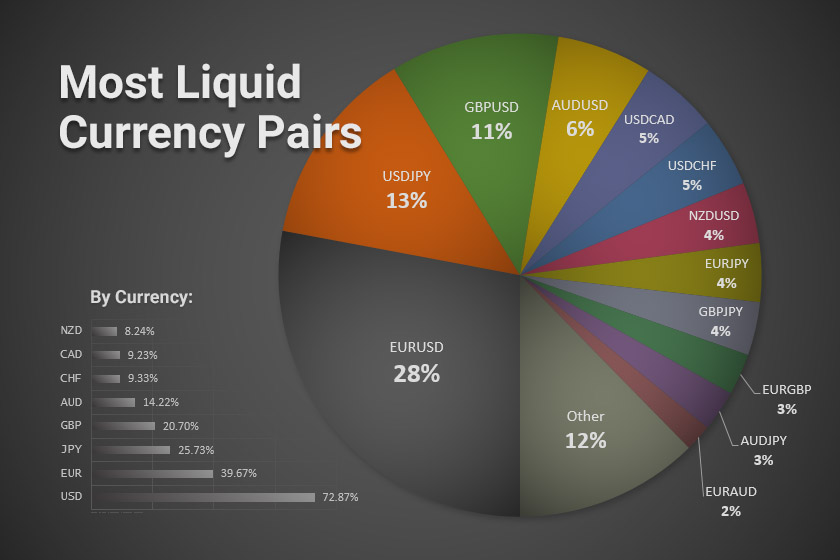

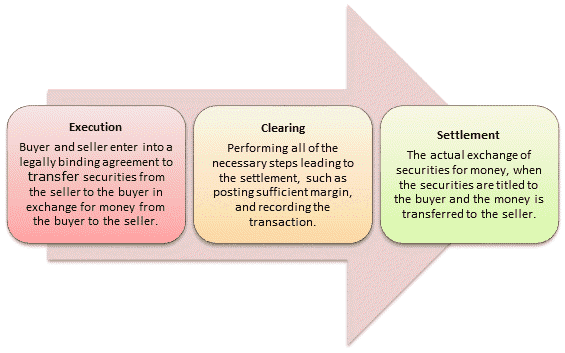

The foreign exchange (forex) market is a vast, global marketplace where currencies are traded. When you trade currencies in the forex market, you are essentially agreeing to exchange one currency for another at a specific rate. The settlement date is the date on which the currency exchange is completed and the currencies are delivered to the respective buyers and sellers.

Image: fxssi.com

There are two main types of settlement dates in the forex market: spot settlement and forward settlement.

Spot settlement is the most common type of settlement date. When you trade currencies on a spot settlement date, the currency exchange is completed within two business days after the trade is executed. This means that if you buy a currency on a spot settlement date, you will receive the currency within two business days, and if you sell a currency on a spot settlement date, you will deliver the currency within two business days.

Forward settlement is a type of settlement date that is used when the buyer and seller agree to exchange currencies at a specific date in the future. When you trade currencies on a forward settlement date, the currency exchange is not completed until the specified future date. This means that you will not receive or deliver the currency until the future date arrives.

Forward settlement dates are often used when the buyer or seller needs to hedge against the risk of currency fluctuations. For example, if you are a company that imports goods from another country, you may buy the foreign currency on a forward settlement date to lock in the exchange rate and protect yourself from the risk of the foreign currency appreciating in value before you receive the goods.

There are pros and cons to both spot settlement and forward settlement. Spot settlement is simpler and faster, but it does not offer the same level of protection against currency fluctuations as forward settlement. Forward settlement offers more protection against currency fluctuations, but it is more complex and can be more expensive.

The type of settlement date that you choose will depend on your individual circumstances and needs. If you are new to the forex market, it is important to speak to a qualified financial advisor to learn more about the different types of settlement dates and to choose the type that is right for you.

Here are some additional things to keep in mind about settlement dates in the forex market:

- The settlement date for a currency pair is determined by the conventions of the forex market. For example, the settlement date for the EUR/USD currency pair is two business days after the trade is executed.

- The settlement date for a currency pair can vary depending on the country in which the trade is executed. For example, the settlement date for the EUR/USD currency pair is two business days after the trade is executed in the United States, but it is one business day after the trade is executed in Europe.

-

The settlement date for a currency pair can also be affected by holidays. If a holiday falls on a settlement date, the settlement date will be extended to the next business day.

Image: top10stockbroker.com

Types Of Settlement Dates In Forex Market

Conclusion

Settlement dates are an important part of the forex market. By understanding the different types of settlement dates and how they work, you can make informed decisions about when to trade currencies and how to protect yourself from the risk of currency fluctuations.