Introduction

In the dynamic world of forex trading, devising winning strategies is paramount. Netting, an essential concept in accounting, plays a pivotal role in maximizing profits while mitigating risks. Understanding the intricacies of netting empowers traders to implement robust strategies, optimize returns, and stay ahead in the ever-evolving forex market.

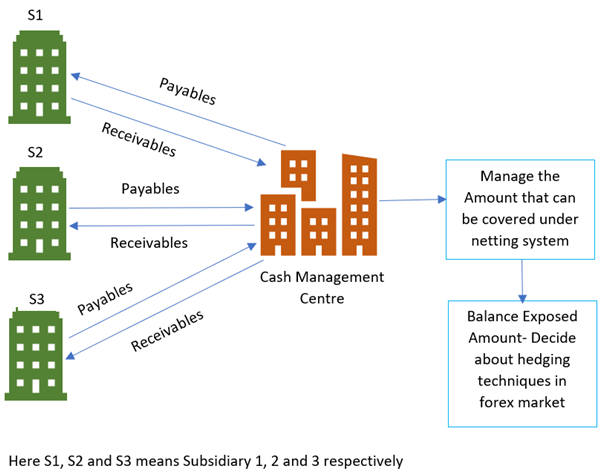

Image: fity.club

Defining Forex Netting

Netting refers to the settlement of multiple transactions between two parties into a single net payment. In the context of forex, it involves consolidating all open positions with the same counterparty and calculating the net difference. This mechanism simplifies settlements by reducing the number of transactions and streamlining the accounting process.

Types of Forex Netting

Forex netting encompasses three primary types:

- Two-Way Netting: This involves netting all open positions between two counterparties, regardless of their direction. For instance, if Trader A has a long position of 10,000 units of EUR/USD and a short position of 5,000 units of EUR/USD with Trader B, the net position is 5,000 units long.

- Partial Netting: Partial netting considers only a portion of open positions within a predefined period. It allows traders to close out selected positions while leaving others open, enhancing flexibility and risk management.

- Margin Netting: This netting method calculates the net value of all open positions by considering the margin requirements. It allows traders to maximize their leverage and capital efficiency, but it also amplifies potential losses.

Benefits of Forex Netting

Netting in forex offers numerous advantages:

- Settlement Simplification: By consolidating positions, netting reduces the number of settlements and simplifies accounting processes, enhancing efficiency and reducing administrative burdens.

- Risk Management: By calculating the net difference between positions, traders can assess their overall exposure and minimize potential losses. This enables them to adopt appropriate hedging strategies to mitigate risk.

- Capital Efficiency: Netting allows traders to maximize their capital utilization by reducing margin requirements on netted positions. This enables them to allocate capital more effectively and increase their trading capacity.

- Cost Savings: Fewer settlements and streamlined accounting processes translate into reduced operational costs and transaction fees for traders, allowing them to preserve their profits.

Image: duluthfishnets.com

Trends and Developments in Forex Netting

The forex netting landscape is constantly evolving with the emergence of new technologies and regulations. Some key trends include:

- Digitalization: Advancements in technology have led to the rise of electronic netting systems, automating the settlement process and increasing efficiency.

- Regulatory Framework: Regulatory bodies are paying increasing attention to netting, seeking to establish robust and harmonized standards to ensure transparency and stability in the market.

- Real-Time Netting: Real-time netting platforms facilitate continuous settlement of positions, minimizing risks associated with intraday fluctuations.

Expert Advice on Forex Netting

To harness the full potential of netting in forex trading, consider the following expert advice:

- Understand Netting Options: Familiarize yourself with different netting methods and their implications to select the most suitable approach for your trading strategy.

- Monitor Net Exposure: Regularly evaluate your net exposure to assess risks and adjust positions accordingly. This helps prevent excessive losses and ensures prudent risk management.

- Seek Expert Guidance: Consult with experienced forex brokers or financial advisors to gain insights into netting complexities and make informed decisions.

- Use Netting Technology: Leverage electronic netting systems to simplify settlement processes and improve operational efficiency. This enables faster trade execution and reduces errors.

Frequently Asked Questions on Forex Netting

Q: What is the purpose of netting in forex?

A: Netting simplifies settlements, reduces risks, enhances capital efficiency, and lowers transaction costs.

Q: How does two-way netting differ from partial netting?

A: Two-way netting consolidates all open positions, while partial netting considers only a subset within a specified timeframe.

Q: What are the key benefits of margin netting?

A: Margin netting maximizes leverage, improves capital utilization, and facilitates more efficient portfolio management.

Types Of Netting In Forex

Conclusion

Netting is a cornerstone of forex trading, empowering traders to streamline settlements, manage risks effectively, optimize capital utilization, and enhance profitability. By mastering the nuances of different netting methods and leveraging expert advice, traders can position themselves for success in the ever-competitive forex market.

Whether you are a seasoned trader or a novice looking to venture into the fascinating world of forex, understanding netting is an indispensable step towards achieving your financial goals.Embrace the power of netting to maximize your profits and navigate the complexities of forex trading with confidence and success.