In the age of global travel and digital commerce, owning a multi-currency forex card has become indispensable for seamless financial transactions abroad. Among the leading offerings, the Axis Bank Multi-Currency Forex Card stands out for its convenience and competitive rates. However, it is crucial to fully understand the terms and conditions governing its use to avoid any potential pitfalls. This comprehensive guide will delve into the intricacies of the card, providing you with the knowledge to make informed decisions and maximize its benefits.

Image: windsorwhock2002.blogspot.com

Definition and Significance

A multi-currency forex card is a prepaid card that allows you to hold multiple foreign currencies in a single card. It eliminates the need to carry large amounts of cash, minimizing security risks and providing the flexibility to access funds in local currencies at the most favorable exchange rates. The Axis Bank Multi-Currency Forex Card is widely accepted worldwide, making it an ideal companion for jet-setters and global nomads.

Benefits and Features

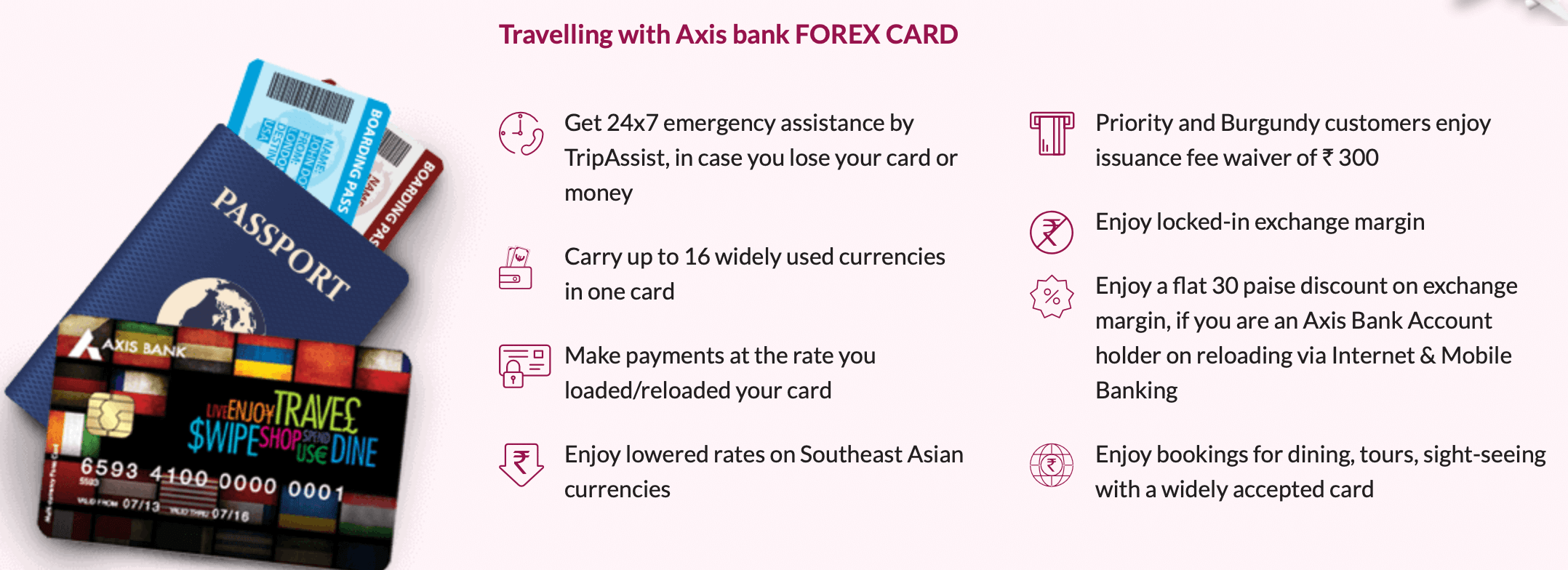

Beyond its multi-currency capabilities, the Axis Bank Multi-Currency Forex Card offers a host of benefits:

- Competitive exchange rates: Enjoy favorable exchange rates, ensuring you get the most out of your hard-earned money.

- Zero cross-currency mark-up: Avoid hidden fees and transaction costs associated with traditional currency exchange services.

- Wide acceptance: Use your card at millions of merchants and ATMs globally, eliminating the hassle of carrying multiple currencies.

- Easy online management: Track transactions, view account balances, and reload funds conveniently through the Axis Bank mobile app or online portal.

Terms and Conditions Overview

Before activating your Axis Bank Multi-Currency Forex Card, it is essential to familiarize yourself with the terms and conditions that govern its use:

- Validity: The card has a validity period of 5 years from the date of issuance.

- Fees: There are no annual or membership fees associated with the card. However, certain transaction fees may apply, such as ATM withdrawals (1% + local charges) and currency conversion (2% + GST).

- Loading limits: The maximum load limit is INR 2 lakhs per financial year.

- Reload options: You can reload your card through Axis Bank branches, net banking, or IMPS.

- Card activation: To activate the card, you need to provide the CVV and PIN received separately from Axis Bank.

- Documentation: You will need to provide valid identification and address proof when applying for the card.

Image: www.youtube.com

Understanding the Currency Conversion Process

One of the key features of the Axis Bank Multi-Currency Forex Card is its ability to convert currencies automatically. Here’s how it works:

- When you make a purchase in a foreign currency, the card will automatically convert the amount from the designated currency in your account.

- The conversion rate is determined by the real-time exchange rates provided by Axis Bank.

- You will be charged a currency conversion fee of 2% + GST on each transaction.

Tips for Maximizing Value

To make the most of your Axis Bank Multi-Currency Forex Card, consider these tips:

- Load the card in local currencies before traveling to secure favorable exchange rates.

- Avoid making ATM withdrawals, as they incur additional fees.

- Monitor your transactions regularly through the mobile app or online portal.

- Inform Axis Bank in advance if you plan to use your card abroad to prevent any authorization issues.

Terms And Conditions Governing The Axis Bank Multi-Currency Forex Card

Conclusion

The Axis Bank Multi-Currency Forex Card is an invaluable tool for global travelers and online shoppers. By understanding the terms and conditions that govern its use, you can harness its benefits and avoid any potential drawbacks. With its competitive exchange rates, wide acceptance, and convenient features, this card will empower you to navigate the world of finance with ease and confidence. Embrace the freedom and financial peace of mind that comes with the Axis Bank Multi-Currency Forex Card and embark on your global journeys with a smile.