Imagine a world where trading foreign exchange and cryptocurrencies was as effortless as reading a gripping novel. Turbo Trader Pro Indicators empower you to step into this reality, transforming complex financial markets into a thrilling adventure.

Image: www.youtube.com

What Are Turbo Trader Pro Indicators?

Turbo Trader Pro Indicators are a sophisticated suite of technical analysis tools meticulously designed to navigate the volatile waters of financial markets. They harness the power of mathematical algorithms to analyze price patterns, identifying lucrative trading opportunities and guiding your investments toward success. From moving averages to support and resistance levels, these indicators provide an unparalleled edge, transforming you from a market novice into a confident trader.

Unveiling the Power of Technical Analysis

Technical analysis, the backbone of Turbo Trader Pro Indicators, unlocks valuable insights into future price movements by scrutinizing historical price data. By identifying patterns and trends, these indicators forecast potential market behavior, allowing you to make informed trading decisions. Empowered with this knowledge, you can anticipate market fluctuations and position yourself to capitalize on profitable opportunities.

Turbo Trader Pro Indicators: Your Trading Arsenal

Embark on a trading journey with Turbo Trader Pro Indicators and witness your trading prowess soar. Whether you’re a seasoned trader or a budding enthusiast, these indicators are your indispensable companions:

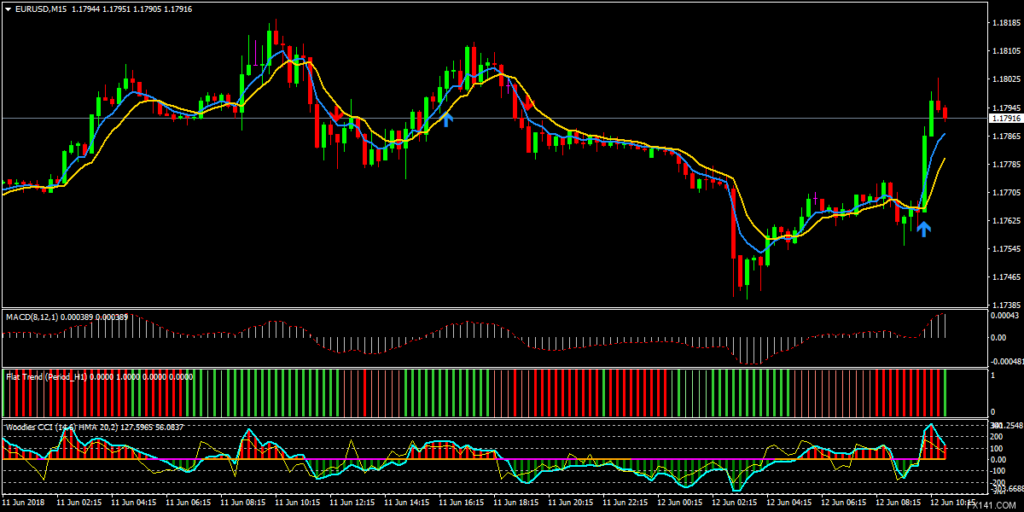

Image: www.fx141.com

1. Moving Averages: Smoothing Out Market Noise

Moving averages neutralize market noise, revealing underlying trends. They project the average price over a specified period, filtering out short-term fluctuations. By identifying the direction of the moving average, you can gauge market momentum and make strategic trading decisions.

2. Relative Strength Index (RSI): Measuring Market Momentum

The RSI gauges market momentum by analyzing price changes, indicating whether an asset is overbought or oversold. Extreme RSI values signal potential market reversals, enabling you to adjust your trades accordingly.

3. Bollinger Bands: Defining Market Volatility

Bollinger Bands visually depict market volatility, creating upper and lower bands around the moving average. Expanding bands suggest increased volatility, while contracting bands indicate reduced volatility. By understanding market volatility, you can optimize your trading strategy.

4. Support and Resistance: Identifying Market Boundaries

Support and resistance levels mark crucial price points where market momentum stalls. Identifying these levels allows you to anticipate potential trend reversals and position your trades to maximize gains.

5. Fibonacci Retracements: Forecasting Market Corrections

Fibonacci Retracements pinpoint potential areas of price retracement following a significant market move. By understanding these retracement levels, you can anticipate market pullbacks and make informed decisions.

Empowering Traders with Expert Insights and Actionable Strategies

Beyond technical indicators, Turbo Trader Pro empowers traders with invaluable expert insights and actionable trading tips. Industry veterans share their wisdom, providing practical strategies to navigate market complexities. These insights arm you with the knowledge and confidence to make informed trading decisions, maximizing your profit potential.

Turbo Trader Pro Indicators For Forex And Crypto

Conclusion

Turbo Trader Pro Indicators are the key to unlocking trading success in the dynamic world of forex and cryptocurrencies. Their sophisticated technical analysis and actionable insights transform you from a passive observer to an active participant, empowering you to seize market opportunities with precision. Embrace Turbo Trader Pro Indicators today and embark on a trading journey that will propel you toward financial freedom. Share your experiences and insights in the comments below, as together we navigate the thrilling world of trading.