In the realm of forex trading, the flickering flames of candlesticks illuminate the intricacies of the market, revealing the ebb and flow of currency values with unmatched clarity. These enchanting charts, with their mesmerizing patterns, hold the power to guide traders through the labyrinthine waters of financial decision-making.

Image: doseninvestor.com

Chapter 1: The Anatomy of Candlesticks

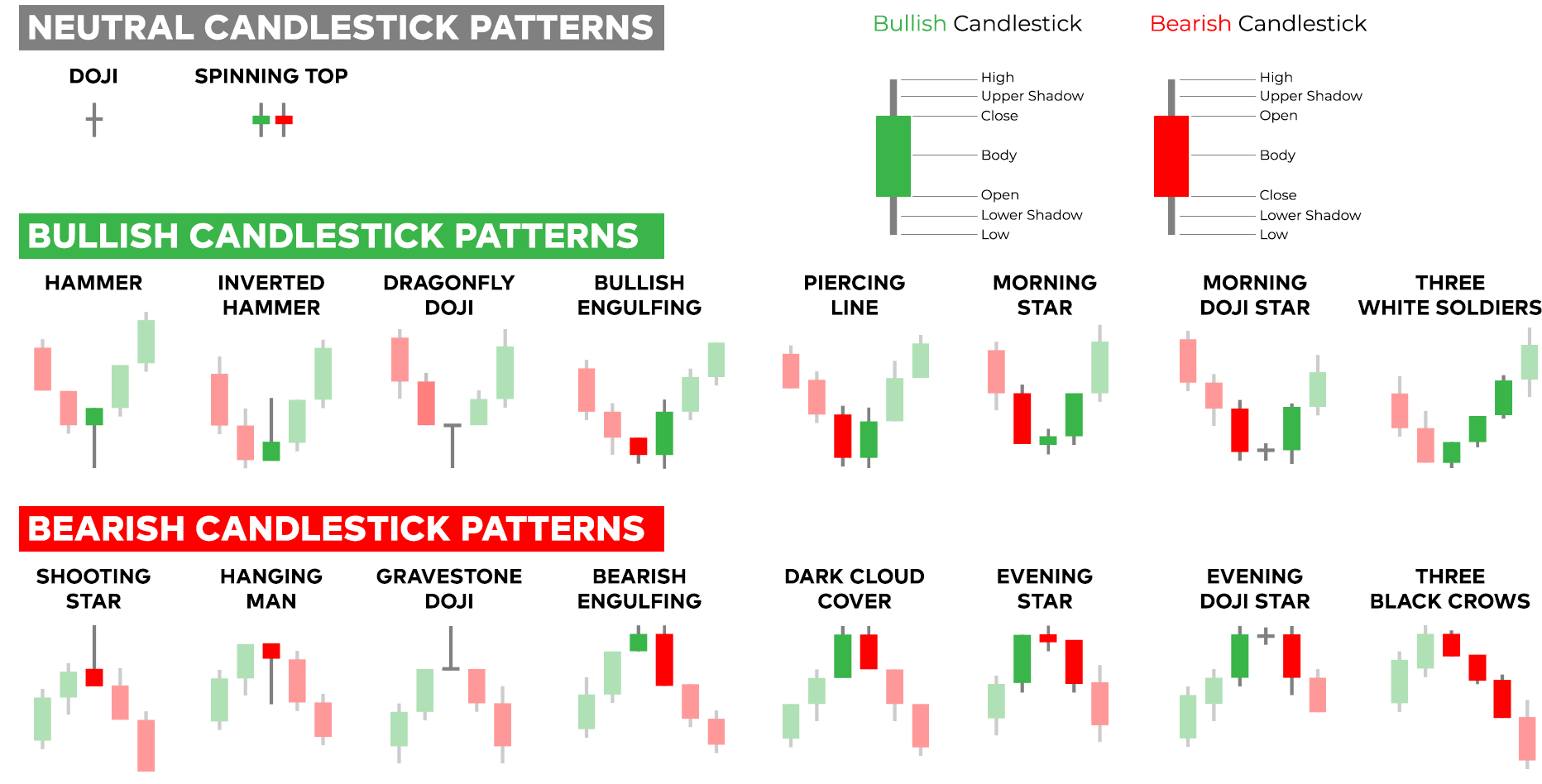

Candlesticks, like miniature beacons, cast their light upon the trajectory of currency prices. Each candle represents a specific period of market activity, typically spanning from hours to days. Their bodies, wicks, and shadows reveal the battle between buyers and sellers, painting a vivid tapestry of market sentiment.

