Picture this: the turn of the millennium, a time of global economic flux and financial uncertainty. As the world navigated an increasingly interconnected landscape, a quiet revolution was unfolding in the world of international finance – the exponential surge in foreign exchange (forex) reserves.

Image: www.zoomnews.in

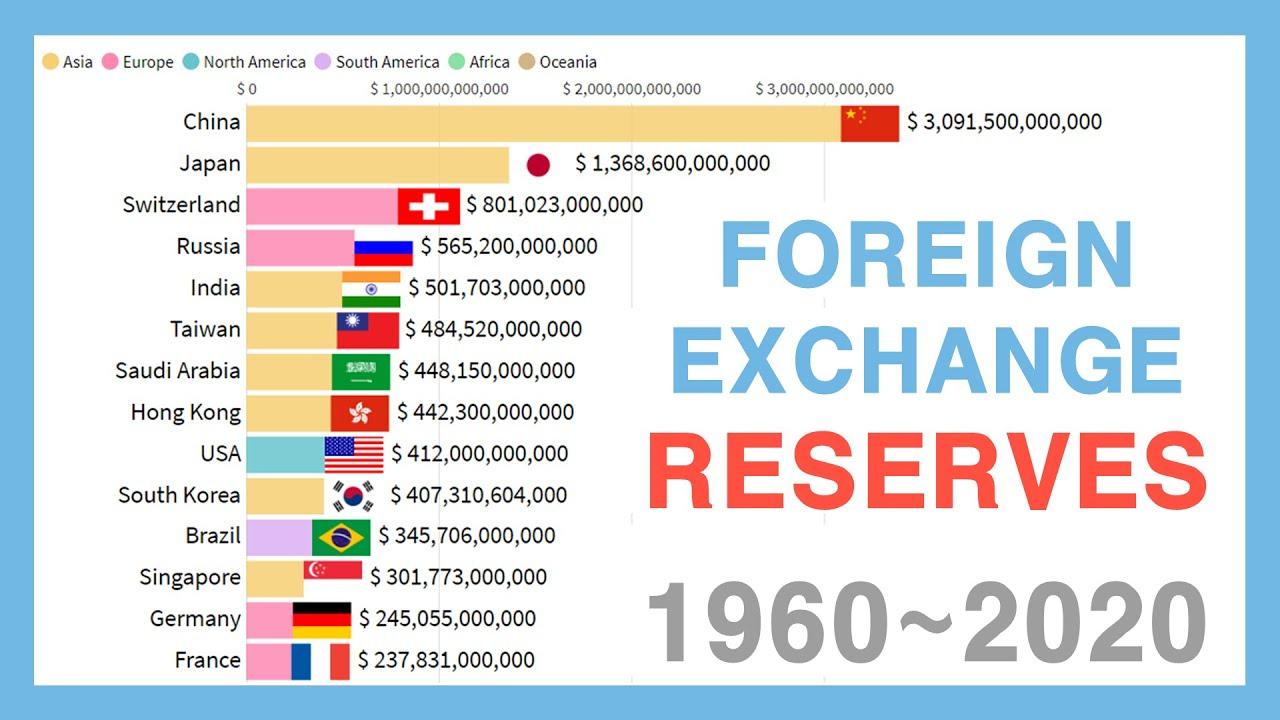

From 2001 to 2008, the collective forex reserves of central banks worldwide soared by a staggering 600% – an unprecedented surge that has left an enduring impact on global economic dynamics. This remarkable ascendancy is a tale worth exploring, a story that holds valuable lessons and insights for today’s financial landscape.

The Catalyst: China’s Economic Ascension

At the heart of this extraordinary surge lay the tectonic economic shift taking place in China. As the 21st century dawned, the country embarked on a transformative course, embracing market-oriented reforms that unleashed its economic potential. Foreign direct investment poured into the country, fostering a surge in exports and fueling a burgeoning trade surplus.

To manage these swelling surpluses, China’s central bank aggressively accumulated forex reserves. This strategy, known as “reserve accumulation,” aimed to stabilize the country’s currency, the yuan, and mitigate the risks associated with its rapid integration into the global economy.

Oil Wealth and Petrodollars

Concurrently, another factor played a pivotal role in the swelling of forex reserves: the rise of oil prices. Fueled by surging global demand, particularly from fast-growing economies like China and India, the price of crude oil skyrocketed, generating windfall profits for oil-exporting nations.

These oil-rich countries, with limited domestic investment opportunities, channeled their newfound wealth into foreign investments and deposits in international banks. This influx of petrodollars contributed significantly to the overall growth of global forex reserves.

The Impact: Booming Investments and Currency Stability

The surge in forex reserves had a profound impact on the global financial landscape. Central banks, awash in excess liquidity, sought investment opportunities that could generate returns on their reserves. This led to a global hunt for higher-yielding assets, such as bonds and emerging market currencies.

As a result, emerging markets experienced a surge in capital inflows, leading to economic growth and financial market development. However, this influx of foreign capital also created vulnerabilities, as it could lead to asset bubbles and financial instability.

Image: forextraders.guide

The Rise Of Forex Reserves From 2001-08

Lessons for Today: Cautionary Tales and Imperatives

The unprecedented rise of forex reserves from 2001-08 offers valuable lessons for today’s policymakers and financial managers. Firstly, it emphasizes the importance of foresight and strategic asset management in managing economic surpluses.

Secondly, the episode serves as a reminder of the interconnectedness of the global economy. Actions taken by one country can have far-reaching consequences for others, highlighting the need for international cooperation and coordination in managing financial risks.

As we navigate the complex and dynamic financial landscape of the 21st century, understanding the lessons of the forex reserve surge is paramount. By embracing sound economic principles and promoting transparency and accountability in international financial markets, we can harness the potential of foreign exchange reserves while mitigating potential risks.