In the bustling world of forex trading, the art of predicting market direction has long been a sought-after skill. One invaluable tool that traders rely upon is the concept of tendencies. These prevailing patterns provide a glimpse into the collective behavior of market participants, offering clues about potential future price movements.

Image: thaibrokerforex.com

Understanding the different types of tendencies and their implications is paramount for any trader seeking consistent profitability. Let’s delve into the nuances of these market phenomena and explore how they can empower you with informed trading decisions.

Primary Trend: The Driving Force of Markets

The primary trend represents the dominant direction towards which the market is moving. It can persist for extended periods, spanning weeks, months, or even years. Identifying this overarching trend is crucial for traders to align their strategies accordingly.

Key indicators that reveal a primary trend include:

- Successive higher highs and higher lows in an uptrend

- Consecutive lower lows and lower highs in a downtrend

Secondary Trend: The Short-Term Dance

Secondary trends, also known as corrections, occur within the primary trend. They represent temporary deviations against the dominant trend direction. These fluctuations provide traders with opportunities for short-term profit-taking.

Identifying secondary trends requires a keen eye for price action and technical analysis indicators. Traders should look for signs of divergence between price and oscillators, such as the relative strength index (RSI) or the stochastic oscillator.

Tertiary Trend: Market Oscillations

Tertiary trends are the most short-lived of the three, often lasting only a few hours or days. They represent minor fluctuations within secondary trends and can be used for scalping or day trading strategies.

Traders should monitor support and resistance levels, as well as momentum indicators, to identify potential tertiary trends. Moving averages and Bollinger Bands can also be helpful in detecting these short-term price oscillations.

Image: www.thathipsterlife.com

Counter-trend Trading: Navigating Against the Grain

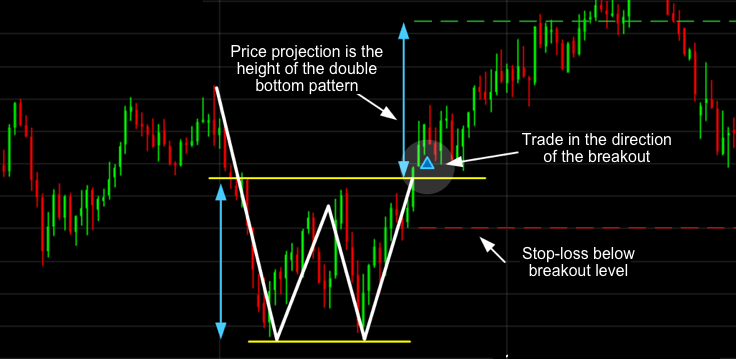

While trading with the trend is a common strategy, some traders opt for a more contrarian approach known as counter-trend trading. This involves attempting to profit from short-term reversals against the prevailing trend.

Counter-trend trading requires exceptional timing and risk management skills. Traders should use appropriate stop-loss and take-profit orders to limit potential losses and lock in profits.

Expert Insights: Mastering Market Trends

“The key to successful trend trading is identifying and aligning with the primary trend,” advises renowned trader Mark Douglas. “Don’t get caught up in secondary fluctuations; focus on the overall direction of the market.”

“Market trends are not always linear,” adds expert analyst Carolyn Boroden. “Traders should be prepared for corrections and reversals. Embrace volatility as an opportunity to reassess their positions.”

Actionable Tips: Leveraging Tendency Analysis

– Use technical analysis tools to determine the primary trend and identify potential secondary trends.

– Monitor support and resistance levels, as well as momentum indicators, to spot tertiary trends.

– Exercise caution when counter-trend trading, ensuring robust risk management strategies.

– Align your trading strategies with the prevailing tendencies to increase your chances of success.

Types Of Tendency In Forex

Conclusion: Embracing Market Truths

In the ever-evolving world of forex trading, the ability to recognize and capitalize on tendencies is an invaluable skill. By comprehending the different types of trends and leveraging expert insights, traders can navigate market fluctuations with a well-informed approach.

Remember, successful trading is not about predicting the future with certainty; it’s about making informed decisions based on an understanding of market dynamics. Embrace the tendencies, learn from the experts, and continue refining your strategies to unlock your trading potential.