Introduction

In the ever-evolving realm of finance, the foreign exchange market, more commonly known as Forex, stands as a behemoth, offering boundless opportunities for traders to navigate the global currency landscape. With its staggering daily trading volume exceeding $5 trillion, Forex presents a tantalizing prospect for wealth creation. However, venturing into this complex market requires discerning knowledge and an understanding of the most lucrative currency pairs to trade. This comprehensive guide will delve into the top Forex pairs, empowering you to capitalize on market fluctuations and achieve trading success.

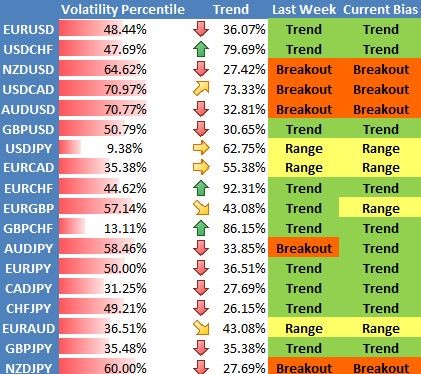

Image: www.audacitycapital.co.uk

The Forex market operates on a decentralized network, facilitating the exchange of currencies between global financial institutions. Its accessibility and flexibility have attracted numerous traders, ranging from seasoned professionals to aspiring novices. Unlike other financial markets, Forex offers 24-hour trading, allowing traders to capitalize on market movements around the clock. Navigating this dynamic market can be daunting, but with the right knowledge and analytical capabilities, Forex trading can be a rewarding endeavor.

Navigating the Forex Market: Key Considerations

Embarking on Forex trading necessitates a thorough understanding of its fundamental principles. The following insights will serve as a guiding compass for your trading journey:

- Know Your Currency Pair: Forex trading involves trading a pair of currencies, with the value of one fluctuating against the other. Each currency pair has its unique characteristics, trading volume, and volatility. It is crucial to familiarize yourself with these nuances to make informed trading decisions.

- Master Currency Exchange: The exchange rate between currencies is a fundamental aspect of Forex trading. It represents the relative value of one currency against another, indicating how much of one currency is required to purchase one unit of another. Understanding exchange rate fluctuations and their determinants is paramount for successful trading.

- Leverage Your Trading Position: Forex brokers provide traders with leverage, allowing them to magnify their trading positions beyond their initial capital. This can significantly amplify profits, but carries the inherent risk of substantial losses if proper risk management strategies are not employed. Leveraging should be utilized cautiously and only after gaining sufficient trading experience.

- Analyze Market Trends: A deep understanding of Forex market trends is essential for effective trading. Fundamental and technical analysis provide traders with the necessary tools to forecast market movements and make informed trading decisions. These analytical methodologies involve studying economic data, political events, price charts, and technical indicators.

- Manage Risk Prudently: Risk management is the cornerstone of successful Forex trading. Traders must implement robust risk management strategies to mitigate potential losses and protect their capital. This includes setting stop-loss orders, limiting position sizing, and diversifying their trading portfolio.

Unveiling the Top Contenders: Forex Pair Powerhouses

The Forex market is a vast ocean, with countless currency pairs navigating its currents. However, a select few stand apart, beckoning traders with their unparalleled liquidity, volatility, and trading volume. Join us as we unveil the top Forex pairs that reign supreme in the global currency market:

1. EUR/USD: The Unrivaled Dominator

As the pair comprising the Euro, the common currency of the European Union, and the U.S. dollar, the global reserve currency, EUR/USD reigns as the most traded currency pair in the Forex market. Its immense liquidity ensures tight spreads and seamless execution, attracting traders seeking stability and reduced transaction costs. This pair is heavily influenced by economic data, monetary policy, and geopolitical events, providing ample opportunities for both short-term and long-term traders.

Image: unbrick.id

2. USD/JPY: The Land of Rising Volatility

The USD/JPY pair, featuring the U.S. dollar and the Japanese yen, is renowned for its volatility and significant price fluctuations. This pair is influenced by interest rate differentials, economic growth prospects, and geopolitical tensions between the United States and Japan. The Bank of Japan’s monetary policy, aimed at maintaining low interest rates, often creates significant trading opportunities for those seeking high-risk, high-reward scenarios.

3. GBP/USD: The Sterling Performer

The GBP/USD pair, commonly known as “Cable,” comprises the British pound sterling and the U.S. dollar. This pair offers a unique blend of liquidity and volatility, influenced by factors such as interest rate decisions, Brexit developments, and the global economic climate. Cable trading provides opportunities for both short-term scalping and long-term trend following strategies, making it a versatile option for traders of varying risk appetites.

4. AUD/USD: The Antipodean Advantage

The AUD/USD pair, featuring the Australian dollar and the U.S. dollar, offers a unique trading experience due to its correlation with commodity prices, particularly gold. The Australian dollar’s exposure to the Chinese economy and the Reserve Bank of Australia’s monetary policy decisions presents a compelling proposition for traders seeking exposure to the Asia-Pacific region. AUD/USD exhibits moderate volatility and provides opportunities for both short-term and long-term trading strategies.

5. USD/CHF: The Haven in the Storm

The USD/CHF pair, comprising the U.S. dollar and the Swiss franc, is regarded as a “safe-haven” pair, attracting traders during periods of market uncertainty. The Swiss franc’s stability and the Swiss National Bank’s interventionist stance make this pair less susceptible to extreme price fluctuations. However, savvy traders can still find opportunities during times of market stress, as the USD/CHF pair is not immune to geopolitical events or global economic shocks.

Top Forex Pair To Trade

Conclusion

Venturing into the world of Forex trading demands a comprehensive understanding of the market’s dynamics and the top currency pairs that drive its pulse. The forex market provides a fertile ground for wealth creation but also carries inherent risks. By familiarizing yourself with the key principles of Forex trading, the specific characteristics of each top currency pair, and implementing prudent risk management practices, you can navigate this dynamic market with increased confidence and the potential to reap its financial rewards. Remember, knowledge is the key to unlocking trading success, so embrace continuous learning and seek out trusted resources to guide your journey.