Transferring back currency from forex is a crucial process for any trader to understand. Whether you’re a seasoned pro or just starting out in the world of foreign exchange, knowing how to efficiently repatriate your funds is essential. In this article, we’ll delve into the intricacies of transferring back currency from forex, providing you with a comprehensive guide that covers everything from methods and costs to security and regulatory considerations.

Image: www.tbsnews.net

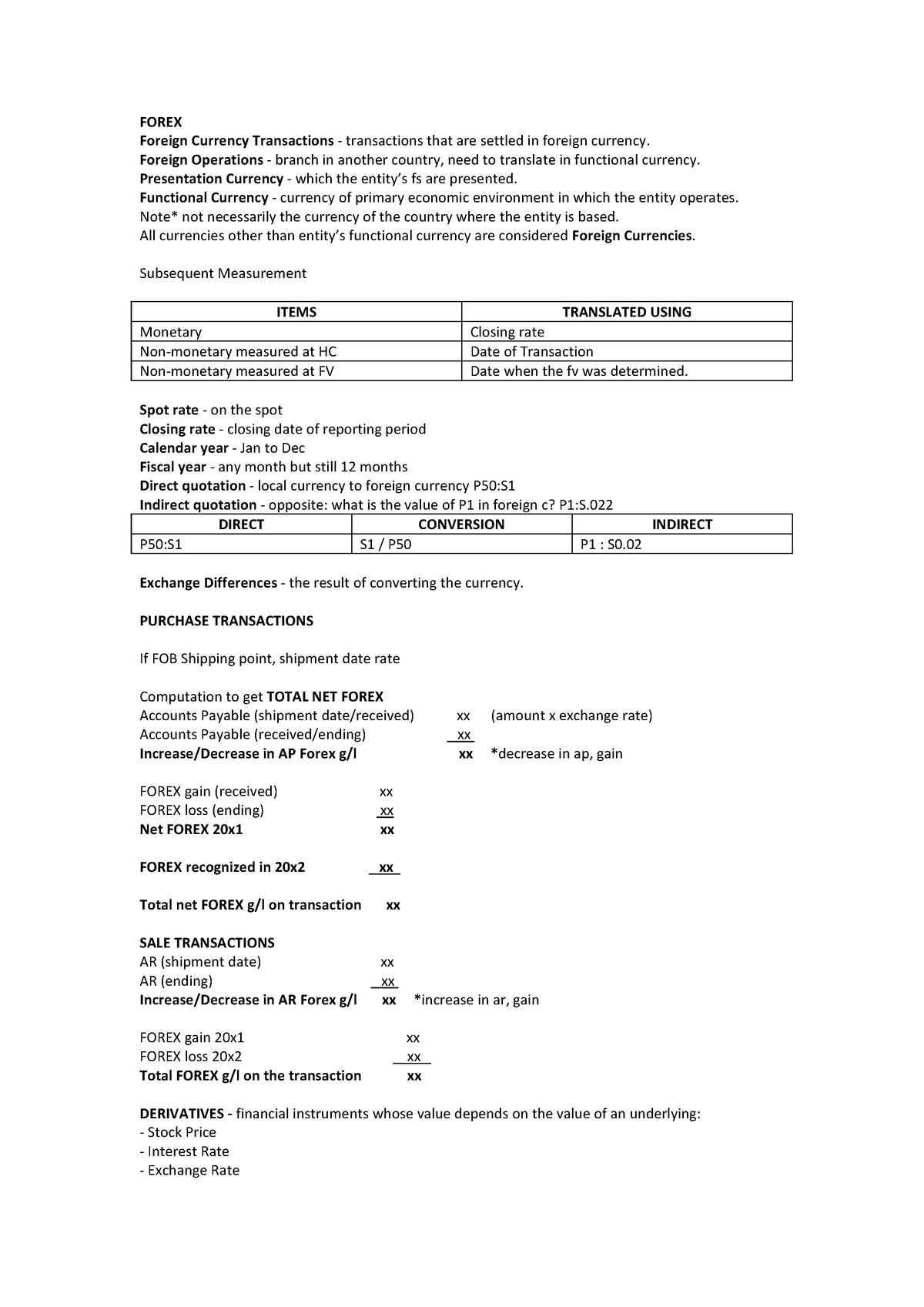

Understanding Forex Transfers

Forex, short for foreign exchange, involves the trading of currencies from different countries. When you trade forex, you’re essentially buying and selling currencies in pairs, aiming to profit from fluctuations in their exchange rates. So, when you buy a currency pair, you’re buying one currency while simultaneously selling another. Once a trade is closed, you can either retain the new currency or convert it back to your original currency to realize your profits (or losses).

Transferring Back Currency: Methods and Costs

There are several methods you can use to transfer back currency from your forex brokerage account. Each method comes with its own set of advantages, disadvantages, and costs.

-

Bank Wire Transfer

Bank wire transfer is a widely used method for large currency transfers. It involves sending the money directly from your brokerage account to your bank account. While bank wire transfers are generally secure and reliable, they can be relatively slow and expensive, especially for international transfers. Transfer fees and processing times can vary depending on the banks involved.

-

Image: www.studocu.comOnline Payment Platforms

If you prefer a more convenient and faster option, online payment platforms like PayPal and Skrill offer an alternative to bank wire transfers. These platforms allow you to transfer funds online to your bank account or debit/credit card. While they may charge slightly higher fees than bank wires, they provide a quicker and more streamlined experience.

-

Cheque or Money Order

For smaller amounts, cheques or money orders may be an option. However, this method is slower and less secure compared to the others mentioned above. Cheques can take several days or even weeks to clear, and there’s always a risk of the cheque being lost or stolen.

Security and Regulatory Considerations

When transferring back currency from forex, it’s paramount to prioritize security and compliance with regulations. Here are some key points to keep in mind:

-

Choose a Reputable Broker

Before transferring any funds, it’s essential to ensure you’re dealing with a reputable and regulated brokerage firm. Verify their licenses and certifications and check for any negative reviews or complaints online.

-

Verify Payment Details

Always double-check the recipient’s account details before initiating a transfer. Confirm the account number, account holder’s name, and bank routing information to avoid errors or fraud.

-

Consider Multiple Transfer Methods

To enhance security and mitigate risks, consider using different transfer methods for smaller amounts. Avoid sending large sums in a single transfer.

-

Keep Records

Maintain a record of all your forex transactions, including transfer details, confirmations, and statements. These records can serve as proof of transfer and may be helpful in case of any disputes or inquiries.

-

Seek Professional Advice

If you have any doubts or complex requirements, it’s advisable to consult with a financial advisor or tax professional. They can guide you on the best transfer methods, tax implications, and any other financial considerations related to forex repatriation.

Transfer Back Currency From Forex

Conclusion

Transferring back currency from forex is an important aspect of trading foreign exchange. This guide has provided you with a thorough understanding of the different transfer methods, costs, security measures, and regulatory considerations involved in the process. By carefully evaluating your options and prioritizing security, you can ensure that your funds are repatriated efficiently and securely, empowering you to make informed financial decisions. Remember, knowledge is power, and the better informed you are, the more successful you can be in navigating the world of forex.