In the dynamic realm of forex trading, understanding market reversals is paramount for making informed decisions. A reversal pattern reveals a shift in the underlying trend, providing traders with opportunities to enter or exit positions strategically. Embark on this captivating journey as we unveil the top five reversal patterns that can empower you to navigate market fluctuations with confidence and finesse.

Image: taniforex.com

What Are Reversal Patterns?

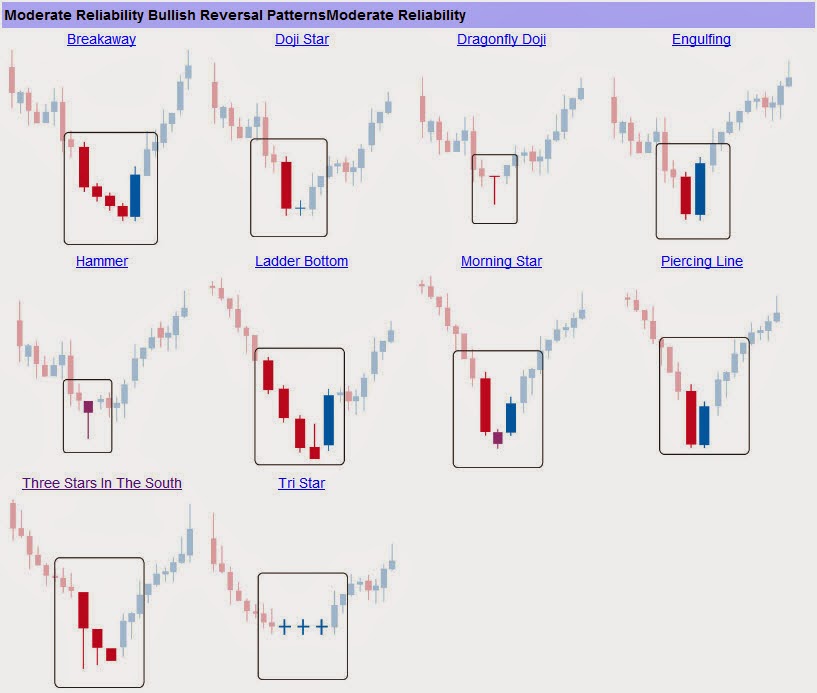

Reversal patterns are technical analysis formations that signal a potential change in the trend. They manifest on price charts when the prevailing price direction is challenged and reversed. Recognizing these patterns allows traders to anticipate impending shifts in market momentum, enabling them to adjust their strategies accordingly.

Double Top and Double Bottom

Considered one of the most well-known reversal patterns, the double top and double bottom formations occur when the price tests a certain resistance or support level twice, creating two consecutive peaks or troughs. A double top pattern foreshadows a bearish reversal, signaling a potential decline in price, while a double bottom pattern heralds a bullish reversal, hinting at a potential price increase.

Head and Shoulders

The head and shoulders pattern emerges when a price peak forms in the middle, higher than subsequent peaks on either side, accompanied by two troughs. This pattern consists of a “head,” “left shoulder,” and “right shoulder,” and it predicts a trend reversal. A head and shoulders pattern with a “neckline” drawn through the lows of the troughs indicates a potential bearish reversal, while the opposite formation, with the neckline drawn through the highs of the peaks, suggests a bullish reversal.

Image: forexclassmaster.blogspot.com

Triple Top and Triple Bottom

Similar to the double top and double bottom patterns, triple top and triple bottom formations occur when the price attempts to break through a resistance or support level three times, forming three successive peaks or troughs. These patterns carry a higher degree of conviction than their double counterparts, suggesting a potential for a stronger reversal. A triple top pattern signifies an amplified bearish reversal, while a triple bottom pattern indicates an intensified bullish reversal.

Inverse Head and Shoulders

The inverse head and shoulders pattern is the inverse of the head and shoulders pattern, mirroring its shape. It features a trough in the middle, lower than subsequent troughs on either side, escorted by two peaks. This pattern consists of an “inverse head,” “inverse left shoulder,” and “inverse right shoulder,” and it forecasts a shift in trend. An inverse head and shoulders pattern with a “neckline” drawn through the highs of the peaks hints at a possible bullish reversal, while the opposite formation, with the neckline drawn through the lows of the troughs, signals a potential bearish reversal.

Top 5 Reversal Pattern In Forex

https://youtube.com/watch?v=7OiY5MMCHp4

Conclusion

Mastering these five essential reversal patterns provides you with the tools to navigate the forex market with greater confidence. By recognizing these patterns, you gain insights into potential shifts in market momentum, allowing you to make informed trading decisions and potentially enhance your returns. Remember, the key to successful trading lies in understanding the intricacies of price action and responding to market cues with precision. Embrace these reversal patterns as your steadfast companions on your journey towards financial empowerment in the forex realm.