The Guardians of Global Liquidity

In the realm of international finance, foreign exchange reserves, often referred to as forex reserves, play a pivotal role in stabilizing currencies, facilitating global trade, and ensuring economic stability. These reserves, held by central banks and other monetary authorities, are a lifeline for countries facing unforeseen financial crises or economic shocks. Join us on an enthralling expedition to unravel the intricacies of total forex reserves, their significance in the global financial landscape, and the strategies adopted by nations to manage these precious assets.

Image: www.thestreet.com

A Glimpse into the Forex Reserve Realm

Forex reserves encompass a wide array of assets, including gold, foreign currencies, and special drawing rights (SDRs), an international monetary reserve currency issued by the International Monetary Fund (IMF). The composition of a nation’s forex reserves depends on various factors, such as economic conditions, political stability, and foreign exchange market dynamics.

The Importance of Forex Reserves

Forex reserves serve multiple crucial functions:

-

Currency Stabilization:

Reserves act as a buffer to mitigate currency fluctuations, preventing sharp devaluations and maintaining exchange rate stability.

-

Trade Facilitation:

They facilitate international trade by providing access to foreign exchange for import payments, thereby reducing uncertainties and transaction costs.

-

Economic Resilience:

In times of economic downturns, forex reserves provide a cushion, enabling countries to withstand financial shocks and maintain economic equilibrium.

-

Debt Servicing:

They ensure timely repayment of foreign debt obligations, enhancing a country’s creditworthiness and fostering international investor confidence.

-

Political Stability:

Ample forex reserves boost confidence in a country’s financial system and political stability, attracting foreign investment and fostering economic growth.

Global Forex Reserve Trends

The total forex reserves of all countries have witnessed a steady rise over the past decade, reflecting the increasing interconnectedness of the global economy and the growing importance of international trade. As of June 2023, global forex reserves surpassed a staggering $13 trillion, with significant contributions from China, Japan, and the United States.