The body of a candlestick, the harbinger of strength or weakness, is inked in distinct hues. A filled body, like a valiant knight’s armor, speaks of dominance, signaling a higher closing price than the opening price. Conversely, an empty body, resembling a ghostly void, hints at vulnerability, indicating a lower close than open.

The ethereal wicks, the candlesticks’ celestial antennas, extend upward and downward, capturing the extremes of a trading period. A protruding upper wick whispers tales of bullish aspirations reaching for the heavens, while a descending lower wick signifies bearish attempts to plumb the depths.

Chapter 2: The Symphony of Doji Candlesticks

Among the diverse candlestick formations, Dojis stand out as enigmas, their neutral stance casting an air of uncertainty upon the market. A Doji candlestick, marked by a body that appears as a thin line or a cross, suggests indecision, a delicate balance between buyers and sellers.

Doji candlesticks come in various guises, each carrying a nuanced message. A Long-legged Doji, with elongated wicks and a diminutive body, hints at an intense struggle between opposing forces. The Gravestone Doji, its body resembling a gravestone, warns of a potential reversal in the market’s direction. In contrast, the Dragonfly Doji, with its wicks pointing upward, signifies a possible bullish reversal.

Chapter 3: The Empowering Trio: Bullish, Bearish, and Neutral Candlesticks

Candlesticks unfurl a captivating narrative of bullish and bearish momentum, shaping the narrative of the market. A Bullish Engulfing pattern, like a valiant army breaking through enemy lines, signals a resurgence of buying pressure. Its engulfing nature, with its filled body completely enclosing the previous candle’s body, heralds a shift in the market’s power dynamics.

On the other side of the battlefield, the Bearish Engulfing candlestick, a harbinger of selling pressure, mirrors the Bullish Engulfing pattern. Its cavernous body engulfs the preceding candle, heralding a potential decline in prices.

Neutral candlesticks, as their name suggests, occupy a liminal space, representing periods of market equilibrium. The Spinning Top candlestick, with its diminutive body and long wicks, symbolizes a state of indecision, a spinning top teetering between gains and losses. The Three Inside Up/Down pattern, a sequence of three candlesticks with progressively larger bodies, depicts a gradual shift in momentum.

Image: derivbinary.com

Chapter 4: Reversal and Continuation Candlesticks: Navigating the Crossroads

Candlesticks not only illuminate market sentiment but also offer invaluable insights into potential trend reversals or continuations. Reversal candlesticks, like beacons in a stormy sea, signal a possible change in the market’s prevailing direction.

The Hammer, a bullish reversal candlestick, resembles a blacksmith’s hammer, its long lower wick symbolizing a rejection of lower prices. Its twin brother, the Hanging Man, a bearish reversal candlestick, mirrors the Hammer’s structure but appears at market highs, hinting at a potential reversal in trend.

Continuation candlesticks, on the other hand, confirm the ongoing market trend, providing reassurance to traders. The Marubozu candlestick, with its filled body from open to close, signals a decisive move in one direction. The Three Black Crows pattern, a trio of bearish candlesticks, underscores a persistent downtrend, casting a shadow over the market’s future.

Chapter 5: Mastering Candlesticks: A Trader’s Odyssey

Harnessing the wisdom of candlesticks empowers traders to navigate the turbulent waters of the forex market with greater confidence. By deciphering the language of these illuminating charts, traders gain a profound understanding of market dynamics and can make informed trading decisions.

Candlesticks empower traders to identify potential trend reversals and continuations, capitalize on market momentum, and manage their risk exposure effectively. The ability to interpret these patterns, like a virtuoso musician reading a symphony’s score, grants traders an unparalleled edge in the competitive world of forex trading.

Types Of Candles In Forex Trading

In the Realm of Forex Trading, Candlesticks Hold the Key

The study of candlesticks, with their vast array of patterns and nuances, is an ongoing journey of discovery for forex traders. By embracing the wisdom of these flickering flames, traders embark on a transformative odyssey, unlocking the secrets of the market and illuminating the path to trading success.