In the dynamic realm of financial markets, foreign exchange trading, commonly known as forex, holds a prominent position. This global marketplace, where currencies are bought, sold, and exchanged, has witnessed a surge in popularity over the years, attracting traders from all corners of the globe. Among the diverse nations engaging in forex, a select few have emerged as dominant players, shaping the very fabric of this trillion-dollar industry.

Image: www.compareforexbrokers.com

Exploring the intricate web of global forex trading, this article delves into the top 10 countries that have established themselves as powerhouses in this lucrative arena. From economic prowess to technological advancements, we unravel the factors that have propelled these nations to the forefront of the currency exchange ecosystem. By shedding light on their strategies and innovations, we aim to illuminate the path to success for aspiring forex traders and investors alike.

1. United Kingdom: A Global Forex Hub

Boasting the highest liquidity and the largest share of the global forex market, the United Kingdom stands as the undisputed leader in currency trading. London, the nation’s capital city, has long been recognized as a financial powerhouse, serving as home to the world’s leading banks, hedge funds, and investment firms. Regulatory stability, coupled with a skilled workforce and cutting-edge infrastructure, has solidified the UK’s position as a forex trading mecca.

2. United States: The Forex Trailblazer

Trailing closely behind the UK, the United States has firmly established itself as a forex trading behemoth. The nation’s vast economy, coupled with its deep and liquid financial markets, has attracted a plethora of participants, ranging from seasoned professionals to retail investors. Regulatory oversight by the Commodity Futures Trading Commission (CFTC) has instilled confidence among traders, fostering a thriving ecosystem for forex exchange.

3. Japan: Technological Prowess in Forex Trading

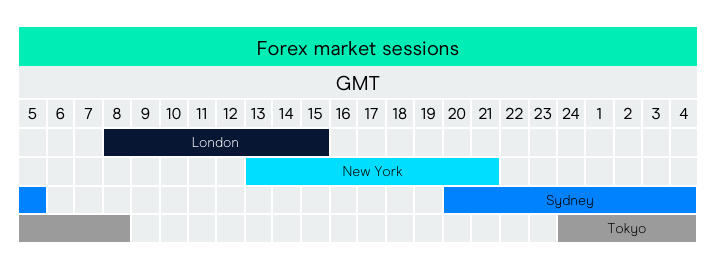

Japan’s technological prowess has catapulted it to the forefront of forex trading. The nation is renowned for its innovative trading platforms and sophisticated risk management tools. Tokyo, Japan’s financial hub, hosts the world’s third-largest forex market, leveraging advanced electronic trading systems to facilitate seamless currency exchange. The country’s expertise in artificial intelligence (AI) and machine learning has further reinforced its position as a forex trading powerhouse.

Image: nurtasapra.blogspot.com

4. Switzerland: Stability and Security in the Forex Market

Nestled in the heart of Europe, Switzerland has built a reputation for stability and security within the global financial landscape. Zurich, the nation’s financial center, is home to numerous private banks and currency exchange institutions. The Swiss franc’s stable value, coupled with robust financial regulations, has made Switzerland a popular haven for forex traders seeking safe and reliable trading conditions.

5. Hong Kong: A Gateway to Asian Forex Markets

As the gateway to China and other flourishing Asian economies, Hong Kong has emerged as a major player in forex trading. Its strategic location, coupled with a robust financial infrastructure and a highly skilled workforce, has transformed Hong Kong into a hub for currency exchange. The city’s free-market environment and regulatory framework have further enhanced its appeal among forex enthusiasts.

6. Singapore: A Pro-Business Hub for Forex Traders

Singapore, consistently ranked among the world’s most competitive economies, has also made significant strides in the realm of forex trading. The nation’s pro-business policies, coupled with a robust regulatory framework, have attracted a vast array of financial institutions and forex brokers. Singapore’s advanced technological infrastructure and its embrace of innovation have further solidified its status as a leading forex trading hub in Southeast Asia.

7. Australia: Riding the Wave of Asia-Pacific Growth

Australia has emerged as a force to be reckoned within the Asia-Pacific forex trading scene. Leveraging its close proximity to the rapidly developing economies of the region, Australia has witnessed a surge in forex activity. Sydney, the nation’s financial capital, has established itself as a significant forex trading center, buoyed by a skilled workforce and robust regulatory oversight.

8. Canada: A Stable and Regulated Forex Trading Environment

Canada has carved a niche for itself in the global forex market by fostering a stable and regulated trading environment. Toronto, the nation’s financial epicenter, is home to several major banks and forex trading firms. Strict regulations, transparent markets, and investor protection measures have made Canada an attractive destination for traders seeking a trustworthy and secure trading ecosystem.

9. France: A Major European Forex Trading Center

France, with its long-established financial heritage, has emerged as a cornerstone within the European forex trading landscape. The nation’s capital, Paris, is a hub for major banks, investment firms, and forex brokers. A skilled workforce and advanced technological infrastructure have further reinforced France’s position as a leading destination for currency traders.

Top 10 Mostly Forex Trading Countries

10. Germany: Precision and Innovation in Forex Trading

Germany, renowned for its manufacturing excellence and technological aptitude, has translated these strengths into the realm of forex trading. Frankfurt, the financial heart of Germany, boasts a substantial forex market, anchored by some of the world’s leading banks and financial institutions. The nation’s focus on precision and innovation has driven the development of sophisticated trading platforms and risk management tools, solidifying Germany’s position among the top forex trading countries.

The article’s conclusion should summarize the key points and emphasize the value