Introduction:

In the labyrinthine world of finance, forex trading stands as a colossal industry, alluring traders from all corners of the globe with its potential for substantial returns. Yet, navigating the ever-fluctuating forex markets requires a prudent approach and a firm grasp of effective trading strategies. This comprehensive case study unveils the top 10 forex trading strategies, empowering you with the knowledge to make informed decisions in the pursuit of trading success.

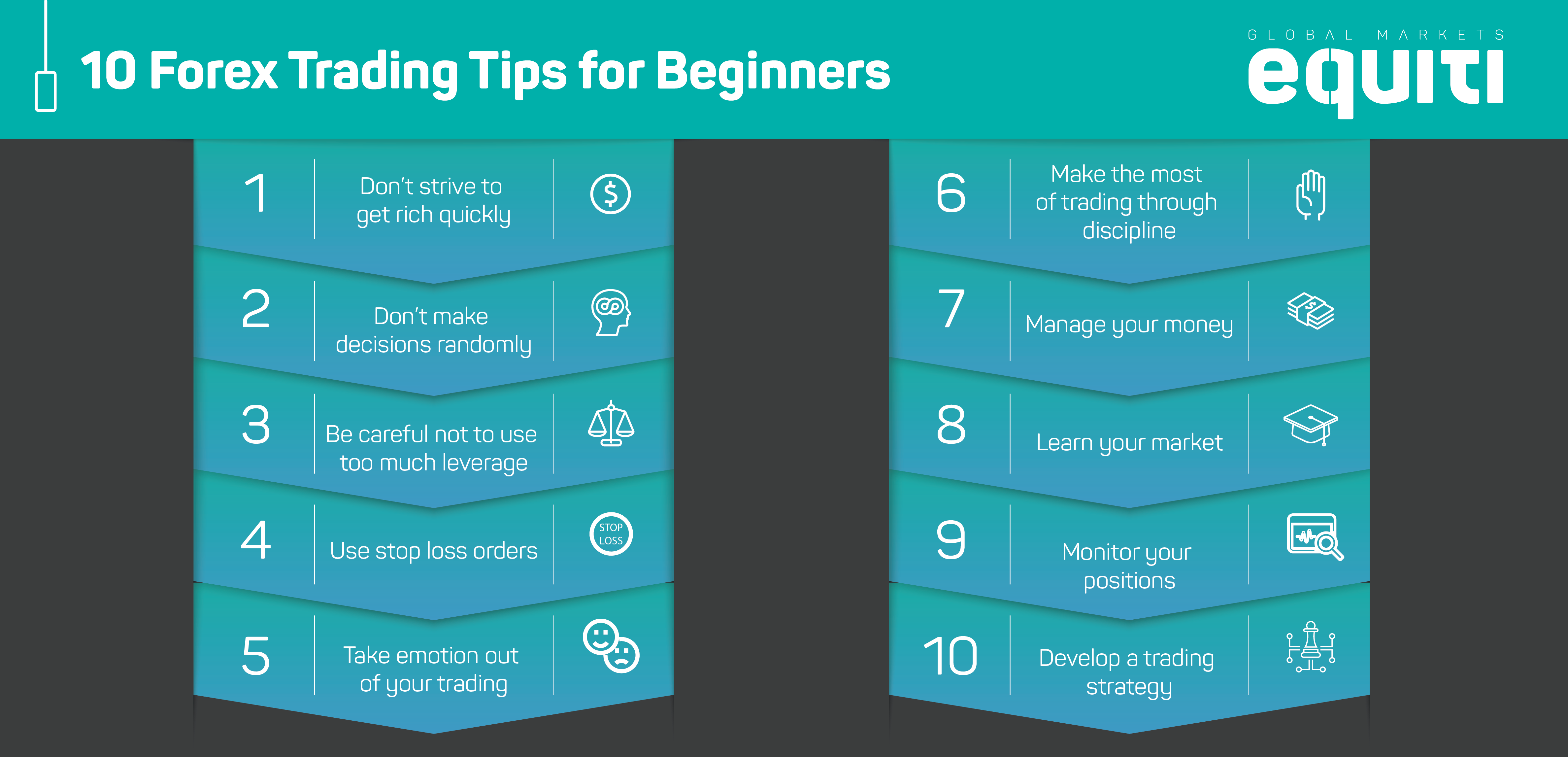

Image: www1.equiti.com

01. Scalping:

Initiating numerous trades throughout the trading day, scalpers capitalize on minute price movements to accumulate profits. This strategy demands pinpoint accuracy, sharp reflexes, and the ability to manage risk effectively. Armed with this approach, traders seek small gains over short timeframes, often utilizing technical indicators like moving averages and support/resistance levels.

