Unlock the Secrets of High-Frequency Trading on the Forex Market

The forex market presents a vast ocean of opportunities for traders, and among them, scalping stands out as a lucrative strategy.

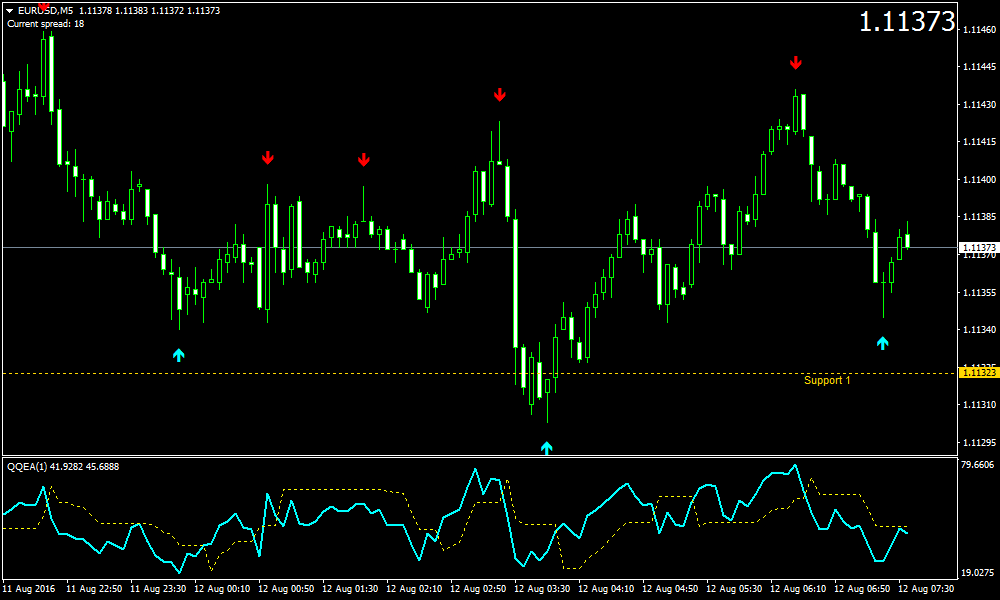

Image: www.forexmt4indicators.com

Forex scalping involves opening and closing positions within typically less than 30 minutes, profiting from small price fluctuations. While it requires discipline and a keen eye for the market, it also holds the potential for significant returns.

Understanding Forex Scalping on 30-Minute Charts

One of the critical aspects of scalping is identifying the right timeframe. 30-minute charts offer a balance between too much noise (on shorter timeframes) and too little volatility (longer timeframes).

By dividing the 30-minute candle into smaller timeframes, such as each 5-minute section, scalpers can identify potential entry and exit points with greater precision.

Technical Analysis for Scalping Success

Technical analysis forms the cornerstone of successful scalping. Identifying patterns, trends, and support and resistance levels are all part of the trader’s arsenal in the quest for profitable trades.

Popular indicators for scalping on 30-minute charts include moving averages, Bollinger Bands, and Stochastic oscillators. These tools help identify potential trade opportunities and manage risk.

