Unveiling the Latest Developments Transforming India’s Forex Landscape

Amidst a dynamic global economy, the foreign exchange (forex) markets in India have witnessed a surge in activity, driven by transformative developments and a rapidly evolving regulatory environment. The Reserve Bank of India (RBI), the country’s central bank, continues to play a pivotal role in shaping the forex market, implementing innovative measures that foster growth and bolster market resilience.

Image: forbesmarket.net

Expanding the Domestic Forex Market

Recognizing the growing importance of forex trading in India, the RBI has taken significant steps to expand the domestic forex market. The central bank has introduced various liberalization measures, including the abolition of the 5/25 rule that restricted domestic corporates from accessing foreign exchange for overseas investments. This move has opened up new opportunities for Indian companies to invest and expand their global footprint.

Facilitating Cross-Border Transactions

To promote cross-border trade and investment, the RBI has simplified the process for corporates to access foreign exchange. The Liberalised Remittance Scheme (LRS), introduced in 2004, allows Indian residents to remit up to USD 250,000 per financial year for various purposes, including travel, education, and medical treatment. This initiative has eased the movement of funds across borders, facilitating global trade and personal transactions.

Enhancing Regulatory Oversight

The RBI has reinforced its regulatory framework for forex markets to ensure transparency and market integrity. The central bank has introduced guidelines on the use of over-the-counter (OTC) derivatives, which are increasingly used by corporates to manage their foreign exchange risk. These regulations provide greater clarity on the use and reporting of OTC derivatives, promoting market stability and reducing systemic risk.

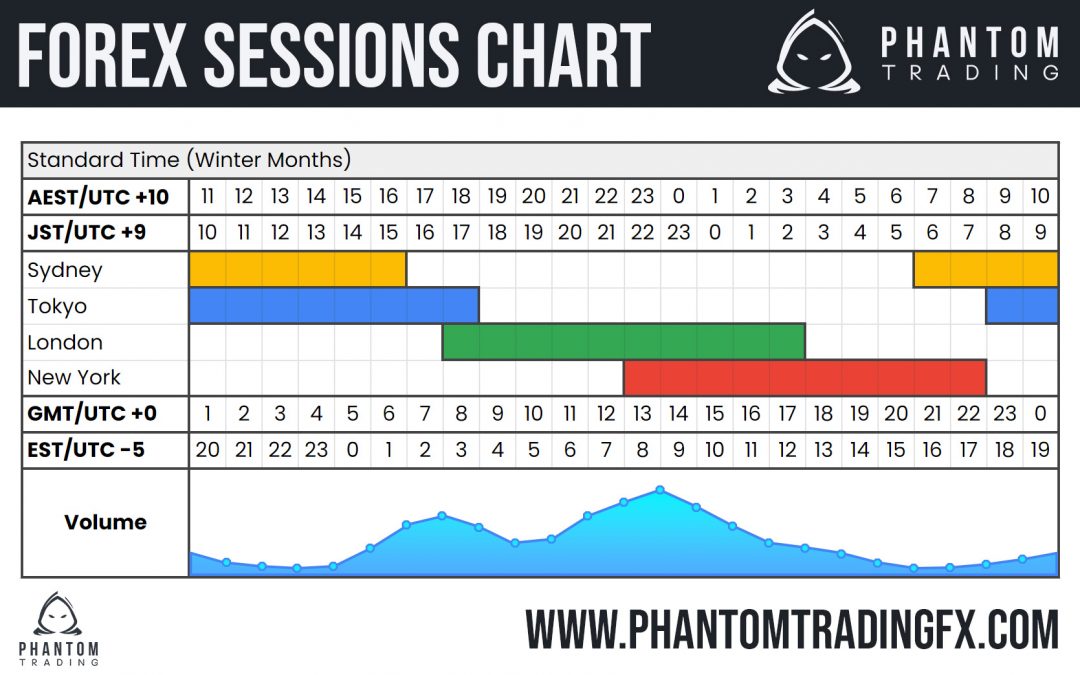

Image: phantomtradingfx.com

Promoting Offshore Trading and Investment

In line with India’s growing global economic footprint, the RBI has encouraged the development of offshore forex markets. The International Financial Services Centre (IFSC) in GIFT City, Gujarat, offers a conducive environment for foreign exchange trading and investment. The IFSC provides competitive tax incentives, simplified regulatory norms, and a skilled workforce, attracting both domestic and international participants to its forex platform.

The Rise of Digital Forex Trading

Technological advancements have revolutionized forex trading in India. The emergence of online forex platforms and mobile trading applications has made it accessible to a wider range of participants, including retail traders and small businesses. Digital forex trading offers convenience, real-time access to market data, and advanced order execution capabilities, empowering traders with greater control over their trades.

The Lastest Development Of Forex Markets In India

https://youtube.com/watch?v=qRFf7KDf-9M

Conclusion

The forex markets in India are undergoing a transformative journey, driven by proactive initiatives by the RBI and technological advancements. The expansion of the domestic market, facilitation of cross-border transactions, enhanced regulatory oversight, promotion of offshore trading, and rise of digital platforms have created a vibrant and sophisticated forex landscape. As India continues to integrate with the global economy, the forex market is poised to play an even more pivotal role in supporting its growth and development.