Unveiling the Power of Forex Forecast Tools: A Window into the Future of Currency Markets

Image: www.mycryptopedia.com

In the realm of currency trading, the ability to forecast price movements can mean the difference between success and failure. Enter the realm of forex forecast tools, the indispensable navigational aids that empower traders with unparalleled insights into the ever-evolving financial landscape. With these cutting-edge instruments, traders can decipher market dynamics, anticipate trends, and make informed decisions that can maximize their profits.

But what exactly are these revolutionary tools, and how can you harness their transformative power? In this comprehensive guide, we will embark on an enlightening journey into the world of forex forecast tools, shedding light on their genesis, unraveling their intricacies, and empowering you with the knowledge to leverage their capabilities to the fullest. Prepare to unlock a treasure trove of information that will forever alter your forex trading trajectory.

The Genesis of Forex Forecast Tools: A Journey of Innovation

The genesis of forex forecast tools can be traced back to the early days of currency trading, when traders relied on instinct and rudimentary economic indicators to gauge market sentiment. However, as the forex market evolved into a complex and dynamic global phenomenon, the need for more sophisticated forecast tools became imperative.

With the advent of computers and the rise of artificial intelligence (AI), the development of forex forecast tools gained momentum. The convergence of advanced statistical techniques, machine learning algorithms, and vast datasets paved the way for the creation of innovative tools that could analyze market data with unmatched accuracy and speed.

Unraveling the Intricacies: A Comprehensive Taxonomy of Forecast Tools

The landscape of forex forecast tools is a diverse tapestry of offerings, each tailored to specific trading styles and preferences. From technical analysis tools to fundamental analysis tools and hybrids that combine both approaches, the choice of a forecast tool depends on the individual trader’s risk tolerance, investment horizon, and trading strategies.

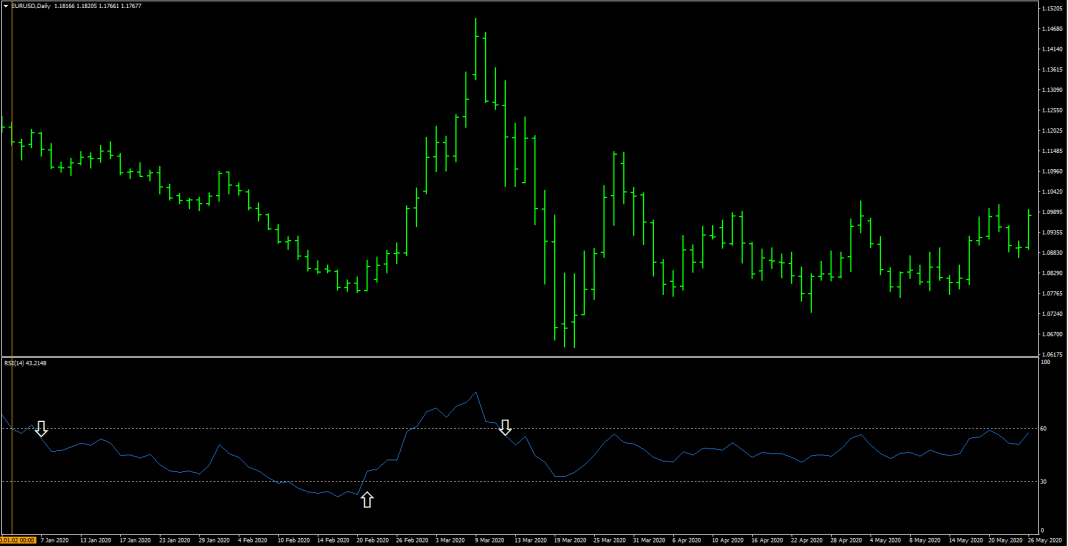

Technical analysis tools unravel market patterns, identify trends, and predict price movements based on historical data. Indicators like Bollinger Bands, moving averages, and stochastic oscillators are staples in the arsenal of many technical traders.

Fundamental analysis tools, on the other hand, delve into economic fundamentals, such as interest rates, inflation, and political events, to gauge their impact on currency values. News feeds, economic calendars, and central bank announcements are essential resources for fundamental analysts.

Hybrid forecast tools synergize the strengths of both technical and fundamental analysis, providing a holistic view of market dynamics. These tools often incorporate AI and machine learning algorithms to interpret complex data and deliver highly accurate forecasts.

Empowering Traders: Actionable Insights for Informed Decision-Making

The true value of forex forecast tools lies in their ability to empower traders with actionable insights that can guide their trading decisions. These tools can:

-

Identify Trading Opportunities: By spotting potential trends and reversals, forecast tools help traders identify lucrative trading opportunities that align with their risk appetite and investment goals.

-

Manage Risk: Forex forecast tools provide early warnings of potential market volatility or unexpected shifts in currency values, allowing traders to adjust their positions accordingly and mitigate risk exposure.

-

Plan Trade Entries and Exits: Forecast tools enable traders to determine optimal entry and exit points for their trades, maximizing profit potential while minimizing losses.

-

Stay Ahead of Market Trends: With the ability to analyze vast amounts of data in real-time, forecast tools provide traders with a competitive edge, allowing them to stay ahead of market trends and capitalize on emerging opportunities.

Harnessing the Power: A Practical Guide to Utilizing Forecast Tools

To harness the full potential of forex forecast tools, it’s essential to adopt a strategic approach that aligns with your trading style and investment goals. Consider the following practical tips:

-

Choose the Right Tool: Select a forecast tool that complements your trading style and risk tolerance. If you prefer technical analysis, consider tools that specialize in pattern recognition and trend analysis. If fundamental analysis is your forte, opt for tools that provide in-depth coverage of economic data and geopolitical events.

-

Understand Tool Limitations: Recognize that even the most advanced forecast tools have limitations. Market conditions can change rapidly, and unforeseen factors can disrupt even the most accurate predictions. Avoid relying solely on forecast tools, and use them in conjunction with other trading strategies.

-

Monitor Multiple Tools: Don’t limit yourself to a single forecast tool. Consider using multiple tools to gain a more comprehensive view of market sentiment and identify potential trading opportunities from different perspectives.

-

Stay Updated: Regularly update your forecast tools to access the latest features and ensure accurate predictions. Technological advancements and market dynamics evolve constantly, and updated tools will provide the most up-to-date insights.

A Glimpse into the Future: The Next Frontier of Forex Forecasting

The future of forex forecast tools is rife with exciting possibilities. AI and machine learning algorithms are poised to further refine these tools, enhancing their predictive accuracy and user experience. Integration with mobile devices will make it easier for traders to access real-time insights and make informed decisions on the go.

As the forex market continues to grow and evolve, the demand for innovative forecast tools will only intensify. The transformative power of these tools will empower traders with unparalleled foresight, enabling them to navigate the complexities of the currency markets and achieve unprecedented levels of success.

Conclusion: A New Era of Forex Forecasting

Forex forecast tools have forever changed the landscape of currency trading, providing traders with a powerful arsenal to decipher market dynamics and make informed decisions. From technical analysis tools to fundamental analysis tools and hybrid offerings, the choice of forecast tool depends on the individual trader’s unique trading style and investment goals.

By understanding the genesis, unraveling the intricacies, and harnessing the power of forex forecast tools, traders can gain a competitive edge in the currency markets. As we venture into the future, the evolution of these tools promises to unlock even more transformative possibilities, empowering traders to navigate the complexities of currency trading with unprecedented accuracy and efficiency. Embrace the power

Image: smarttoolz.net

Tools That Give Forex Forecast