Introduction

Navigating the dynamic and often unpredictable world of forex trading requires a keen understanding of market trends and behaviors. Forex indicator signals serve as essential tools for traders, providing valuable insights into price movements, potential trend reversals, and optimal entry and exit points. In this comprehensive guide, we delve into the top 10 forex indicator signals, empowering traders with the knowledge and techniques to enhance their trading strategies and maximize their profitability.

Image: riset.guru

Leading Indicators

1. Relative Strength Index (RSI)

The RSI measures the magnitude of price changes over a specified period, providing insights into overbought or oversold market conditions. Values above 70 indicate overbought conditions while values below 30 suggest oversold conditions, potentially signaling potential reversals.

2. Stochastic Oscillator

The Stochastic Oscillator compares the closing price to the price range over a specific period, indicating overbought/oversold zones. Traders often look for oversold readings below 20% or overbought readings above 80% to identify potential trend changes.

3. Moving Average Convergence/Divergence (MACD)

The MACD is a combination of two exponential moving averages (EMA) that tracks momentum and trend direction. Divergences between the MACD line and the signal line can provide early warnings of potential reversals or trend continuations.

Lagging Indicators

4. Moving Average (MA)

The Moving Average smooths out price data by calculating the average price over a specific period. Traders commonly use the 50-day MA or 200-day MA as support or resistance levels, identifying underlying market trends.

5. Bollinger Bands

Bollinger Bands consist of an upper and lower band that fluctuate around a moving average. Breaches or bounces off these bands can signal overbought/oversold conditions or potential breakouts.

6. Ichimoku Cloud

The Ichimoku Cloud is a composite indicator that visualizes multiple time frames and trend direction. The cloud’s color and position can provide insights into current and future market sentiment.

Oscillators

7. Awesome Oscillator (AO)

The AO measures the difference between two exponential moving averages, with positive values indicating bullish momentum and negative values signaling bearish momentum. Crossovers or divergences in the AO can provide trade signals.

8. Momentum Indicator

The Momentum Indicator compares the closing price to the closing price of a previous period, providing insights into the rate of price change. Extreme positive or negative values can indicate potential trend reversals.

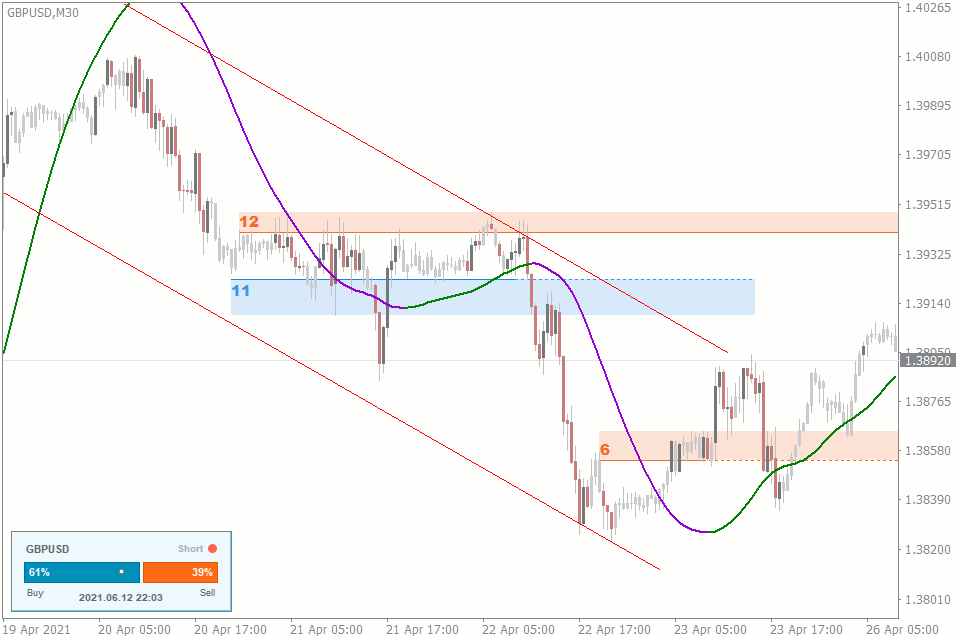

Image: riset.guru

Trend Indicators

9. Trend Lines

Trend lines connect price highs and lows, creating visual representations of prevailing market trends. Breaks or bounces off trend lines can signal potential changes in direction.

10. Fibonacci Retracement

Fibonacci Retracement levels are based on a mathematical sequence and indicate potential support or resistance levels after a price surge or decline. Traders use these levels to anticipate possible retracements or continuation trends.

Top 10 Forex Indicator Signal

Conclusion

The top 10 forex indicator signals presented in this guide serve as invaluable tools for traders seeking to enhance their decision-making process. By understanding the mechanics and implications of each indicator, traders can navigate the forex market with greater confidence, identify profitable trading opportunities, and mitigate risk effectively. Remember, trading involves inherent risk, and it’s crucial to use these indicators in conjunction with sound risk management strategies and a comprehensive trading plan.