Sample Scalping Strategy

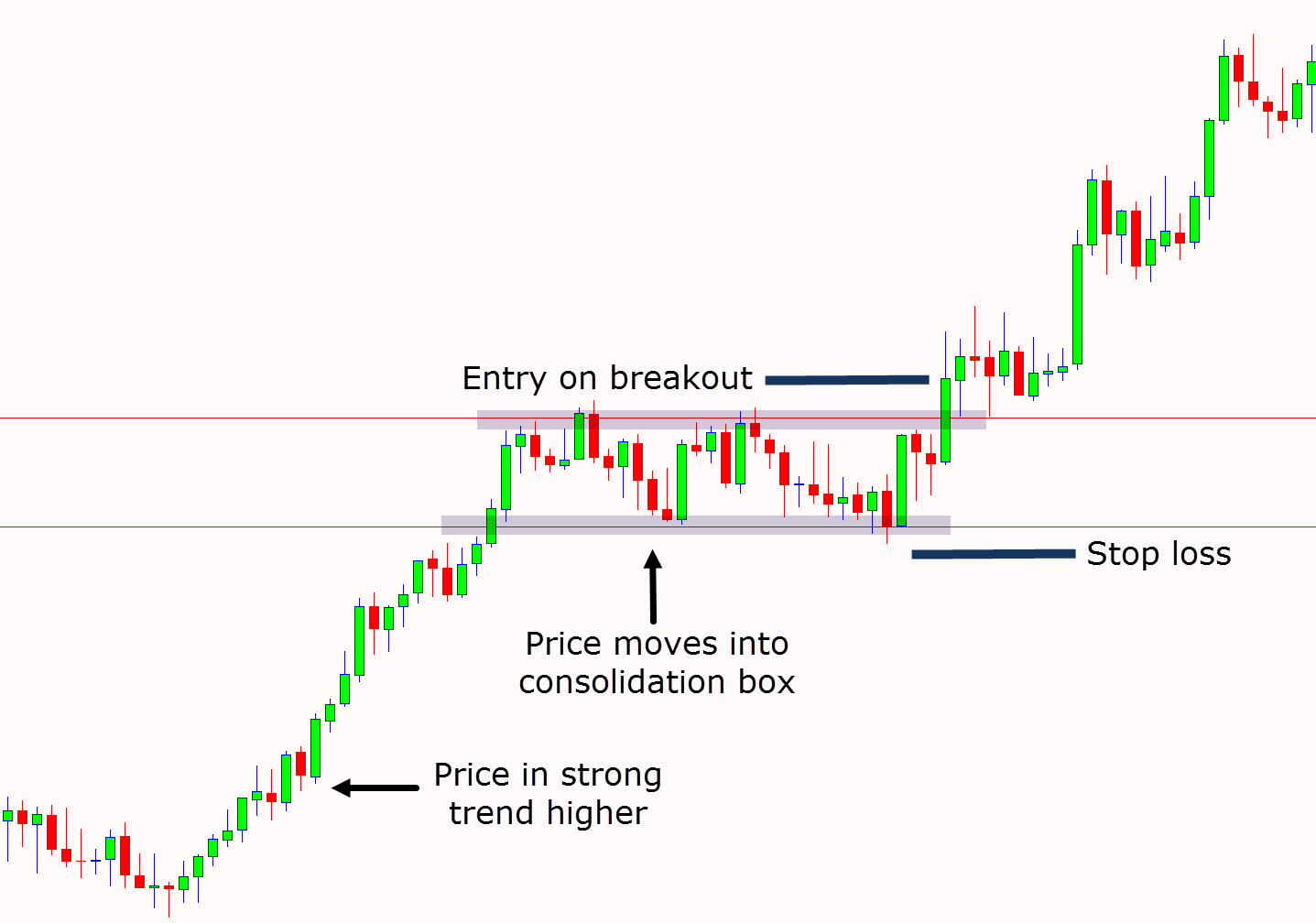

- Trend Analysis: Identify the predominant trend using technical analysis tools like Moving Averages.

- Range Identification: Look for areas where price has found support or resistance in the recent past.

- Indicator Confirmation: Confirm your trading idea using a combination of momentum indicators such as the Relative Strength Index (RSI) or Stochastic oscillator.

Image: learnpriceaction.com

Tips for Effective Scalping on 30-Minutes Charts

Mastering scalping on 30-minute charts requires a blend of knowledge, skill, and the right approach. Here are some crucial tips to remember:

- Control Emotions: Scalping can be a fast-paced and intense environment. Keeping emotions in check is paramount for maximizing results.

- Risk Management: Use stop-loss orders to limit potential losses and maintain a positive risk-to-reward ratio.

- Trade Discipline: Adherence to a strict trading plan is crucial to avoid impulsive decisions and maintain consistency.

FAQs on Forex Scalping on 30-Minute Charts

Q: Why is 30-minute charting recommended for scalping?

A: 30-minute charts provide a balance between identifying short-term price fluctuations and filtering out excessive noise.

Q: Can scalping be performed on any currency pair?

A: While scalping can be applied to various currency pairs, choosing highly liquid ones like EUR/USD or GBP/USD is generally recommended for better spreads.

Trading System Forex Scalping On 30 Mins

Conclusion

Forex scalping on 30-minutes charts can be a rewarding trading strategy when approached with the correct mindset and technical skills. By understanding the market dynamics, implementing effective scalping techniques, and adhering to sound risk management principles, traders can leverage this fast-paced trading style and navigate the forex market with greater confidence and efficiency.

Are you ready to embark on the thrilling journey of forex scalping? Embrace the principles outlined in this guide and unleash your trading potential.