02. Day Trading:

Unlike scalpers, day traders execute trades within the same trading day, entering and exiting positions before market close. They analyze market trends, identify trading opportunities, and leverage risk management techniques to maximize profits. Day trading can be both rewarding and challenging, requiring a deep understanding of market dynamics and the ability to make swift, decisive decisions.

03. Swing Trading:

Swing trading encompasses a longer time horizon than day trading, with traders holding positions for several days to weeks. They capitalize on larger price swings, utilizing technical analysis to identify market trends and potential price reversals. Swing traders aim to capture a significant portion of price movements while minimizing risk exposure.

Image: tradingstrategyguides.com

04. Position Trading:

As the name suggests, position trading involves holding positions for an extended period, often months or even years. Position traders analyze fundamental factors like economic data and geopolitical events to speculate on long-term price trends. This strategy necessitates patience, disciplined money management, and the ability to endure market fluctuations.

05. News Trading:

News trading revolves around profiting from market volatility caused by significant economic or political events. News traders monitor economic calendars, assess news releases, and attempt to anticipate how markets will react to these events. Timing and quick decision-making are crucial, as markets can fluctuate rapidly following news announcements.

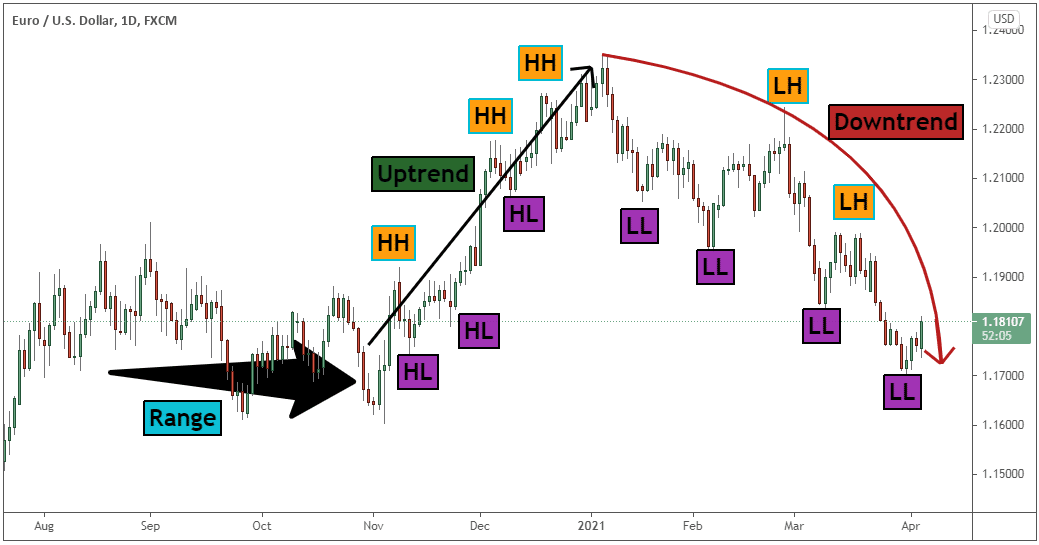

06. Trend Trading:

Trend traders align their positions with prevailing market trends, benefiting from sustained price movements. They identify trend directions using technical indicators and market analysis, capitalizing on momentum to maximize profits. Trend trading can be particularly lucrative in trending markets but requires patience and disciplined risk management.

07. Range Trading:

When markets oscillate within a defined range, range traders seek to profit from these price fluctuations. Analyzing support and resistance levels is fundamental, as range traders aim to buy near support and sell near resistance, capturing profits within the established range.

08. Hedging:

Hedging strategies involve using multiple positions in different assets to offset potential losses. Traders aim to neutralize risk exposure by taking offsetting positions in correlated or inversely correlated markets. Hedging can be beneficial for preserving capital and managing overall risk in a trading portfolio.

09. Copy Trading:

Copy trading offers a unique approach for novice traders, allowing them to mirror the trades of experienced or successful traders. This strategy involves subscribing to a copy trading service that automatically executes trades based on the signals or strategies of the chosen trader.

10. Algorithmic Trading:

Algorithmic trading, also known as algo trading, employs computer algorithms to execute trades based on predefined parameters and models. These algorithms analyze market data, identify trading opportunities, and execute trades autonomously. Algo trading can offer benefits like reduced emotional biases, faster execution, and 24/7 monitoring.

Top 10 Forex Trading Strategy My Case Study

https://youtube.com/watch?v=ujHd1Ww_HNE

Conclusion:

The pursuit of profitability in forex trading hinges upon mastering effective trading strategies and customizing them to suit individual risk tolerance and trading styles. This case study has meticulously outlined the top 10 forex trading strategies to equip traders with the knowledge they need to navigate the complexities of the forex markets. Whether you’re a seasoned trader or an aspiring one, understanding these strategies empowers you to make informed decisions and increase your chances of trading success. Remember, dedication, continuous learning, and disciplined risk management are invaluable companions in this ever-evolving financial landscape.