Financial reporting and accounting in an international business context involve complexities due to varying currencies. As businesses engage in cross-border transactions, fluctuations in foreign exchange rates can impact their financial statements. Tally ERP 9, a widely used accounting software in India, offers features to manage foreign currency transactions and record the resulting foreign exchange gains or losses. This article will delve into the concept of unadjusted forex gain loss, its treatment in Tally ERP 9, and its implications for businesses.

Image: www.youtube.com

Understanding Unadjusted Forex Gain Loss

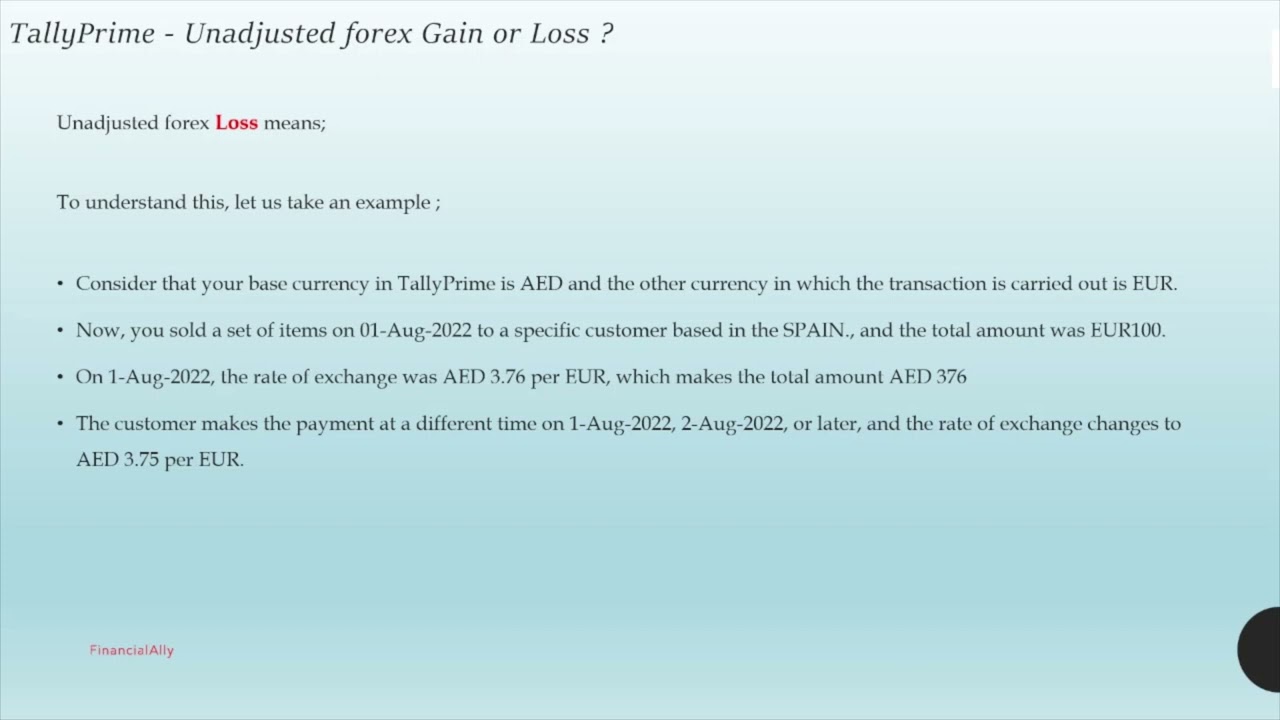

Unadjusted foreign exchange gain or loss refers to the unrealized gain or loss arising from the difference between the historical exchange rate and the current exchange rate applicable to outstanding foreign currency transactions. This gain or loss is called ‘unadjusted’ because it is not yet realized and is recognized only when the underlying transaction is settled. It represents the potential gain or loss that may be realized or incurred when the foreign currency transaction is eventually settled at the prevailing exchange rate.

Treatment of Forex Gain/Loss in Tally ERP 9

Tally ERP 9 allows businesses to track and record foreign currency transactions, including the recognition of unadjusted forex gain/loss. The software provides the flexibility to define multiple currencies and set exchange rates. By enabling the ‘Maintain Foreign Currency Accounts’ option, businesses can create foreign currency ledger accounts to record transactions in foreign currencies.

-

Realized Gain/Loss: When a foreign currency transaction is settled, the realized gain or loss is calculated and recognized in the profit or loss statement. This gain or loss is the difference between the foreign currency transaction amount converted at the historical exchange rate and the foreign currency transaction amount converted at the current exchange rate.

-

Unadjusted Gain/Loss: Tally ERP 9 provides a feature to record unadjusted forex gain or loss. This feature allows businesses to recognize the potential gain or loss on outstanding foreign currency transactions based on the current exchange rate. The unadjusted forex gain/loss is recorded in the ‘Forex Gain/Loss’ account and is considered an unrealized gain or loss until the transaction is settled.

-

Maintaining Exchange Rate Fluctuation Account: To track the cumulative unadjusted forex gain or loss, Tally ERP 9 provides an ‘Exchange Rate Fluctuation’ account. This account captures the net effect of the unrealized gains or losses on outstanding foreign currency transactions. The balance of the ‘Exchange Rate Fluctuation’ account represents the cumulative unrealized forex gain or loss.

Implications for Businesses

Managing unadjusted forex gain/loss is crucial for businesses engaged in international trade and foreign currency transactions. It has implications for various aspects of financial management and reporting.

-

Financial Reporting: Unadjusted forex gain/loss can impact financial statements, particularly the income statement and balance sheet. The recognition of unrealized gains or losses can affect net income and equity. Proper accounting and disclosure of forex gain/loss are essential for accurate financial reporting.

-

Financial Planning: Unadjusted forex gain/loss can influence financial planning and decision-making. Businesses need to consider the potential impact of exchange rate fluctuations on future cash flows and profitability. By closely monitoring unadjusted forex gain/loss, businesses can make informed decisions and mitigate risks.

-

Tax Implications: In some jurisdictions, realized and unrealized forex gains or losses may have tax implications. Businesses need to be aware of the tax laws and regulations related to forex transactions to ensure proper tax treatment.

-

Cash Flow Management: While unadjusted forex gain/loss is unrealized, it can impact cash flow when the underlying transactions are eventually settled. Monitoring and managing unadjusted forex gain/loss can help businesses anticipate potential cash flow fluctuations and plan accordingly.

-

Risk Management: Unadjusted forex gain/loss can expose businesses to foreign exchange risk. By understanding and managing unadjusted forex gain/loss, businesses can mitigate the potential risks associated with currency fluctuations.

Image: ceceliadirarew38.blogspot.com

Unadjusted Forex Gain Loss Appears In Tally Erp 9

Conclusion

Managing unadjusted forex gain/loss in Tally ERP 9 is crucial for businesses engaged in international trade. By understanding the concept and leveraging the features provided by Tally ERP 9, businesses can accurately record foreign currency transactions, track unrealized gains or losses, and mitigate risks associated with foreign exchange fluctuations. Proper management of forex gain/loss ensures accurate financial reporting, informed decision-making, and effective risk management, ultimately contributing to the financial health and success of the business.