In the dynamic world of finance, leverage has emerged as a transformative tool, enabling traders to amplify their potential profits exponentially. Forex leverage, in particular, has revolutionized the currency trading landscape, allowing traders to gain exposure to higher-value trades with limited capital. However, navigating the complexities of leveraged forex trading requires a profound understanding of its mechanisms, risks, and rewards.

Image: www.audacitycapital.co.uk

Defining Forex Leverage: A Magnifying Glass for Market Opportunities

Forex leverage, simply put, is a loan facility provided by brokers to magnify the trading power of their clients. It allows traders to control a larger position than their account balance would permit, effectively increasing their buying or selling capacity. This magnification effect can be a double-edged sword, amplifying both profits and losses.

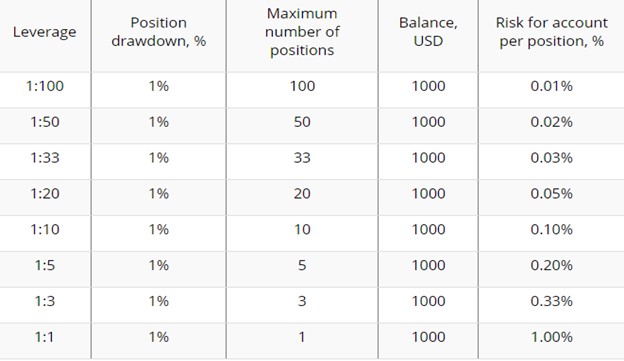

The amount of leverage offered by brokers varies, often expressed as a ratio. For instance, a leverage ratio of 100:1 implies that a trader can control a position worth $100,000 with only $1,000 in their account. This leverage can open up vast opportunities for those with limited capital, enabling them to capitalize on favorable market conditions and pursue potentially lucrative trades.

Leverage in Action: Unleashing the Market’s Potential

To illustrate the impact of leverage, consider a currency pair like EUR/USD. If the trader believes the Euro will appreciate, they could employ a leverage ratio of 100:1. This means they can purchase a position worth $100,000 of EUR/USD with just $1,000 upfront. If their prediction holds true and the Euro rises in value by 1%, they will reap a profit of $1,000, effectively doubling their investment.

Conversely, if the Euro depreciates by 1%, they will incur a loss of $1,000, wiping out their initial capital. This underscores the double-edged nature of leverage, where potential gains and losses are both magnified.

The Perils of Overleveraging: A Cautionary Tale

While leverage can be an empowering tool, it’s crucial to approach it with caution. Excessive leverage can lead to substantial losses, particularly during market volatility.

Continuing with the previous example, if the leverage ratio was increased to 500:1, a 1% depreciation in the Euro’s value would result in a loss of $5,000 – five times the trader’s initial capital. In such scenarios, traders risk losing more than their initial investment, potentially incurring significant financial strain.

Image: allaboutforexs.blogspot.com

Harnessing Leverage Responsibly: A Guide for Prudent Traders

To mitigate the risks associated with leveraged forex trading, traders must adhere to sound risk management practices:

- Start Small: Begin with a modest leverage ratio (e.g., 10:1 to 20:1) to familiarize yourself with the risks and develop a trading strategy.

- Define Risk Tolerance: Determine the maximum loss you’re willing to accept on any given trade.

- Use Protective Stops: Implement stop-loss orders to automatically exit losing trades once they reach a predefined threshold, limiting potential losses.

- Manage Leverage Dynamically: Adjust leverage ratios based on experience, market conditions, and account balance.

Expert Insights: Navigating Forex Leverage with Confidence

“Leverage is a powerful tool, but it’s essential to approach it with discipline and a comprehensive understanding of risk,” advises renowned trader Mark Douglas. “Proper risk management and a well-defined trading plan are key to leveraging its potential without jeopardizing your financial well-being.”

Trading In Forex At Leverage

Conclusion: Empowering Traders, Unleashing Market Potential

Approached responsibly, forex leverage has the potential to empower traders, amplifying their market opportunities and unlocking the potential for significant returns. By understanding its mechanisms, managing risks prudently, and incorporating expert insights, traders can harness the power of leverage to navigate the complexities of the currency markets and achieve their financial goals. Leverage becomes not just a trading tool but an instrument of financial empowerment, enabling traders to maximize opportunities and conquer market challenges with confidence.