Introduction

Navigating the realm of foreign exchange (forex) cards can be a daunting task, especially when faced with the enigma of transaction charges. These fees can significantly impact your travel budget, making it crucial to understand their nature and strategies to minimize their burden. This article delves deep into the intricacies of forex card transaction charges, equipping you with the knowledge to make informed decisions and maximize your financial advantage.

Image: derivbinary.com

Forex cards, also known as travel cards, are a convenient and secure way to manage your finances while abroad. They allow you to avoid carrying large amounts of cash and benefit from favorable exchange rates compared to traditional currency exchange services. However, lurking beneath this convenience hide transaction charges that can erode your funds if not understood. These charges vary depending on the card issuer, transaction type, and destination country, creating a complex landscape to navigate.

Types of Transaction Charges

The maze of forex card transaction charges encompasses a myriad of categories, each with its unique implications:

-

Foreign Transaction Fee (FTF): Perhaps the most prevalent charge, the FTF is a percentage-based fee levied on every purchase made in a foreign currency. This fee typically ranges from 1% to 3%, noticeably chipping away at your spending power.

-

Cash Withdrawal Fee: If you opt to withdraw local currency from an ATM, brace yourself for a cash withdrawal fee. These fees can be substantial, often exceeding $5 per transaction, emphasizing the importance of planning your cash withdrawals judiciously.

-

Dynamic Currency Conversion (DCC) Fee: Some merchants offer the seemingly convenient option of converting the transaction amount to your home currency at the point of sale. However, this convenience comes at a price, as DCC fees can be exorbitant, eclipsing even the FTF. Opting for the local currency option is invariably the more cost-effective choice.

-

Reload Fee: Should you need to replenish your forex card while overseas, be prepared to incur a reload fee. These fees can be a percentage of the amount reloaded or a flat fee, adding to your overall expenses.

Strategies to Minimize Transaction Charges

While transaction charges are an inherent aspect of forex card usage, there are astute strategies to minimize their impact:

-

Compare Different Card Issuers: The competitive forex card market grants you the leverage to compare offerings from various issuers. Scrupulously examine the transaction charges associated with each card and opt for the one that best aligns with your travel habits and budget.

-

Use Your Card Only for Large Transactions: To mitigate the impact of FTFs, reserve your forex card usage for substantial purchases. Smaller transactions would be better suited for cash or a debit card linked to your home bank account, potentially incurring lower fees.

-

Avoid Cash Withdrawals: ATM cash withdrawals attract hefty fees, making them a costly endeavor. If possible, plan your expenses around making purchases directly with your forex card, thereby avoiding the need for cash withdrawals.

-

Be Wary of DCC: The allure of DCC may entice you, but remember, it comes at a significant cost. Always decline DCC offers and opt for the local currency option to save money.

-

Consider Prepaid Travel Cards: Prepaid travel cards are a viable alternative to forex cards and often offer lower transaction charges. Explore the options available and assess whether a prepaid travel card better suits your needs.

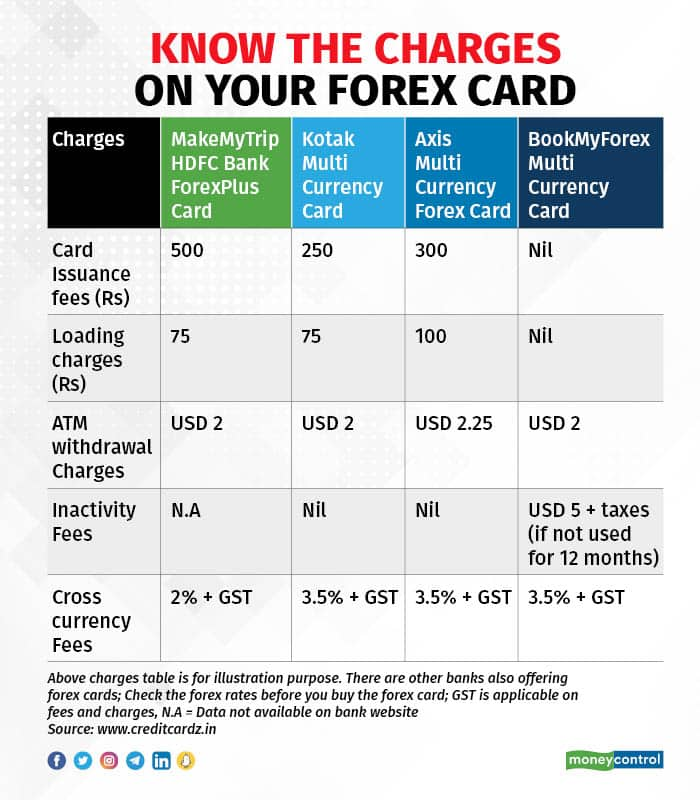

Image: www.moneycontrol.com

Transaction Charges On Forex Card Quora

Conclusion

Demystifying transaction charges on forex cards empowers you to make informed decisions and optimize your financial standing while traveling abroad. By understanding the types of charges, their implications, and employing savvy strategies, you can navigate the complexities of forex card usage and minimize the impact on your budget. Remember, knowledge is the key to unlocking the full potential of forex cards and ensuring a financially rewarding travel experience.