Unlock Global Financial Freedom

In the digital age, conducting international money transfers has become indispensable. Whether it’s for personal remittances, business transactions, or investments, seamless remittance services are paramount. Tangerine Bank, renowned for its innovative financial offerings, provides reliable and secure platforms for international remittances through intuitive SWIFT codes and transit numbers. This comprehensive guide will empower you to navigate the intricacies of foreign exchange (forex) and equip you with the necessary knowledge to facilitate seamless global financial transactions.

Image: www.studocu.com

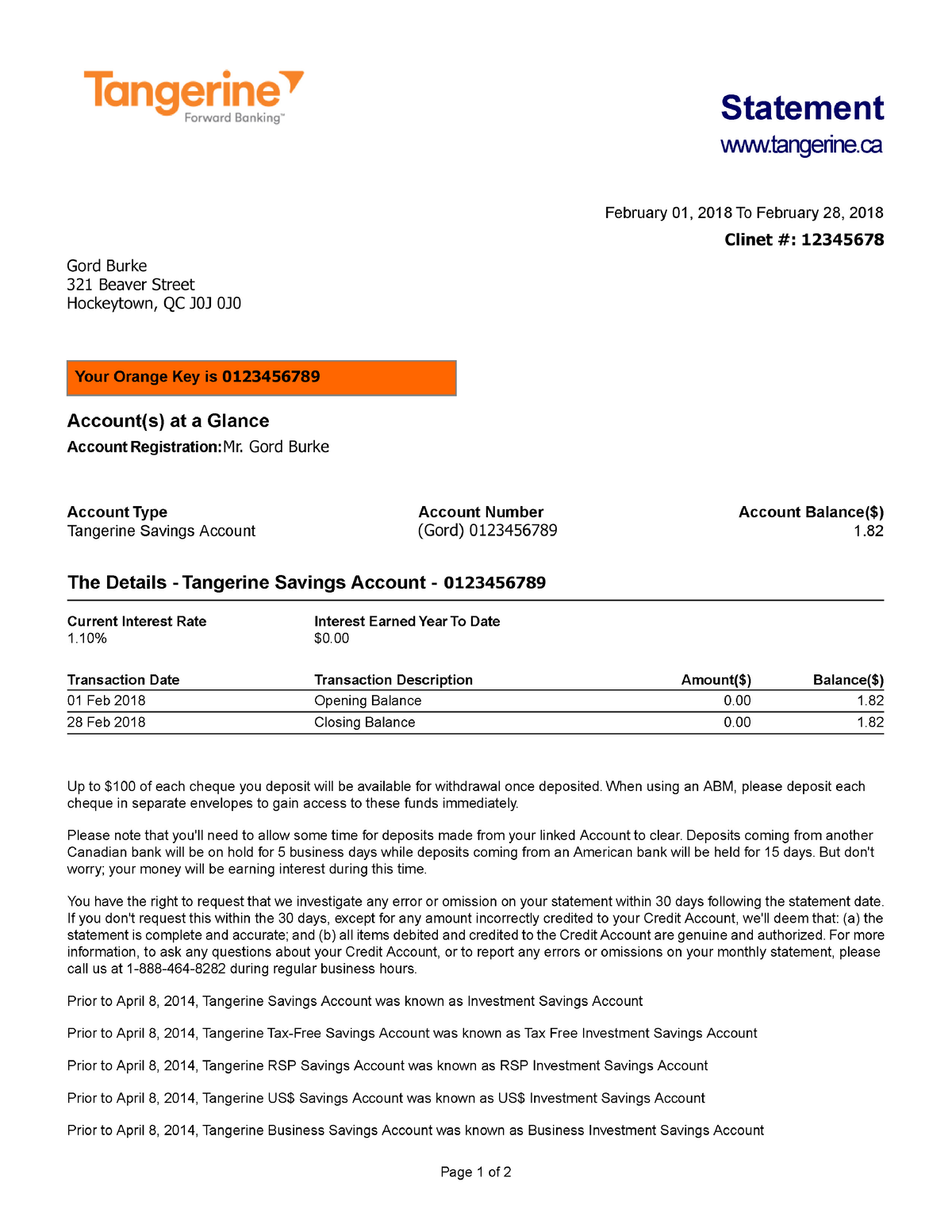

Tangerine Bank SWIFT Codes and Transit Numbers

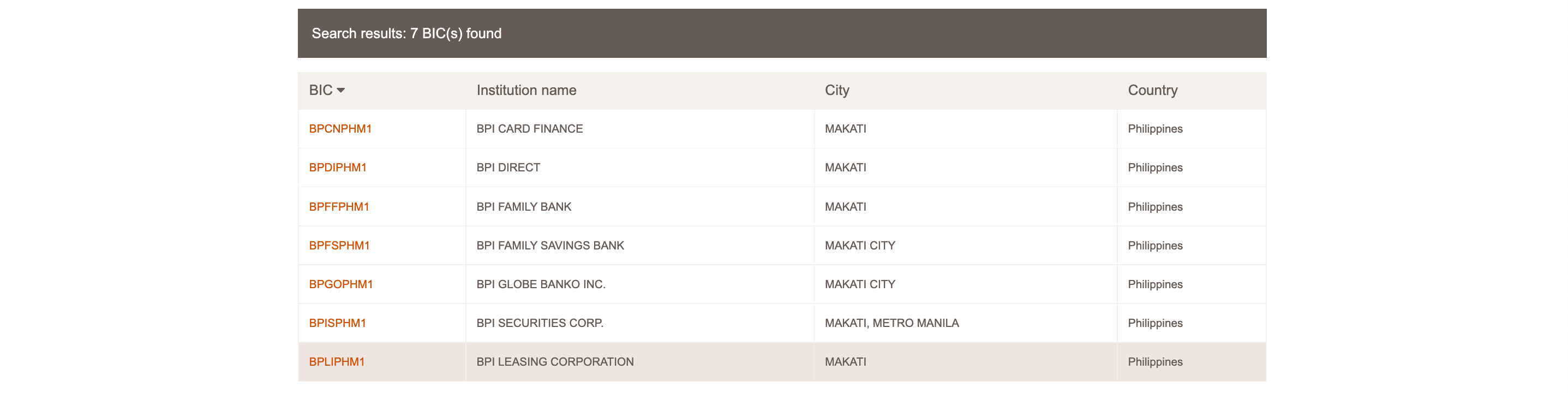

SWIFT (Society for Worldwide Interbank Financial Telecommunication) codes and transit numbers are vital for facilitating international wire transfers. These codes identify specific financial institutions and their respective locations, ensuring the secure and swift movement of funds across borders. Tangerine Bank customers can access the following SWIFT codes and transit numbers:

- SWIFT Code: TDBICATOTOR

- Transit Number: 04785

Forex Remittance with Tangerine

Tangerine offers convenient forex remittance services, allowing customers to transfer funds abroad with competitive exchange rates and low transfer fees. Here’s a step-by-step guide to initiate a forex remittance with Tangerine:

- Log into your Tangerine account: Access your online banking or mobile app.

- Select “Remit Money”: Navigate to the “Transfer Funds” or “Remittance” section.

- Choose your transfer type: Specify whether you’re sending funds to another Tangerine account, another Canadian bank account, or an international account.

- Enter recipient details: Provide the recipient’s name, address, and account information.

- Confirm the transfer amount and currency: Review the details and ensure you’re sending the correct amount in the desired currency.

- Enter the SWIFT code and transit number: Specify the recipient’s bank’s SWIFT code and the transit number for international remittances.

- Set up recurring transfers (optional): If desired, set up recurring transfers for regular remittances.

- Review and authorize: Thoroughly review all details and authorize the transaction.

Benefits of Tangerine Bank Forex Remittance

Harnessing Tangerine Bank’s forex remittance services offers several advantages:

- Competitive exchange rates: Tangerine’s competitive exchange rates minimize conversion costs.

- Low transfer fees: Transfer fees are kept minimal, ensuring cost-effective remittances.

- Secure transactions: SWIFT and transit numbers ensure secure fund transfers between banks.

- Convenience and flexibility: Online and mobile banking platforms provide 24/7 access for remittances.

- Customer support: Tangerine’s dedicated customer support team is available to assist with any queries.

Image: web.z.com

Latest Trends and Developments

