Navigating the complexities of international business can be a daunting task, with varying currencies and currency exchange rates influencing financial transactions.

Image: www.numerade.com

In this realm, understanding the treatment of unadjusted foreign exchange (forex) gain or loss in a company’s balance sheet is crucial for accurate financial reporting. Unadjusted forex gain or loss arises when the value of a company’s foreign currency-denominated assets or liabilities changes due to fluctuations in exchange rates.

Understanding Unadjusted Forex Gain Loss

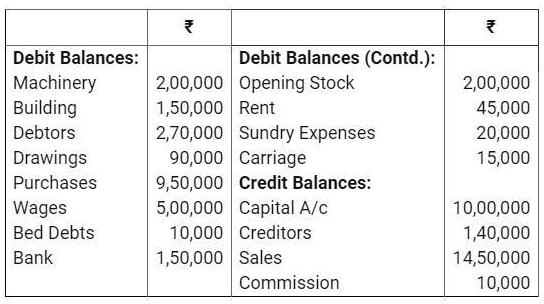

Forex gain or loss represents the difference between the original value of an asset or liability and its current value due to exchange rate fluctuations. Unadjusted forex gain or loss is recognized in the balance sheet, but it is not included in the company’s income statement. This is because it’s an unrealized gain or loss until the asset or liability is sold or settled. However, the gain or loss is recorded in the company’s equity section, specifically in the “Other Comprehensive Income” component.

Accounting Considerations

When a company prepares its balance sheet, it must translate its foreign currency assets and liabilities into its functional currency. This translation process can result in an unadjusted forex gain or loss, which is recorded on the balance sheet date. The gain or loss is calculated as the difference between the translated value of the assets and liabilities at the current exchange rate and their translated value at the historical exchange rate. It’s important to note that this gain or loss doesn’t affect the company’s cash flow or its net income in the current period.

Unadjusted forex gain or loss can fluctuate significantly over time, as exchange rates continue to change. Therefore, it’s essential to monitor these fluctuations and assess their potential impact on the company’s financial position.

Latest Trends and Developments

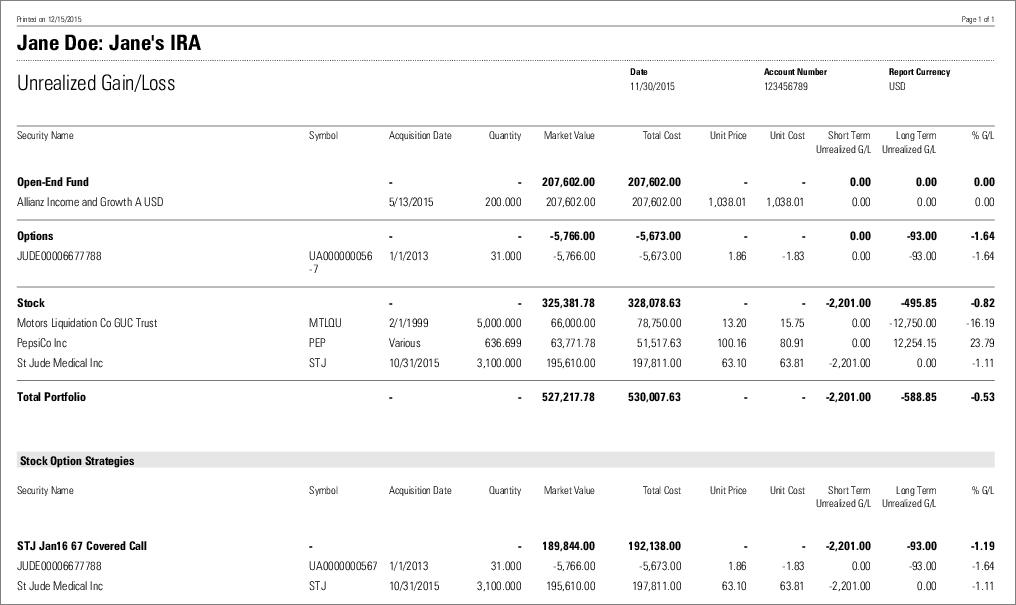

The treatment of unadjusted forex gain or loss in the balance sheet has been subject to ongoing discussions and updates within the accounting community. International Financial Reporting Standards (IFRS) and U.S. Generally Accepted Accounting Principles (GAAP) have specific guidelines for recognizing and reporting forex gain or loss. Recent revisions to these standards have aimed to provide greater transparency and consistency in the reporting of foreign currency transactions.

Furthermore, technological advancements and the rise of sophisticated currency trading platforms have made it easier for companies to hedge against foreign exchange risk. Hedging instruments, such as forward contracts and options, allow companies to lock in exchange rates, reducing the impact of unadjusted forex gain or loss on their financial performance.

Image: awgmain.morningstar.com

Expert Tips and Advice

To effectively manage unadjusted forex gain or loss, companies should consider the following expert tips:

- Regularly monitor exchange rates: Stay updated on currency fluctuations and their potential impact on your company’s financial position.

- Assess currency risk: Evaluate the exposure of your business to foreign currency risk. Determine which assets and liabilities are denominated in foreign currencies and understand the potential impact of exchange rate changes.

- Consider hedging strategies: Explore available hedging instruments, such as forward contracts or currency options, to mitigate the risks associated with unadjusted forex gain or loss.

- Review accounting policies: Ensure that your accounting policies for foreign currency transactions are compliant with relevant standards and best practices.

FAQs

-

Q: How is unadjusted forex gain or loss reported on the balance sheet?

A: Unadjusted forex gain or loss is recorded in the “Other Comprehensive Income” component of the equity section.

-

Q: Is unadjusted forex gain or loss included in the income statement?

A: No, unadjusted forex gain or loss is not included in the income statement.

-

Q: What are the potential implications of unadjusted forex gain or loss?

A: Unadjusted forex gain or loss can affect the company’s equity and overall financial position.

-

Q: How can I reduce the impact of unadjusted forex gain or loss?

A: Companies can use hedging strategies, such as forward contracts or currency options, to mitigate the risks associated with unadjusted forex gain or loss.

Treatment Of Unadjusted Forex Gain Loss In Balance Sheet

Conclusion

Understanding the treatment of unadjusted forex gain or loss in the balance sheet is crucial for accurate financial reporting. Companies need to monitor exchange rate fluctuations, assess currency risk, and consider hedging strategies to mitigate the potential impact of unadjusted forex gain or loss on their financial performance.

By adhering to established accounting standards and best practices, companies can ensure transparency and reliability in their financial reporting, providing valuable information to investors and other stakeholders.

Are you interested in learning more about unadjusted forex gain loss in balance sheet? Let me know in the comments below!