Introduction

In the ever-evolving digital landscape, businesses confront numerous challenges when navigating cross-border payments. Diverse currencies, complex regulations, and exorbitant fees often hinder seamless global trade. Enter Payoneer, a groundbreaking unified payment integrator that unlocks a world of financial convenience and efficiency for both businesses and individuals. This article delves into the world of Payoneer, exploring its transformative capabilities and the myriad advantages it offers to global enterprises.

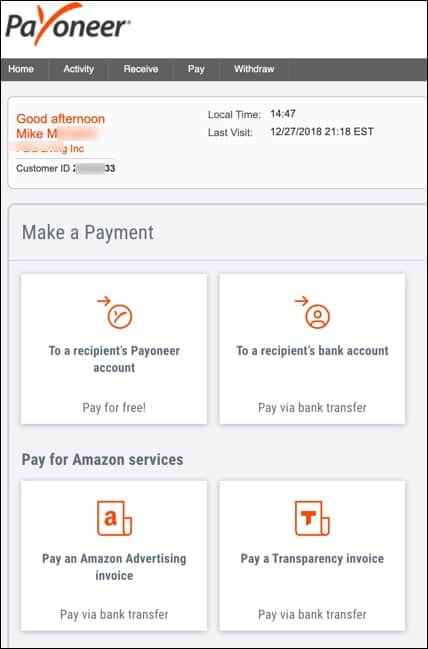

Image: www.behance.net

Payoneer has emerged as a pioneer in the financial industry, offering an all-encompassing solution that streamlines cross-border payments, simplifies foreign exchange operations, and enables businesses to operate seamlessly in the global marketplace. Its fully integrated platform consolidates diverse payment methods into a single, user-friendly interface, empowering companies to send and receive funds effortlessly across different countries and currencies. By leveraging Payoneer’s robust infrastructure and expertise, businesses gain not only operational efficiency but also significant cost savings.

Dispelling Forex Complexities: Payoneer’s Currency Exchange Expertise

One of the most significant challenges businesses face in international trade is managing currency exchange risks and complexities. Fluctuating exchange rates can significantly impact profit margins, making it crucial for companies to secure competitive rates and execute transactions at the right time. Payoneer’s comprehensive suite of forex services empower businesses to overcome these challenges by offering real-time currency exchange rates, tailored hedging solutions, and expert guidance. This comprehensive approach enables companies to lock in favorable exchange rates, protect profit margins, and make informed decisions about their international financial operations.

Embracing Flexibility: Payoneer’s Multitude of Payment Options

In an increasingly globalized business environment, flexibility is paramount. Businesses demand a comprehensive range of payment options to meet varying customer preferences and comply with different regional regulations. Payoneer recognizes this need by providing a diverse suite of payment solutions that cater to a global client base. From bank transfers and credit cards to e-wallets and prepaid cards, Payoneer empowers businesses to send and receive payments in the most convenient and cost-effective manner. This flexibility empowers businesses to optimize cash flow, cater to global clientele, and expand their reach in new markets.

Cross-Border Payments Made Easy: Unifying Global Transactions

Cross-border payments often involve a multitude of intermediaries and intermediaries, leading to delays, hidden fees, and a lack of transparency. Payoneer transcends these barriers by providing a direct and secure payment channel that connects businesses directly with their global counterparts. Through its advanced technology, Payoneer eliminates the need for third parties, enabling businesses to send and receive payments swiftly, securely, and with exceptional cost efficiency. This streamlined process reduces transaction times, lowers costs, and provides real-time visibility into cross-border payments, empowering businesses to manage their cash flow effectively.

Image: www.globalfromasia.com

Accelerating Global Expansion: Empowering Businesses to Venture Beyond Borders

The allure of global expansion is undeniable, yet navigating the regulatory complexities and logistical hurdles can be daunting. Payoneer serves as a trusted partner for businesses seeking to break into new markets by providing comprehensive support and guidance. With its extensive global network of local experts and regulatory compliance, Payoneer helps businesses understand and meet local regulations, open foreign bank accounts, and establish local entities. This seamless navigation of international complexities allows businesses to accelerate their global expansion, capitalize on new market opportunities, and elevate their brand presence on a global scale.

Tailored Solutions: Payoneer’s Custom-Fit Approach to Financial Needs

Every business is unique and faces a distinct set of challenges in its international financial operations. Payoneer acknowledges this diversity by tailoring its solutions to meet the specific needs of each client. Its team of financial experts works closely with businesses to understand their objectives, challenges, and industry trends. By customizing its services to align with individual requirements, Payoneer delivers tailored solutions that optimize financial efficiency, drive growth, and empower businesses to thrive in the global marketplace.

Unified Payment Integrator Payoneer Forex

Conclusion

In a world of interconnected commerce, the ability to transact seamlessly across borders is fundamental to business growth and competitiveness. Payoneer’s unified payment integration platform empowers businesses to navigate the complexities of cross-border payments, foreign exchange operations, and international expansion. By consolidating diverse payment methods, providing real-time currency exchange services, and offering tailored solutions, Payoneer reduces costs, enhances efficiency, and simplifies financial operations for global enterprises. As a trusted partner with a wealth of expertise, Payoneer positions businesses for success in the ever-evolving landscape of international trade. Embracing the power of Payoneer, businesses unlock the potential for global growth, enhanced profitability, and a truly unified experience in their cross-border financial operations.