If the allure of the currency markets has piqued your interest and you’re seeking a competitive edge in forex trading, this article presents you with an essential guide to the top 10 forex signal indicators for the renowned MetaTrader 4 (MT4) platform. Let’s embark on a journey that will empower you to navigate the complex world of forex trading with newfound confidence and clarity.

Image: forexpops.com

Unveiling the Power of Forex Signal Indicators

Forex signal indicators hold immense value in the toolkit of every aspiring and experienced trader alike. These indicators analyze market data, employing various technical and fundamental parameters, to provide insightful trading signals that aim to augment your profit-making potential. By harnessing the power of the MT4 platform, traders gain access to an array of these invaluable trading tools, enabling them to make informed decisions that can significantly improve their chances of success.

Analyzing market trends, identifying trading opportunities, and managing risk become a breeze with the implementation of forex signal indicators. They mitigate the need for extensive manual analysis, saving you time and effort while equipping you with actionable insights to optimize your trading strategies.

The Ultimate MT4 Forex Signal Indicator Toolkit

- ADX (Average Directional Index): Quantifies the trend’s strength and direction, assisting traders in recognizing lucrative trading opportunities.

- Bollinger Bands: Outlines the market’s volatility by constructing bands around the moving average, offering valuable insights into price action dynamics.

- Ichimoku Cloud: A comprehensive indicator that merges several technical analysis components to provide a comprehensive view of market trends and momentum.

- MACD (Moving Average Convergence Divergence): Evaluates the relationship between two moving averages, aiding in the identification of trend reversals and potential trading opportunities.

- Parabolic SAR (Stop and Reverse): Plots a series of parabolic curves that trail the price action, allowing traders to determine potential trend reversals.

- Relative Strength Index (RSI): Assesses the market’s momentum by measuring recent price changes, helping traders gauge overbought and oversold conditions.

- Stochastic Oscillator: Determines the overbought and oversold levels by comparing the closing price to the price range over a specific period, providing valuable insights into potential trend reversals.

- Support and Resistance: Highlights critical price levels where the trend may potentially reverse, empowering traders to identify potential trading opportunities.

- Trend Following: A group of indicators that identify and capitalize on prevailing market trends, assisting traders in aligning their strategies with the dominant market momentum.

- Volume: Measures the number of transactions executed over a given period, aiding in detecting market sentiment and potential trend reversals.

Expert Tips and Advice for Enhanced Trading Success

- Embrace a Multifaceted Approach: Utilize a combination of forex signal indicators to gain a comprehensive perspective of market dynamics, rather than relying solely on a single indicator.

- Fine-Tune Your Settings: Experiment with different parameters and settings within each indicator to optimize their performance and align them with your trading style and risk tolerance.

- Manage Your Risk: Maintain a prudent risk management strategy by determining your risk appetite and implementing stop-loss orders to mitigate potential losses.

- Learn, Refine, and Adapt: Continuously enhance your forex trading knowledge by exploring different strategies, indicators, and technical analysis techniques to refine your approach over time.

- Seek Expert Mentorship: Consider seeking guidance from experienced traders or forex mentors to accelerate your learning curve and gain valuable insights from their expertise.

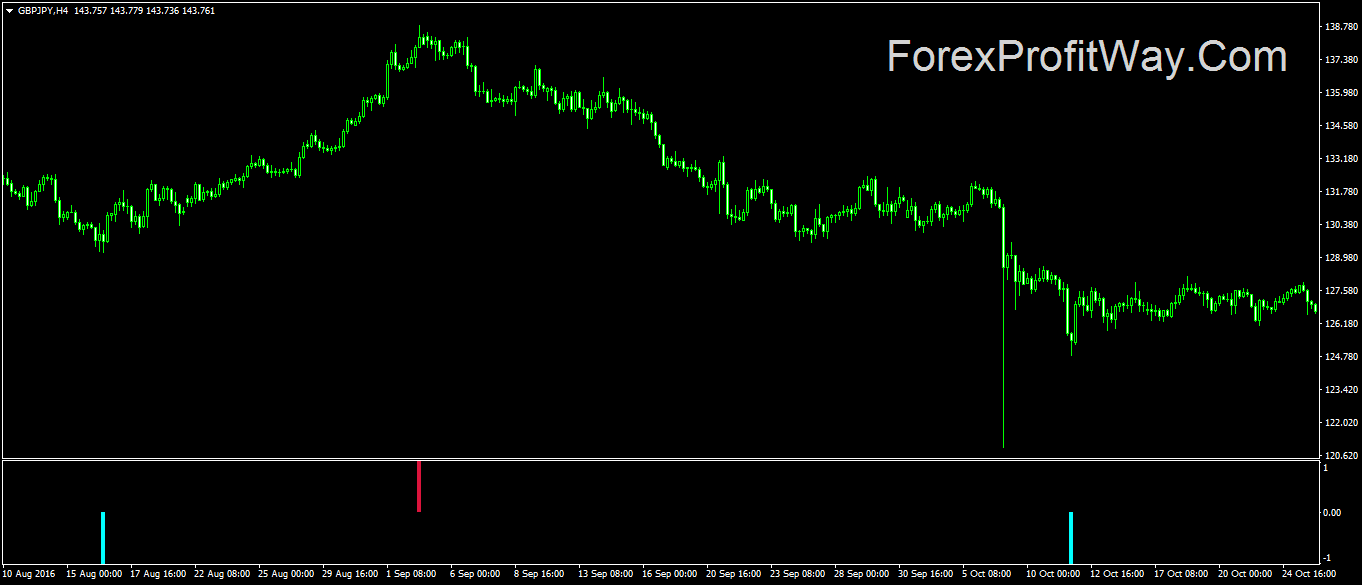

Image: forexprofitway.com

FAQs Regarding Forex Signal Indicators

Q: Are forex signal indicators foolproof?

A: While forex signal indicators provide valuable insights, they should not be treated as a guarantee of success. They offer probabilistic signals that require interpretation and prudent decision-making by the trader.

Q: How do I choose the right forex signal indicator?

A: Determine the indicators that align with your trading style, risk tolerance, and the specific market conditions you trade in. Experiment with different indicators to find the best fit for your needs.

Q: Can I use multiple forex signal indicators simultaneously?

A: Yes, combining multiple indicators can provide a comprehensive view of market dynamics, but it’s crucial to use them in conjunction with sound risk management practices to avoid overwhelming yourself with too much information.

Top 10 Forex Signal Indicator Mt4

Conclusion

The realm of forex trading offers both immense opportunities and potential risks. By incorporating the top-rated forex signal indicators into your trading strategy, you equip yourself with a powerful arsenal to navigate the dynamic currency markets with greater confidence and clarity. Remember to continuously refine your approach through education and experience, and stay adaptable to the ever-evolving market landscape.

Are you ready to elevate your forex trading prowess and maximize your earning potential? Embrace the power of these top 10 forex signal indicators for MT4 today and embark on a journey toward trading success.