Navigating the World of Currency Exchange with Confidence

In today’s globalized economy, currency exchange plays a vital role in international trade, travel, and personal finance. Understanding the foreign exchange market and accessing real-time currency rates is crucial for informed decision-making. This article delves into the world of foreign exchange, with a focus on HDFC Bank’s forex rates, empowering you with the knowledge and tools to navigate the complexities of currency exchange.

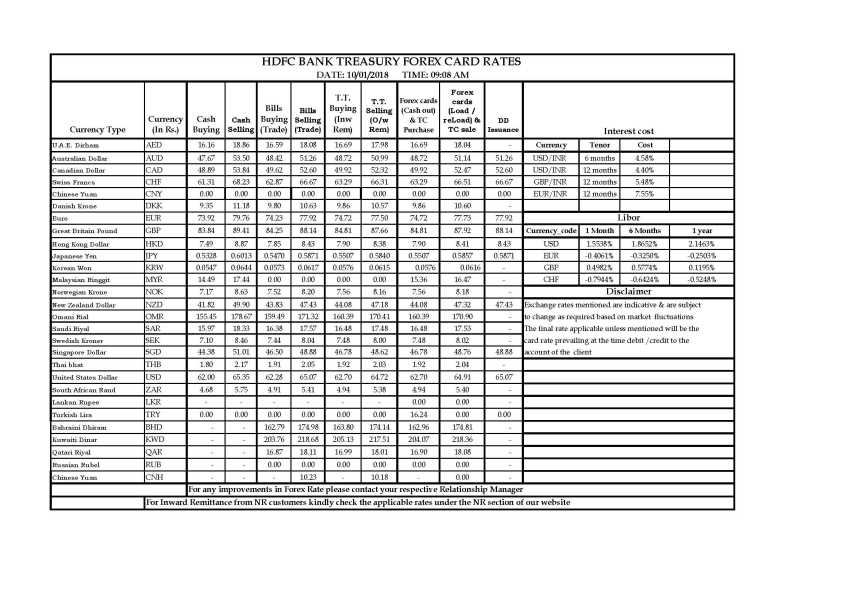

Image: management.ind.in

HDFC Bank: A Leading Force in Forex

HDFC Bank, India’s largest private sector bank, is renowned for its comprehensive suite of financial services, including foreign exchange services. HDFC Bank’s forex rates are competitive and reflect the dynamic nature of the currency market. With extensive experience in international banking, HDFC Bank has established a reputation for accuracy, reliability, and customer-centric service.

HDFC Bank’s online portal provides real-time forex rates for over 25 currencies, allowing you to compare rates, track currency movements, and make informed decisions in real-time.

Understanding Foreign Exchange Rates

Foreign exchange rates represent the value of one currency relative to another. They are constantly fluctuating due to various economic and geopolitical factors. Fluctuations in currency rates can impact businesses, travelers, and individuals who have international commitments. Understanding these factors is crucial for making prudent financial decisions.

Factors Influencing Forex Rates:

- Economic Growth: A strong economy can lead to an appreciation of the currency.

- Interest Rates: Higher interest rates can attract foreign investment, boosting demand for the currency.

- Political Stability: Political instability can lead to currency devaluation.

- Supply and Demand: The demand for a particular currency relative to its supply influences its value.

- Global Events: Major economic or political events worldwide can impact forex rates.

Image: investorplace.com

Tips for Navigating Forex Rates

Whether you are a seasoned business traveler or an individual planning an international trip, understanding forex rates is essential. Here are a few tips to help you navigate the world of currency exchange with confidence:

Plan Ahead:

Keep track of currency trends and plan your exchange transactions accordingly. HDFC Bank’s real-time forex rates allow you to monitor currency movements.

Compare Rates:

Compare forex rates offered by different banks and money changers to secure the best deal. HDFC Bank’s competitive rates are designed to offer value to customers.

Consider Using a Currency Exchange Card:

Currency exchange cards offer secure and convenient means of carrying foreign currency. Preloaded with a specific amount in a chosen currency, they eliminate the need for carrying cash and can save on exchange fees.

FAQs on Forex Rates

- How do I find the latest HDFC Bank forex rates?

You can visit HDFC Bank’s online portal or download their mobile application for real-time forex rates.

- What factors influence forex rates?

Forex rates are influenced by various economic, political, and global factors.

- How can I stay updated on currency market trends?

Follow financial news sources, subscribe to currency updates, and monitor forex rate websites.

- What are the advantages of using a currency exchange card?

Currency exchange cards provide security, convenience, and reduced exchange fees.

Today Hdfc Bank Forex Rate Today

Conclusion

HDFC Bank forex rates provide a reliable benchmark for individuals and businesses navigating the currency exchange market. By staying informed about forex trends, understanding the factors that influence exchange rates, and implementing these tips, you can make informed financial decisions and optimize your foreign exchange transactions. Explore HDFC Bank’s suite of forex services, including real-time rate updates, competitive pricing, and expert guidance, to empower yourself in the world of global finance.

Do you have any questions or experiences with HDFC Bank forex rates? Share your thoughts in the comments below!