Introduction

Time seems to slip away like sand through our fingers, especially when we’re engrossed in the dynamic world of forex trading. As the clock ticks down on trading hours, it’s crucial to make the most of the time left to maximize profits and minimize losses. Embark on this journey as we delve into the dwindling time left for forex trading, exploring strategies and insights to seize the remaining opportunities.

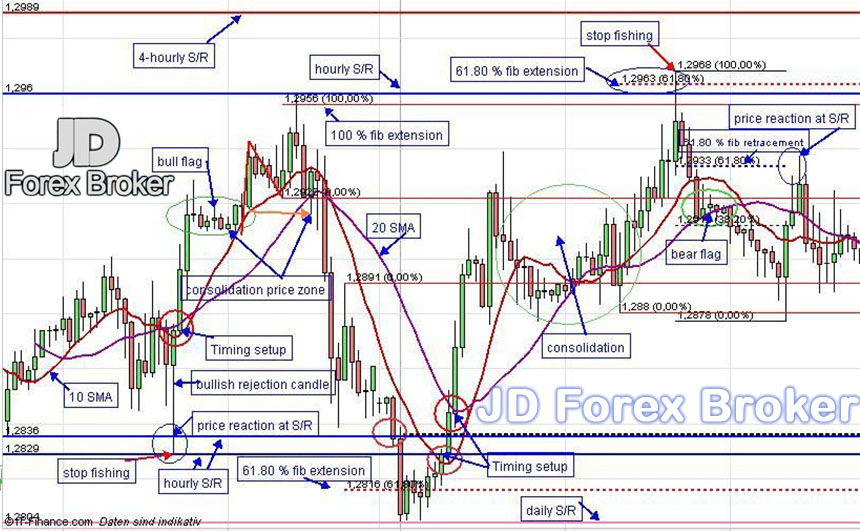

Image: www.jdforexbroker.com

Upholding time-sensitive precision in forex trading is paramount. The market’s ebb and flow hinges upon a perpetual cycle of fleeting moments, where decisions made in an instant can reap bountiful rewards or profound losses. Forex traders must possess an acute sense of timing, akin to skilled chess players calculating their next move with calculated finesse.

Window of Opportunity: Dawn and Dusk Advantage

The first and last hours of the trading day present golden opportunities for discerning traders. During these twilight hours, volatility often surges as global markets overlap. The early morning sees Asian and European markets intertwine, while the evening twilight witnesses the baton passing to American and European markets. These trading hours offer a fertile ground for strategic maneuvers and lucrative entries and exits.

Midday Lull: Time for Reflection and Strategy

As the sun ascends to its zenith, forex markets typically experience a period of relative calm. This midday lull provides an ideal interval for traders to pause, reflect on their strategies, and plan for the remaining hours of trading. Market analysis and charting necessitate meticulous attention and a clear mind, making the midday lull an opportune time to engage in these critical tasks.

Taking Advantage of Country-Specific Events

The forex market is a tapestry woven from the threads of global economies. Savvy traders recognize the significance of country-specific events, such as economic data releases, central bank announcements, and political developments. These events have the power to send shockwaves through the market, creating profitable trading opportunities for those who anticipate and react swiftly.

Image: app.jerawatcinta.com

The Power of Technical Analysis in Timing Trades

Technical analysis serves as a potent tool in the trader’s arsenal. By studying price charts and identifying patterns, traders can make informed decisions about market direction. Candlestick formations, moving averages, and support and resistance levels provide valuable insights into potential price movements, enabling traders to time their entries and exits with greater precision.

Hedging and Risk Management: Preserving Capital

While the allure of substantial profits captivates traders, prudent risk management practices are essential. Hedging strategies, such as stop-loss orders and position sizing, act as safety nets, protecting capital from unforeseen market fluctuations. By implementing robust risk management measures, traders can navigate volatile markets with greater confidence and peace of mind.

Mindful Trading: The Key to Long-Term Success

Forex trading demands a balanced approach, harmonizing technical analysis with self-awareness. Traders must cultivate mindfulness and emotional resilience to withstand the inevitable ups and downs of the market. A clear trading plan and unwavering discipline serve as anchors during turbulent market conditions, preventing impulsive decisions that could jeopardize long-term success.

Time Left For Forex Trading

Conclusion

Time is a paradoxical enigma in forex trading. It can both be a friend and a formidable adversary. By embracing time-sensitive strategies, capitalizing on unique market conditions, and implementing robust risk management protocols, traders can make the most of the time left for forex trading. Remember, time is but a river flowing relentlessly forward. Seize the opportunities, ride the waves of the market, and emerge victorious in the realm of forex trading.