Trading Forex: A Lucrative Endeavor Unleashing Profits

Navigating the realm of foreign exchange trading, or forex, is a tantalizing pursuit that beckons traders with the promise of lucrative rewards. However, embarking on this financial odyssey without the compass of knowledge can lead to treacherous waters, potentially capsizing your financial aspirations. Embarking on this journey requires careful consideration of the opportune moments to trade, but more importantly, recognizing the times when prudence dictates refraining from trading activities.

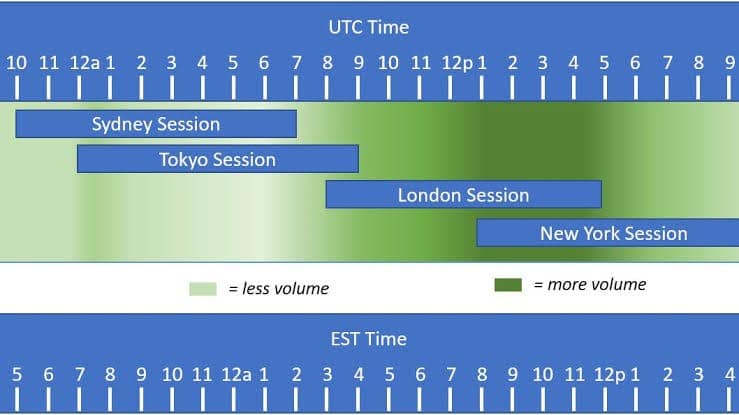

Image: www.vpsmalaysia.com.my

Timing is Paramount: Identifying the Forbidden Trading Intervals

To achieve long-term success in the ever-shifting forex market, traders must possess an acute awareness of the times when discretion is the better part of valor. These intervals, fraught with heightened volatility and unpredictable market movements, present formidable challenges for even the most seasoned traders. Discerning these periods of trading adversity can prove to be the linchpin between preserving capital and harnessing the transformative power of the market.

Market Closures: A Time for Respite and Reflection

When global financial centers close their doors, the forex market enters a period of relative dormancy, devoid of the frenetic trading activity that characterizes its peak hours. This respite provides an ideal opportunity for traders to disengage, allowing their minds to recalibrate, and to reassess their trading strategies. Attempting to navigate the uncharted waters of a closing market, where liquidity dwindles, can be akin to setting sail in a stormy sea.

Holidays: Embracing Festive Merriment and Trading Cessation

As the world pauses to celebrate, forex markets across the globe fall silent. These festive intervals offer ample time for traders to indulge in the revelry of the season and reconnect with their loved ones. While the allure of potential profits may linger, the wise trader recognizes that these moments of joyous respite are not for trading. Market dynamics during these periods are often unpredictable, making profitable trading ventures a daunting endeavor.

Image: www.calibrateindia.com

News and Market Events: Caution Amidst Volatility

The release of market-moving economic news and geopolitical events has the profound ability to trigger seismic shifts in currency values. During these times, the tranquil waters of the forex market transform into a tempest, with wild price swings and high volatility becoming the norm. While these moments may present fleeting opportunities for seasoned traders, for the uninitiated, they can be a perilous minefield. Treading cautiously during these events is the prudent path, allowing the storm to pass before re-entering the market’s turbulent currents.

Technical Analysis: A Guiding Light Amidst Uncertainty

Technical analysis, a powerful tool in a trader’s arsenal, provides insights into market trends and price movements based on historical data. By diligently analyzing charts and applying technical indicators, traders can identify potential trading opportunities and avoid potential pitfalls. However, it is critical to remember that technical analysis is not an infallible crystal ball, and its efficacy diminishes during volatile periods. When the market exhibits erratic behavior, relying solely on technical indicators can lead to disastrous consequences.

Risk Management: The Cornerstone of Preserving Capital

Risk management is the bedrock upon which successful trading is built. Forex traders must possess a steadfast commitment to managing their risk exposure, ensuring that potential losses do not eclipse their financial fortitude. Prudent risk management dictates understanding one’s risk tolerance, implementing stop-loss orders, and employing position sizing strategies. During volatile market conditions, adopting a conservative approach to risk management is imperative.

Emotional Discipline: Mastering the Inner Turmoil

Navigating the forex market demands emotional fortitude, the ability to remain steadfast amidst the rollercoaster of market movements. Unchecked emotions, such as fear and greed, can cloud judgment and lead to impulsive decisions that imperil capital. Traders must strive to maintain emotional discipline, ensuring that their trading decisions are guided by rational analysis rather than knee-jerk reactions. Volatile market conditions present a formidable test to emotional discipline, amplifying the need for composure and self-control.

Times Not To Trade Forex

Conclusion: Embracing the Wisdom of Timing and Discipline

Embarking on a trading odyssey requires a discerning eye, one that recognizes the auspicious moments for trading and the intervals when caution prevails. By internalizing the times when trading should be avoided, such as during market closures, holidays, news and market events, and periods of excessive volatility, traders can navigate the perilous waters of the forex market with greater confidence and mitigate the associated risks. Moreover, embracing the tenets of risk management, technical analysis, and emotional discipline is paramount in preserving capital and unlocking the path to sustained trading success.