Introduction

The global forex market, where currencies are constantly exchanged and traded, is a trillion-dollar arena that presents numerous opportunities for traders to profit from currency fluctuations. Among the diverse financial instruments employed in forex trading, derivatives play a pivotal role. Forex derivatives allow traders to speculate on the future value of currencies without directly buying or selling the underlying asset. This article will embark on an in-depth journey into the top 60 forex derivatives, empowering you with the knowledge and insights to navigate this dynamic market effectively.

Image: www.pinterest.pt

Derivatives, by nature, derive their value from an underlying asset, in this case, currencies. They provide traders with a wider range of instruments to manage risk while creating new opportunities for profit. By harnessing the power of leverage and offering flexibility in contract structuring, forex derivatives have become indispensable tools for currency traders worldwide.

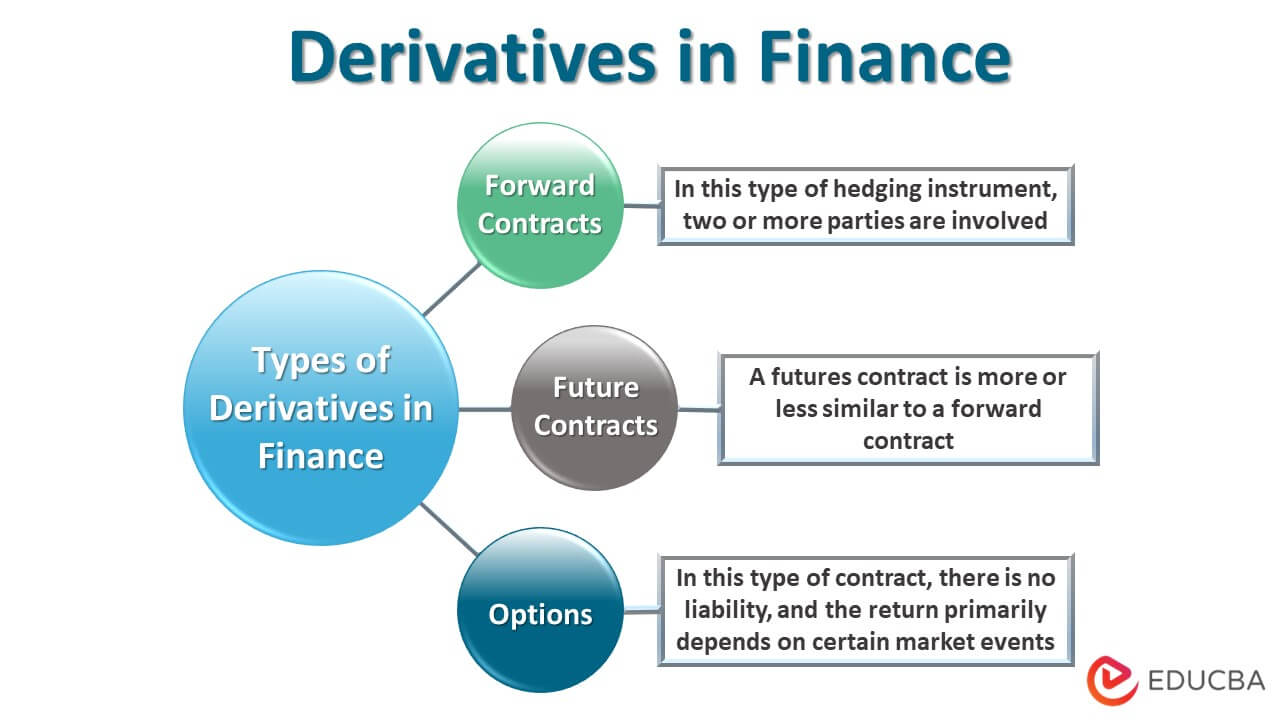

Exploring the Types of Forex Derivatives

The forex derivatives market is a diverse landscape, offering an array of instruments tailored to varying trading strategies and risk appetites. Here are some of the most commonly traded forex derivatives:

1. Forward Contracts: Over-the-counter (OTC) agreements between two parties to exchange a set amount of currency at a predetermined rate on a specified future date.

2. Futures Contracts: Standardized exchange-traded contracts that obligate buyers to purchase and sellers to deliver a stipulated amount of currency at a predetermined price and date.

3. Currency Options: Contracts that provide the buyer with the right, but not the obligation, to buy or sell a set amount of currency at a specific exchange rate on or before a particular date.

4. Currency Swaps: OTC agreements that involve the exchange of principal and interest payments denominated in different currencies over a specified period.

Each type of forex derivative comes with its own unique set of benefits and risks. Understanding the nuances of these instruments is crucial for traders to make informed decisions and optimize their trading strategies.

Leverage and Risk Management

One of the key advantages of forex derivatives is the ability to employ leverage. Leverage allows traders to control a larger amount of currency with a relatively small initial investment. While leverage can amplify potential profits, it can also magnify losses if market movements go against the trader’s position.

Effective risk management is paramount in forex derivative trading. Traders should carefully consider their risk tolerance and employ strategies such as stop-loss orders and diversification to mitigate potential losses. Sound risk management practices can help traders preserve capital and enhance their chances of long-term success.

Identifying Trading Opportunities

The forex derivative market offers numerous trading opportunities, from hedging currency exposures to speculating on future market movements. Traders can identify trading opportunities by conducting thorough technical and fundamental analysis, monitoring economic data, and staying abreast of geopolitical events that may impact currency values.

Technical analysis involves studying historical price charts to identify patterns and make predictions about future price movements. Fundamental analysis, on the other hand, focuses on economic factors that may affect currency values, such as interest rates, inflation, and political stability.

By combining technical and fundamental analysis, traders can develop informed trading strategies andcapitalize on potential opportunities in the forex derivatives market.

Image: www.educba.com

Top 60 Forex Derivatives To Trade

Conclusion

The world of forex derivatives is a vast and dynamic landscape that offers traders a diverse range of instruments and opportunities to profit from currency market fluctuations. By understanding the different types of forex derivatives, utilizing leverage effectively, and implementing sound risk management strategies, traders can navigate this market with confidence and potentially reap substantial rewards.

Embarking on this journey into the top 60 forex derivatives may seem overwhelming at