Image: spotthewrld.blogspot.com

The intricate world of forex trading is often fraught with complex economic dynamics, one of which is the intricate balance between trade deficit and trade surplus. In a world where interconnected economies strive for prosperity, understanding the underlying concepts and implications of these two phenomena is crucial. This article aims to shed light on the multifaceted nature of trade deficit and trade surplus, offering a nuanced understanding of their impact on the foreign exchange market.

Unveiling the Trade Deficit: A Closer Look

A trade deficit occurs when a country imports more goods and services than it exports. This disparity leads to an outflow of funds from the importing nation, resulting in a shortfall. The trade deficit is often perceived negatively, as it is seen as a sign of a country’s inability to produce enough goods and services to meet domestic demand. However, it is important to note that a trade deficit is not inherently negative and can, in certain instances, be beneficial.

Benefits of a Trade Deficit

Paradoxically, a trade deficit can sometimes indicate a country’s economic strength. When a country imports more than it exports, it often signifies a robust consumer demand, indicating a healthy and growing economy. Moreover, a trade deficit can allow countries to access goods and services that they cannot produce domestically, enhancing consumer choice and spurring innovation.

Risks of a Trade Deficit

While a trade deficit can have its benefits, it also poses potential risks. If the deficit is too large and persists over a prolonged period, it can lead to currency devaluation, rising inflation, and increased external debt. Additionally, a chronic trade deficit can make a country more vulnerable to external shocks, such as changes in global demand or trade policies.

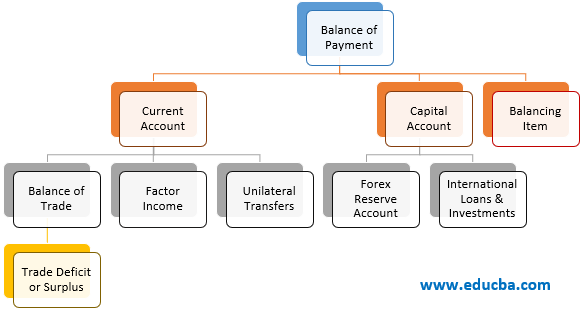

Image: www.educba.com

Exploring the Trade Surplus: A Tale of Two Sides

In contrast to a trade deficit, a trade surplus occurs when a country exports more goods and services than it imports. This results in an inflow of funds into the exporting nation, creating an excess of revenues. Trade surpluses are generally viewed positively as they indicate a country’s ability to produce goods and services in excess of domestic demand.

Benefits of a Trade Surplus

A trade surplus can provide several economic advantages. It can lead to currency appreciation, making imports cheaper and boosting the purchasing power of consumers. Additionally, a trade surplus can contribute to a country’s foreign exchange reserves, providing a buffer against economic downturns or financial crises.

Risks of a Trade Surplus

Despite its apparent benefits, a trade surplus can also pose challenges. An excessive surplus can lead to a country’s currency becoming overvalued, making exports more expensive and imports cheaper. This can harm domestic industries that compete with imports and erode the country’s global competitiveness.

Trade Deficit vs. Trade Surplus: A Comparative Overview

To fully grasp the implications of trade deficit and trade surplus, it is essential to consider their contrasting effects on various economic indicators:

- Economic Growth: A trade surplus can generally indicate strong economic growth, while a persistent trade deficit can hinder growth prospects.

- Currency Exchange Rates: A trade surplus tends to strengthen a country’s currency, while a trade deficit can lead to depreciation.

- Inflation: A trade deficit can contribute to inflation by increasing the demand for imported goods and services. A trade surplus, on the other hand, can dampen inflationary pressures by reducing the cost of imported goods.

- Interest Rates: Central banks may raise interest rates to curb inflation caused by a trade deficit and lower rates to stimulate growth in the presence of a trade surplus.

Trade Deficit And Trade Surplus Cad Forex

Navigating Trade Deficit and Surplus in Forex Trading

Understanding the dynamics of trade deficit and trade surplus is critical for forex traders and investors. By monitoring trade data, traders can assess the potential impact on currency exchange rates and make informed trading decisions. For instance, if a country with a persistent trade deficit is expected to announce further widening of the deficit, traders may anticipate a depreciation of its currency and adjust their positions accordingly.

Conclusion

Trade deficit and trade surplus are complex economic phenomena that shape the forex market. While a superficial understanding may lead to simplistic conclusions, a thorough analysis of the underlying factors and their implications is crucial for making informed decisions. By embracing a nuanced perspective, forex traders and investors can harness the insights provided by trade deficit and trade surplus data to navigate the ever-evolving financial landscape.