The foreign exchange market, also known as Forex, is a vast and dynamic marketplace where currencies are traded globally. It’s a truly international market, operating 24 hours a day, five days a week, with no centralized exchange. This decentralized nature and constant activity make Forex an incredibly complex and challenging environment to navigate successfully. However, with the right data and tools, traders can harness the power of the Forex market and achieve significant profits.

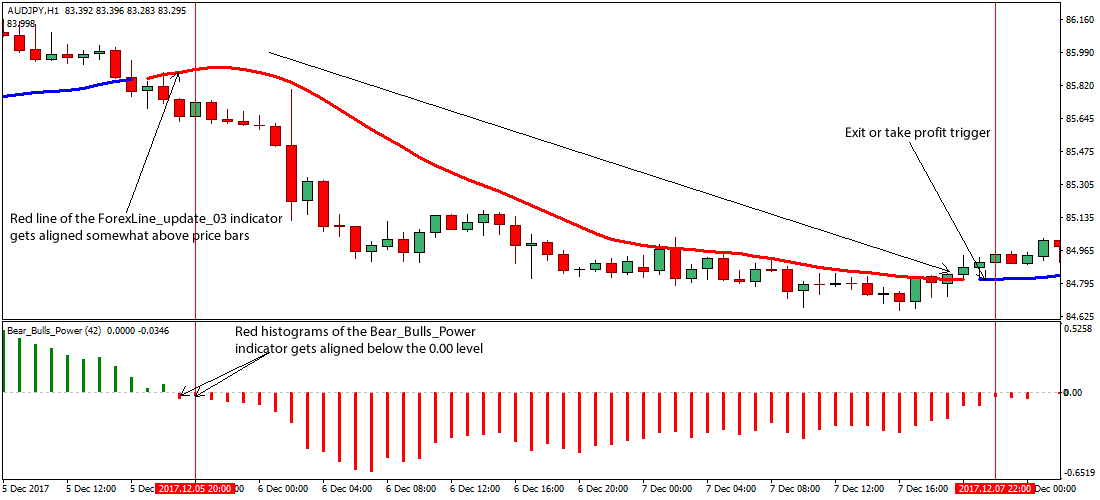

Image: www.fxtsp.com

Essential Forex Data

The first step in successful Forex trading is gathering and understanding the necessary data. This includes market quotes and historical data, which provide insights into currency movements and trends. Real-time quotes are crucial for making informed trading decisions, as they reflect the latest market conditions. Historical data, on the other hand, allows traders to analyze past price movements and identify patterns that may indicate future behavior.

Another important type of data is economic data, such as GDP, inflation, and unemployment figures. This data provides insights into the underlying economic fundamentals that drive currency movements. For example, a strong economy typically leads to a stronger currency, as it attracts foreign investment and increases demand for that currency. Conversely, a weak economy can lead to a weaker currency, as investors withdraw their funds and seek safer investments.

Harnessing the Power of Forex Data

Once traders have gathered the necessary data, they can use it to power their trading strategies. Some of the most common strategies include:

-

Technical Analysis: This involves analyzing price charts and identifying technical indicators to predict future market behavior. Technical indicators are mathematical calculations that are applied to price data to identify trends and patterns.

-

Fundamental Analysis: This involves analyzing economic data and news events to assess the underlying factors that drive currency movements. By understanding the economic fundamentals that influence currencies, traders can make more informed trading decisions.

-

Algorithmic Trading: This involves using computer programs to automate trading decisions based on pre-determined rules. Algo trading can be a powerful tool for traders who want to eliminate emotion from their trading and execute trades more efficiently.

Data Sources

There are numerous sources of Forex data available online and through specialized software. Some of the most reliable sources include:

-

Data Providers: Companies like Reuters and Bloomberg provide real-time market data and historical data for a fee. They also offer software tools and analytics to support traders in their decision-making process.

-

Currency Exchanges: Some currency exchanges also provide real-time market data and historical data to traders. This data is typically free but may be limited in terms of scope and functionality.

-

Online Brokers: Most online Forex brokers offer real-time market data and basic chart analysis tools to their clients. This data is typically sufficient for beginner traders but may not meet the needs of more experienced traders.

Image: www.kindpng.com

The Forex Data You Need To Power Any Project

Conclusion

Forex data is an indispensable tool for anyone who wants to succeed in the Forex market. By gathering and understanding the right data, traders can gain insights into market movements and develop effective trading strategies. Whether you’re a technical trader, a fundamental trader, or an algo trader, having access to reliable and accurate Forex data is crucial for making informed trading decisions and maximizing your profits.