Uncover the Secrets to Expert Trading

As a Forex trader, timing is everything. Entering and exiting positions at the right moment can make or break your trading success. Utilizing template Forex indicators with entry and exit levels is a powerful tool that can significantly improve your trading performance by providing objective signals and insights into market behavior.

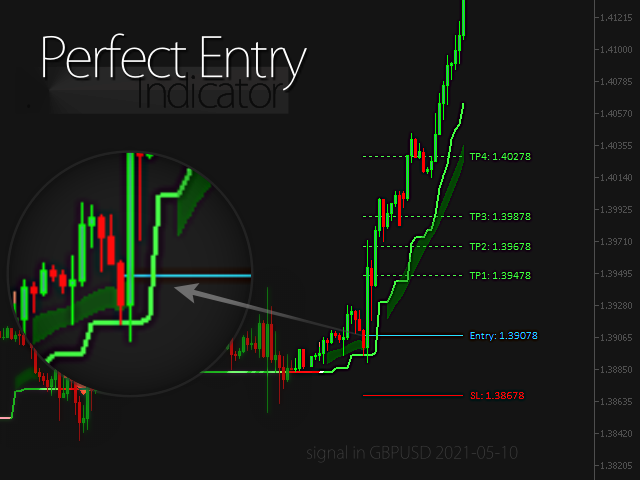

Image: mavink.com

Understanding Template Forex Indicators

Template Forex indicators are pre-built technical indicators designed to identify potential trading opportunities based on historical market data. They automate the process of analyzing charts and finding trading patterns, making them accessible to traders of all experience levels.

Types of Template Forex Indicators

Numerous template Forex indicators exist, each with a unique set of criteria for identifying trading opportunities. Some popular types include:

-

Moving Averages: Calculate the average price of an asset over a specific period, highlighting trends and potential support and resistance levels.

-

Bollinger Bands: Use standard deviation to create upper and lower bands around an asset’s price, indicating potential breakout points.

-

Relative Strength Index (RSI): Measures the magnitude of recent price changes to identify overbought or oversold conditions.

-

Stochastic Oscillator: Compares an asset’s closing price to its price range over a set period, highlighting momentum and potential turning points.

Using Entry and Exit Levels

Once you have chosen a suitable template Forex indicator, you must establish entry and exit levels to determine when to enter and exit the market. These levels can be based on:

-

Support and Resistance Levels: Areas where price action historically encounters significant resistance or support, indicating potential breakout or reversal zones.

-

Fibonacci Retracement Levels: Proportional levels derived from the Fibonacci sequence, which can serve as potential areas for price retracement or extension.

-

Trailing Stop Losses: Dynamic stop-loss orders that adjust automatically as price moves in your favor, protecting profits and limiting risk.

Image: indicatorchart.com

Tips for Using Template Forex Indicators

-

Use Multiple Indicators: Combining several complementary indicators enhances signal accuracy and reduces the risk of false signals.

-

Confirm Signals: Do not rely solely on indicator signals; always corroborate them with other trading strategies and market analysis.

-

Manage Risk: Use stop-loss orders to limit potential losses and preserve your trading capital.

-

Test on Demo Accounts: Practice using indicators in a risk-free environment before deploying them in live trading.

-

Stay Informed: Monitor market news and events that can impact currency prices and influence indicator signals.

FAQs on Template Forex Indicators

Q: What is the best template Forex indicator?

A: The choice of indicator depends on your trading style and preferences; no single indicator is universally best. Experiment with different types to find the ones that align with your strategy.

Q: Are template Forex indicators accurate?

A: While indicators can provide valuable insights, they are not foolproof. They rely on historical data and may not predict future price movements with certainty.

Q: How do I interpret indicator signals?

A: Each indicator has unique interpretation rules. Study the specific indicator’s guidelines and practice using it in a demo account to understand how to interpret its signals effectively.

Template Forex Indicator With Entry Level And Exit Levels

Conclusion

Incorporating template Forex indicators with entry and exit levels into your trading arsenal can significantly enhance your decision-making process and improve your overall trading performance. By equipping yourself with this powerful tool and following the expert tips and guidance provided in this article, you can gain a competitive edge in the dynamic world of Forex trading.

Are you ready to elevate your trading game? Embark on this journey to discover the invaluable insights that template Forex indicators with entry and exit levels offer. Unveil the secrets of expert trading and unlock the potential for consistent success.