foreign Exchange Operations (40%):

- Foreign Exchange Market Overview

- Spot and Forward Exchange Transactions

- Derivatives in Foreign Exchange

- Risk Management in Foreign Exchange

III. Financial Accounting and Analysis (15%):

- Accounting Principles and Standards

- Balance Sheets and Income Statements

- Financial Analysis and Valuation

IV. Laws and Regulations (10%):

- Foreign Exchange Regulation Act

- Prevention of Money Laundering Act

- Banking Regulation Act

V. Risk Management Techniques (5%):

- Exchange Rate Risk Management

- Interest Rate Risk Management

- Credit Risk Management

Understanding the Exam Format:

The Union Bank of India’s Forex Officer Exam comprises two parts:

Part A: Objective Type (75%):

- Multiple Choice Questions (MCQs)

- True or False

- Match the Following

Part B: Descriptive Type (25%):

- Essay-type Questions

Tips for Effective Preparation:

- Begin Early: Give yourself ample time to study thoroughly and avoid last-minute stress.

- Read the Syllabus Carefully: Familiarize yourself with the syllabus and understand the coverage of each section.

- Acquire Textbooks and Study Materials: Invest in comprehensive textbooks and seek additional resources such as online courses and articles.

- Join Study Groups: Engage with other candidates, share notes, and discuss complex topics.

- Practice MCQ and Descriptive Questions: Test your knowledge with mock tests and practice questions.

- Stay Updated with Current Affairs: Keep abreast of the latest news and developments in the forex industry.

Conclusion:

The Union Bank of India’s Forex Officer Syllabus 2019 is a gateway to a promising career in the dynamic world of foreign exchange. By dedicating yourself to understanding the syllabus and developing a solid foundation, you’ll increase your chances of success in the exam. Embrace this opportunity to enhance your knowledge, unlock new horizons in the forex industry, and embark on a fulfilling career path.

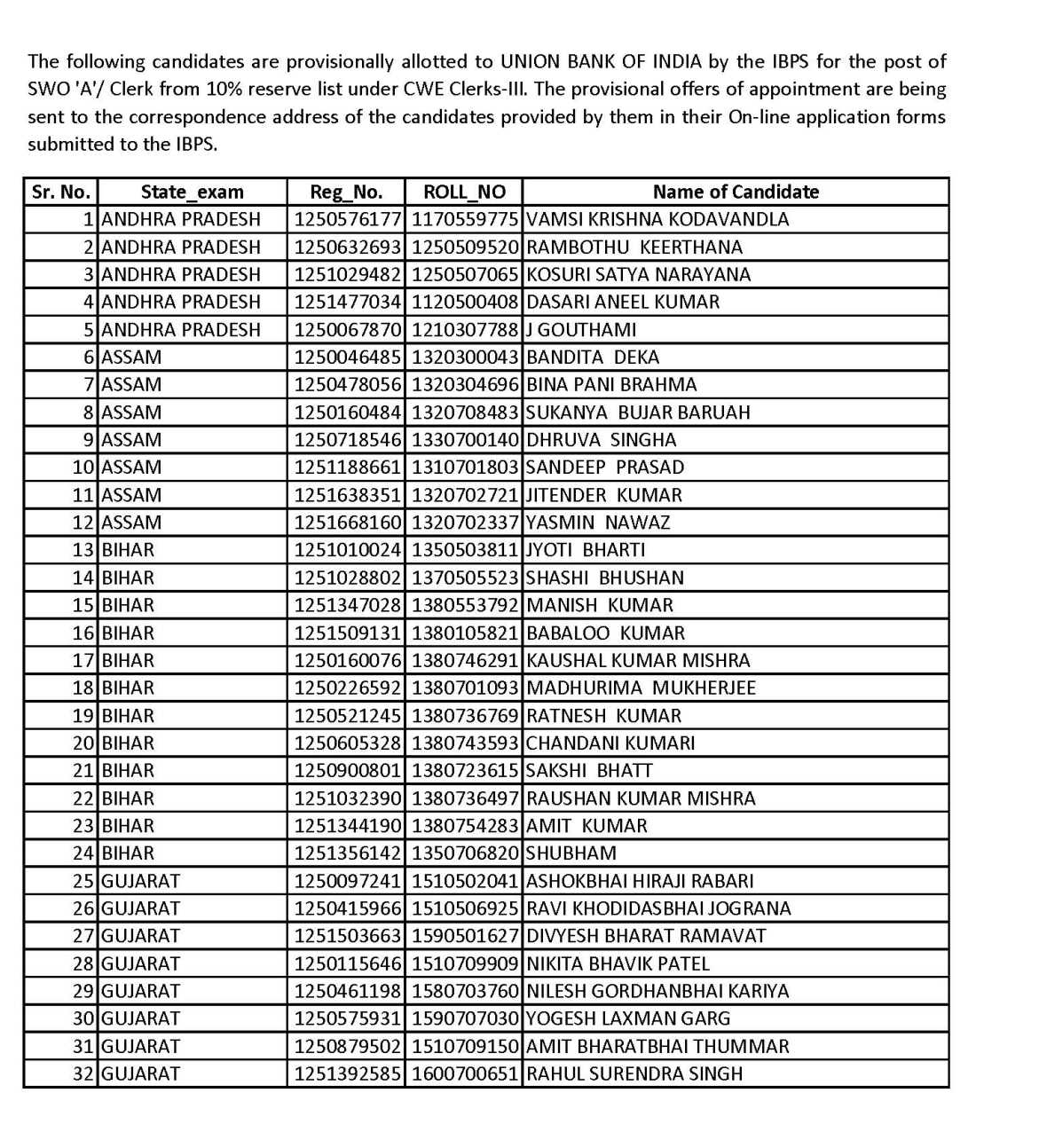

Image: management.ind.in

Union Bank Of India Syllabus 2019 Forex Officer