In the dynamic world of foreign exchange trading, every aspect of the process holds immense significance. One such aspect that often raises questions among forex dealers is the applicability of Tax Deducted at Source (TDS) on service charges. As a vigilant taxpayer, it’s essential to understand the complexities surrounding TDS to ensure compliance and avoid potential penalties.

Image: mungfali.com

Let’s embark on a comprehensive journey to demystify TDS on service charges in forex trading, empowering you with the knowledge to navigate the financial landscape confidently.

Understanding Tax Deducted at Source (TDS)

TDS is a mechanism implemented by the Indian government to collect tax at the source of income. It’s a part of the Direct Tax collection system, and the deductor (in this case, the forex dealer) is responsible for withholding a specific percentage of tax from payments made to the recipient (the customer or service provider).

The deducted amount is then deposited with the government, ensuring that taxes are paid upfront and on time. TDS serves as a crucial tool for the government in combating tax evasion and widening the tax net.

Applicability of TDS on Service Charges

The question of whether TDS applies to service charges in forex trading sparks debate. While the answer is not always straightforward, we can dissect the relevant provisions to shed light on the matter.

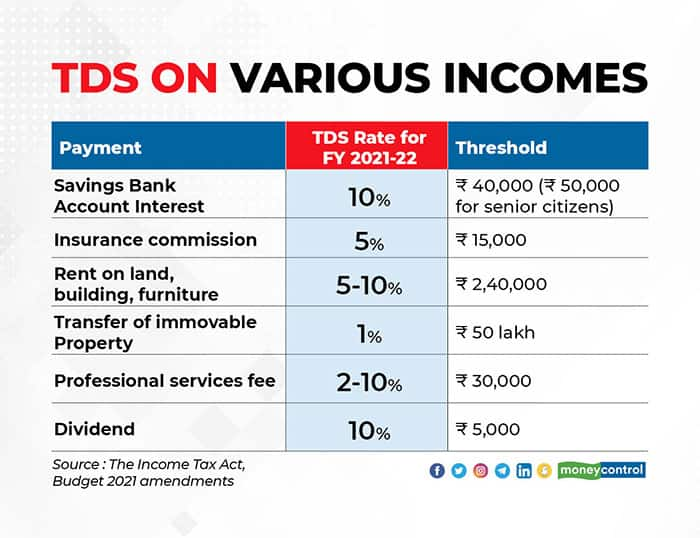

According to Section 194H of the Income Tax Act, TDS is applicable on any payment made to a resident for professional or technical services. Service charges incurred in forex trading can fall under this category, attracting TDS deduction.

However, there’s a crucial exception to this rule. If the forex dealer is registered with the Securities and Exchange Board of India (SEBI) as a broker or sub-broker, TDS is not applicable on service charges.

Calculating TDS on Service Charges

For service charges subject to TDS, the rate of deduction is typically 10%. This means that the forex dealer must deduct 10% of the service charge amount before disbursing the payment to the customer.

The amount of TDS deducted is then deposited with the government through the Centralized Processing Cell (CPC) within a specified timeframe. Timely payment of TDS is essential to avoid penalties and ensure compliance with tax regulations.

Image: www.moneycontrol.com

Implications for Forex Dealers

Forex dealers have specific responsibilities when it comes to TDS on service charges:

- Withholding TDS: Dealers must deduct TDS at the prescribed rate from service charges paid to residents.

- Depositing TDS: The deducted amount must be deposited with the CPC within the stipulated time frame.

- Issuing TDS Certificate: Dealers must provide Form 16A to the customer, acknowledging the TDS deducted and deposited.

- Maintaining Records: Proper records must be maintained for all TDS-related transactions, including details of the customer, amount, and date of TDS deduction.

Consequences of Non-Compliance

Failure to comply with TDS regulations can lead to severe consequences, including:

- Penalties: The non-deduction or late payment of TDS can attract penalties and interest charges from the tax authorities.

- Legal Action: In severe cases, non-compliance can result in legal action and prosecution.

- Reputational Damage: Failure to adhere to TDS regulations can damage a forex dealer’s reputation and credibility.

Tds On Service Charges On Forex Dealer

Conclusion

Understanding the implications of TDS on service charges in forex trading is crucial for maintaining compliance and safeguarding your financial interests. By staying informed and fulfilling your obligations diligently, you can navigate the complexities of taxation with confidence. Embrace the role of a responsible taxpayer and contribute to the nation’s economic growth while protecting your hard-earned income.