Introduction:

Image: algotradingsystem.logdown.com

Imagine navigating the treacherous waters of the financial markets without a compass or a map. Forex trading, with its inherent complexities and constant volatility, can be an overwhelming ordeal for even seasoned investors. However, a beacon of hope shines amidst the uncertainty: the time and direction indicator, a powerful tool that can illuminate the path towards profitable trades.

Understanding the Time and Direction Indicator:

At its core, the time and direction indicator (TDI) is a technical analysis tool used to identify trends and predict future price movements. It consists of two components: a MACD (moving average convergence divergence) histogram and a signal line. The MACD histogram plots the difference between two exponential moving averages (EMAs) of an underlying asset’s price, while the signal line is an EMA of the MACD histogram.

Decoding the Histogram:

The MACD histogram, like a seismograph of market momentum, oscillates above and below a zero line. When the MACD histogram is above zero, it suggests bullish momentum, while a MACD histogram below zero indicates bearish momentum. The divergence between the MACD histogram and the price of the underlying asset provides valuable insights into potential trend reversals.

Leveraging the Signal Line:

The signal line, like a guiding star, represents the smoothed trend of the MACD histogram. When the MACD histogram crosses above the signal line, it signals a potential buy opportunity. Conversely, when the MACD histogram crosses below the signal line, it can indicate a potential sell opportunity.

Utilizing the Time and Direction Indicator:

Harnessing the power of the TDI requires a combination of technical expertise and market understanding. Traders can employ the following strategies to maximize its effectiveness:

- Identify Trends: The TDI can identify the prevailing trend by analyzing the direction and magnitude of the MACD histogram and signal line.

- Detect Divergences: By comparing the TDI to the price action of the underlying asset, traders can identify potential trend reversals.

- Plan Entries and Exits: The TDI provides signals for potential buy and sell opportunities based on the crossings of the MACD histogram and the signal line.

- Set Stop-Loss and Take-Profit Levels: By analyzing the TDI in conjunction with other technical indicators, traders can determine appropriate stop-loss and take-profit levels to manage risk and maximize returns.

Expert Insights and Actionable Tips:

“The TDI is an invaluable tool for forex traders, revealing market momentum and potential trading opportunities,” says renowned trader and analyst, Mark Douglas. “By combining the TDI with other indicators, traders can enhance their trading strategies and achieve consistent results.”

To leverage the TDI effectively, consider these tips:

- Study the Underlying Market: Thoroughly understand the economic and political factors that influence the market you are trading.

- Combine with Multiple Indicators: Use the TDI in conjunction with other technical indicators to confirm signals and reduce false positives.

- Set Realistic Expectations: Recognize that no indicator is perfect, and use the TDI as a guide rather than a definitive predictor.

Conclusion:

Like a compass in the hands of a seasoned mariner, the time and direction indicator empowers forex traders to navigate the tumultuous waters of the financial markets. By comprehending its workings, leveraging expert insights, and implementing actionable tips, traders can enhance their decision-making process, identify profitable opportunities, and mitigate risks. In the relentless pursuit of trading success, the time and direction indicator stands as a beacon of guidance, illuminating the path towards informed and profitable trades.

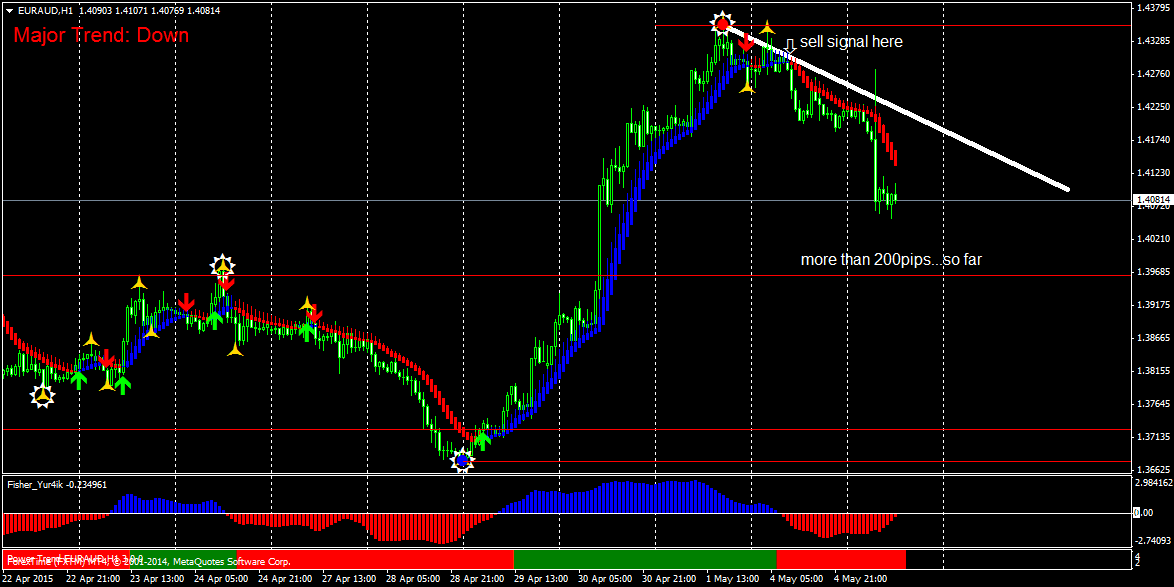

Image: www.mt4tradingbox.com

Time And Direction Indicator In Forex Factory