In the ever-evolving world of finance, where time is of the essence, it is imperative to be cognizant of the ephemeral nature of contracts. Among these time-sensitive instruments, forex derivative contracts stand out, carrying an expiration date that marks the end of their validity. Understanding the significance of this expiration and preparing for it wisely can empower traders to navigate the complexities of the forex market effectively.

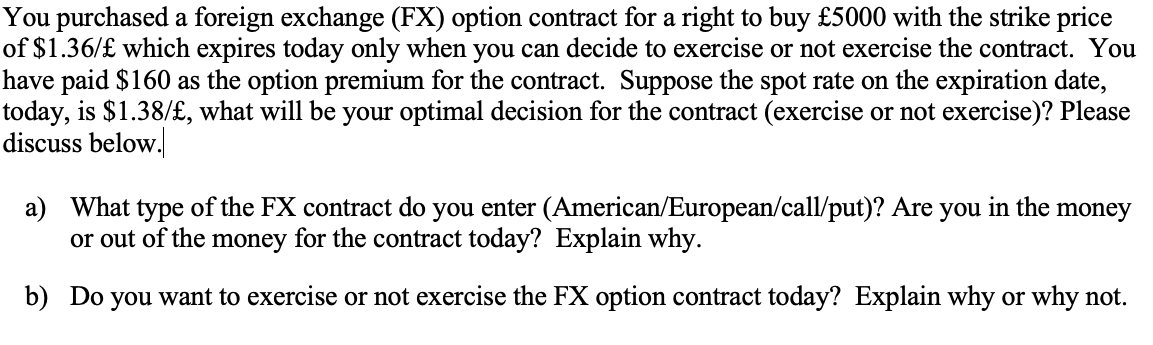

Image: www.chegg.com

Delving into Forex Derivative Contracts: A Primer

Forex derivative contracts, also known as foreign exchange forwards and futures, are financial agreements that obligate two parties to exchange a predetermined amount of currency at a specific exchange rate on a future date. These contracts serve as hedging instruments, allowing traders to mitigate potential losses or lock in favorable exchange rates for future transactions. Forex forwards are customized contracts tailored to specific requirements, while futures are standardized contracts traded on exchanges.

The Impending Expiration: A Catalyst for Vigilance

Forex derivative contracts, like all good things, must come to an end. The expiration date, clearly stated in the contract, signifies the day on which the obligation to exchange currencies ceases to exist. Failure to fulfill the contractual obligation before this date can result in dire consequences, including financial penalties and reputational damage. Thus, it is paramount for traders to be vigilant in monitoring the expiration dates of their contracts and devising a plan for their timely execution or unwinding.

Navigating the Expiration Maze: A Step-by-Step Guide

With the expiration of forex derivative contracts looming on the horizon, traders must adopt a proactive approach to ensure a smooth transition. Below is a comprehensive guide to help traders navigate this critical juncture:

-

Embrace Early Awareness: Vigilantly track the expiration dates of all forex derivative contracts to avoid any unpleasant surprises. Regular monitoring allows ample time for planning and prevents last-minute scrambles.

-

Consider the Options: Upon approaching the expiration date, traders have several options to consider. They can choose to fulfill the contract by exchanging the agreed-upon currencies. Alternatively, they can offset the contract by entering into an opposite transaction, effectively closing out the position.

-

Execute with Precision: If the decision is made to fulfill the contract, traders must adhere to the terms meticulously. This includes delivering the specified amount of currency at the predetermined exchange rate, adhering to settlement procedures, and meeting any additional contractual obligations.

-

Unwinding with Finesse: Traders opting to unwind their positions must carefully consider the prevailing market conditions and the potential impact on their overall portfolio. Unwinding involves offsetting the contract with an opposite transaction, potentially leading to gains or losses depending on market movements.

Image: www.berotak.com

Expert Insights: Navigating the Expiration with Confidence

Renowned forex expert, Dr. Mark Jenkins, emphasizes the significance of meticulous planning and timely action. “Traders should establish a system for tracking expiration dates well in advance and regularly review their portfolio to identify upcoming maturities,” he advises. Dr. Jenkins also highlights the importance of understanding the implications of different unwinding strategies. “Traders should carefully assess market conditions and consider the potential impact of their unwinding decisions on their overall risk profile,” he adds.

The Forex Derivative Contract Expires On The _______

Embrace Knowledge, Achieve Success

By understanding the nuances of forex derivative contract expirations and implementing the strategies outlined in this article, traders can approach these milestones with confidence and make informed decisions, thus maximizing their chances of reaping the rewards while mitigating potential risks. The forex market awaits, teeming with opportunities; seize them with knowledge and strategy as your guiding light.