The forex remittance landscape is constantly evolving, with technology and regulations influencing its trajectory. Tangerine Bank stays abreast of these developments, integrating the latest advancements into its services. Some notable trends include:

- Blockchain integration: Tangerine is exploring blockchain technology to enhance remittance transparency and efficiency.

- Cross-border payment partnerships: Tangerine is partnering with financial institutions worldwide to expand remittance reach.

- Digital currency support: Tangerine is considering offering remittance services for digital currencies like Bitcoin.

Tips and Expert Advice for Forex Remittance

To optimize your forex remittance experience, follow these expert tips:

- Compare exchange rates: Get quotes from multiple providers to find the best rates.

- Monitor market fluctuations: Forex rates fluctuate constantly, so monitor the market to identify favorable times for transfers.

- Choose a reputable provider: Opt for a licensed and regulated provider like Tangerine to ensure security and reliability.

- Check for hidden fees: Beware of hidden fees associated with international remittances, such as correspondent bank charges or intermediary fees.

- Consider a fixed-rate contract: Lock in exchange rates for large transfers over extended periods to minimize potential losses due to rate fluctuations.

FAQs on Tangerine Bank Forex Remittance

Q: What is the minimum amount I can send internationally?

A: The minimum remittance amount varies depending on the destination country. Check Tangerine’s fee schedule for specific details.

Q: How long does an international remittance typically take?

A: Transfer times vary depending on the destination country and payment processing. Most remittances are completed within 1-3 business days.

Q: Can I cancel an international transfer?

A: Yes, but only if the transfer is still in progress. Contact Tangerine customer support as soon as possible to request a cancellation.

Q: How can I track my international transfer?

A: You can track the status of your transfer through Tangerine’s online banking platform or mobile app.

Q: What information do I need to provide for an international transfer?

A: You’ll need the recipient’s name, address, account information, and the SWIFT code or IBAN of the recipient’s bank.

Tangerine Bank Swift Code And Transit Number For Forex Remittance

Conclusion

Tangerine Bank’s SWIFT codes and transit numbers empower you to harness the convenience of forex remittances, facilitating secure and cost-effective cross-border transactions. By leveraging the insights and expert advice covered in this article, you can navigate the ever-evolving landscape of foreign exchange remittances.

Are you ready to unlock global financial freedom with Tangerine? Embark on your remittance journey today and connect seamlessly with the world. Experience the unparalleled simplicity, security, and cost-effectiveness of Tangerine’s forex remittance services.