In the fast-paced world of today, it’s impossible to imagine our lives without the ease and convenience offered by electronic payment systems. Debit, credit, and forex cards are ubiquitous tools that have revolutionized the way we manage our finances, enabling seamless transactions anytime, anywhere. Let’s delve into the intricate technology that powers these indispensable financial instruments.

Image: mkerala.com

The Evolution of Card Payment Technology

Debit and credit cards have come a long way since their inception in the 1950s. The initial magnetic stripe technology, while robust, had limitations in terms of data storage capacity and security. The introduction of chip cards, or EMV cards (Europay, MasterCard, Visa), in the 1990s significantly enhanced transaction security by incorporating an embedded chip that stores encrypted data, making it nearly impossible to forge or counterfeit.

The Anatomy of a Card Payment

When you make a purchase using a debit or credit card, a complex series of events unfolds behind the scenes:

-

Cardholder Authorization: Upon swiping or inserting your card into a payment terminal, the terminal reads the card’s magnetic stripe or embedded chip.

-

Card Verification: The data on the card, including the card number, expiration date, and CVV (Card Verification Value), is securely transmitted to the card issuer for verification.

-

Authorization Request: The issuer verifies the cardholder’s identity and checks if the account has sufficient funds to cover the transaction.

-

Payment Processing: If the verification and authorization are successful, the issuer sends an approval message to the payment terminal.

-

Transaction Verification: The payment terminal records the transaction details and prints a receipt.

Debit vs. Credit Cards: A Comparison

Debit and credit cards share many similarities but also have distinct differences:

-

Debit cards are linked directly to your checking or savings account. When you make a purchase, the funds are immediately deducted from your account.

-

Credit cards allow you to borrow money to make purchases. You have a credit limit, and you must repay the borrowed amount later, typically with interest charged on unpaid balances.

Image: www.sableinternational.com

Forex Cards: The Ideal Travel Companion

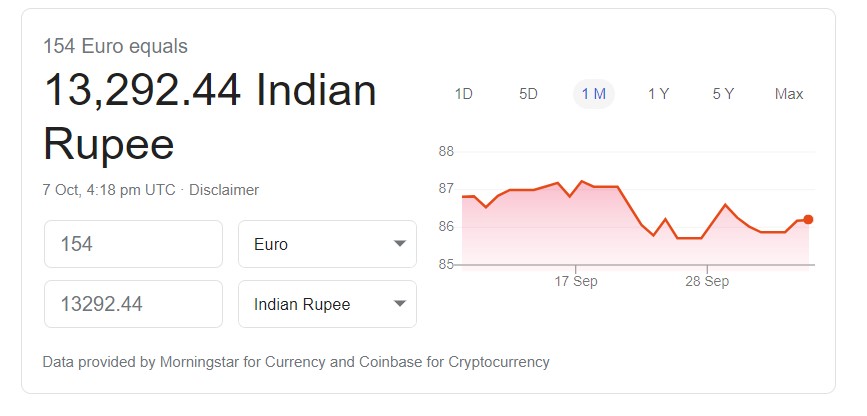

Forex cards, also known as prepaid currency cards, are specialized cards designed for international travel. They are preloaded with foreign currency, eliminating the need to exchange cash or carry large amounts of foreign currency. Forex cards offer currency conversion at interbank rates, avoiding the high fees often associated with currency exchange services.

Tips for Using Debit, Credit, and Forex Cards:

-

Keep your card information confidential and avoid sharing it with untrustworthy sources.

-

Report lost or stolen cards immediately to prevent unauthorized use.

-

Enable SMS alerts for card transactions to detect fraudulent activity early on.

-

Consider using a prepaid debit card for online purchases to limit potential financial exposure.

-

Avoid withdrawing cash using your credit card, as high interest rates and fees apply.

Frequently Asked Questions:

-

Are debit cards more secure than credit cards? Both debit and credit cards offer secure transaction processing. However, unauthorized use of debit cards can result in direct funds loss, while credit cards provide some consumer protection as the user has the option to dispute fraudulent charges.

-

What happens if my forex card is lost or stolen? Report the incident immediately to the card issuer. Most issuers provide emergency assistance and can freeze your card and issue a replacement.

-

Can I use my forex card anywhere? Forex cards are accepted worldwide at businesses that accept credit cards. However, some merchants may charge additional fees for forex transactions.

Technology Of Debit Credit Forex Card

Conclusion

The technology behind debit, credit, and forex cards has transformed the way we transact, making our financial lives easier, more secure, and more convenient. By understanding the underlying mechanisms and following simple tips, you can use these financial instruments effectively and securely.