An Introduction to Forex and Chase Bank

The foreign exchange market, commonly known as Forex, is a decentralized global marketplace where currencies are traded. With trillions of dollars traded daily, Forex allows individuals and businesses to convert one currency into another at real-time exchange rates. Forex cards, as a result, have become an indispensable tool for international travelers, offering convenience, security, and competitive exchange rates. On the other hand, Chase Bank, a leading financial institution in the United States, provides a wide range of banking services, including international money transfers. Understanding how to transfer funds from a Forex card to a Chase Bank account is essential for efficient and secure financial management.

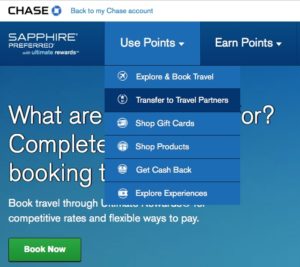

Image: www.palowilltravel.com

Benefits of Transferring Funds through Chase Bank

- Extensive Global Network: Chase Bank boasts a vast network of branches and ATMs worldwide, making it convenient to access your funds in multiple countries.

- Competitive Exchange Rates: Chase Bank offers competitive exchange rates for currency transfers, ensuring favorable conversions.

- Secure Platform: Chase Bank’s online and mobile banking platforms employ robust security measures, safeguarding your personal and financial information.

- Convenient Transaction Options: You can initiate transfers through online banking, mobile app, or in-person at Chase Bank branches, providing flexibility in accessing your funds.

Step-by-Step Guide to Transferring Funds

- Log into Chase Bank Account: Visit the Chase Bank website or mobile app and sign in to your account.

- Navigate to Transfer Section: Select the “Transfer” option from the main menu and choose “International Transfer.”

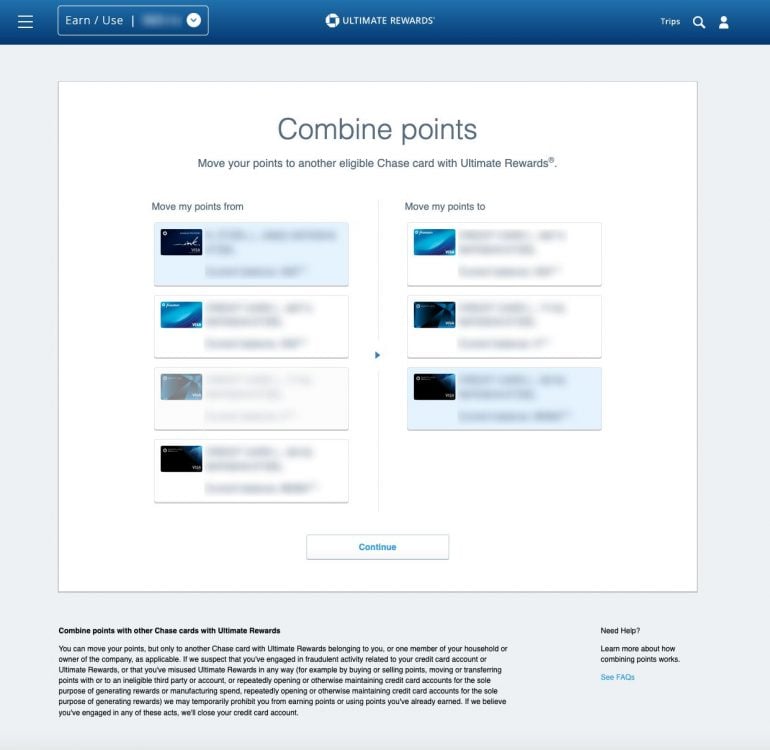

- Select Forex Card as Source: Enter your Forex card details, including the account number and the amount you wish to transfer.

- Verify Chase Bank Account: Specify the Chase Bank account you want to transfer the funds into.

- Confirm and Initiate Transfer: Review the transaction details thoroughly and confirm the transfer. Chase Bank will process the transaction and credit the funds to your account within a specific timeframe.

Factors Affecting Transfer Time

- Bank Processing Time: Banks have varying processing times for international transfers, which can impact the arrival of funds in your Chase Bank account.

- Currency Exchange: Conversion of currencies from Forex card to USD may introduce additional processing time.

- Weekend and Holidays: Transfers initiated during weekends or holidays may take longer to complete.

Image: www.nerdwallet.com

Tips for Secure Transfers

- Use Trusted Devices and Networks: Only access your banking accounts from secure devices and reliable Wi-Fi networks to prevent unauthorized access.

- Enable Two-Factor Authentication: Set up two-factor authentication for your Chase Bank account, requiring an additional verification code for each transaction.

- Monitor Transactions: Regularly review your bank statements and Forex card transactions to identify any unauthorized activity.

- Contact Customer Support Promptly: If you encounter any issues or suspect fraudulent activity, don’t hesitate to contact Chase Bank customer support for assistance.

Frequently Asked Questions

-

Can I transfer funds from any Forex card to my Chase Bank account? Most major Forex cards are compatible with Chase Bank’s transfer services, but it’s advisable to verify with your Forex card issuer and Chase Bank prior to initiating the transaction.

-

Are there any fees associated with transfers? Chase Bank may charge a flat transaction fee or a percentage-based fee for international transfers. It’s recommended to inquire about any potential fees before proceeding with the transfer.

-

Can I transfer funds back to my Forex card? While transferring funds from a Forex card to a Chase Bank account is generally feasible, reversing the process may not be supported by all Forex card issuers.

-

What is the maximum amount I can transfer? Transfer limits may vary depending on Chase Bank’s regulations and your Forex card issuer’s policies. Check with both institutions to determine specific limits.

Transfer From Forex Card To Chase Bank

Conclusion

Transferring funds from a Forex card to a Chase Bank account is a convenient and reliable way to manage your international finances. By leveraging Chase Bank’s extensive network, competitive exchange rates, and secure platform, you can efficiently access your funds and conduct cross-border transactions with peace of mind. Remember to adhere to the aforementioned tips for secure and smooth transfers, ensuring that your financial assets are well-protected and accessible whenever you need them.