Image: www.studyiq.com

Strategies for Effective Forex Reserve Management

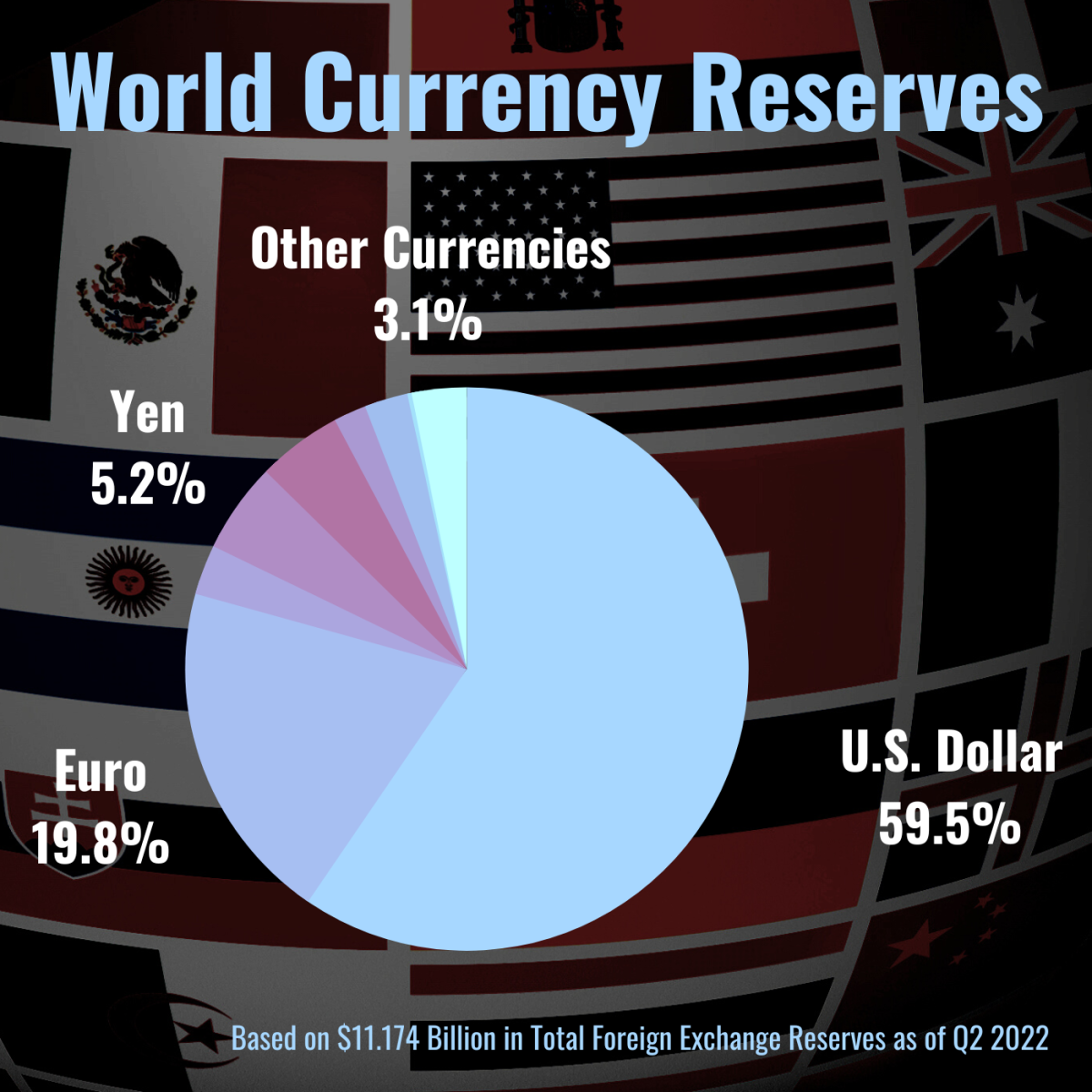

Effective forex reserve management involves a judicious allocation of assets across different instruments and currencies. Central banks employ various strategies to optimize returns while managing risks. These strategies include diversification, currency hedging, and investing in higher-yield assets. Striking the right balance among these strategies is paramount to achieving stable and sustainable forex reserves.

Expert Insights on Forex Reserve Management

Renowned economists and financial experts emphasize the significance of maintaining adequate forex reserves. They advise countries to consider the following tips:

-

Maintain a Prudent Level:

Forex reserves should be sufficient to cover a country’s import needs and external debt obligations.

-

Diversify Assets:

Spreading investments across a range of currencies and assets minimizes risk and enhances returns.

-

Currency Hedging:

Hedging against currency fluctuations protects the value of forex reserves during periods of financial turmoil.

-

Seek Expert Advice:

Consulting with financial advisors and utilizing available tools can aid in optimizing forex reserve management strategies.

Frequently Asked Questions (FAQs)

Q: What are forex reserves used for?

A: Forex reserves serve multiple purposes, including currency stabilization, trade facilitation, economic resilience, debt servicing, and political stability.

Q: Which countries have the largest forex reserves?

A: As of June 2023, China, Japan, and the United States hold the largest forex reserves in the world.

Q: How do central banks manage forex reserves?

A: Central banks employ various strategies, such as diversification, currency hedging, and investing in higher-yield assets, to effectively manage their forex reserves.

Total Forex Reserve Of All Countries

Conclusion

Total forex reserves of all countries represent a critical pillar of the global financial system. Properly managed, they provide countries with the resilience to withstand economic shocks, facilitate international trade, and maintain currency stability. As the global economy continues to evolve, the effective management of forex reserves will remain a key determinant of economic prosperity and financial stability. Are you fascinated by the world of forex reserves? Do you seek to deepen your understanding of their role in shaping global economies? Explore further, engage in discussions, and continue your intellectual journey.