In the fast-paced realm of forex trading, where every second counts, the choice of symbols and time frames is paramount. To navigate the ever-changing markets effectively, it’s imperative to understand how these factors influence your trading decisions.

Image: motivation.africa

The Significance of Symbols

Forex trading involves currency pairs, each represented by a unique symbol. These symbols indicate the base and quote currencies being traded. For instance, “EURUSD” represents the euro against the U.S. dollar. Choosing the right symbols is crucial as it impacts your market exposure and potential profit or loss.

Factors to Consider When Choosing Symbols:

- Correlation: Understand the correlation between currency pairs to manage risk and diversify your portfolio.

- Volatility: Select symbols that exhibit appropriate volatility levels to match your risk tolerance and trading style.

- Liquidity: Opt for symbols with high liquidity to ensure easy order execution and minimize slippage.

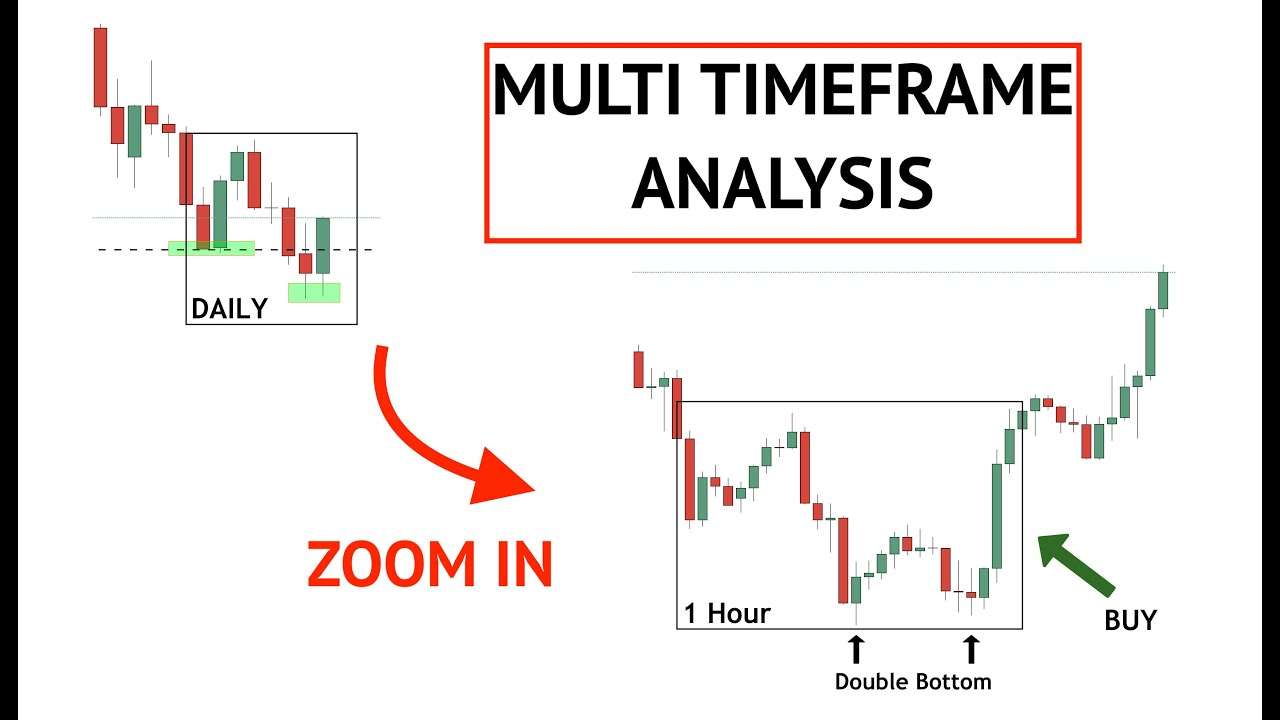

The Power of Time Frames

Time frames provide a window into the varying market dynamics. Each time frame offers a different perspective, revealing distinct patterns and trends. The choice of time frame hinges on the time horizon of your trades, personal trading style, and the available trading platform.

Image: thewaverlyfl.com

Types of Time Frames:

- Scalping: Trades executed within minutes, targeting small profit margins and high volume.

- Day Trading: Trades held for a single trading day, usually closed before the market closes.

- Swing Trading: Positions held for several days or weeks, capturing market swings and longer-term trends.

- Position Trading: Trades held for months or years, targeting substantial market moves and relying on fundamental analysis.

Expert Advice and Tips

Seasoned traders and industry experts provide invaluable insights into the art of forex trading. Here are some tips to elevate your trading strategy:

- Trend Following: Identify trend reversals and follow established trends to maximize profit potential.

- Support and Resistance Levels: Utilize support and resistance levels to identify potential entry and exit points.

- Risk Management: Determine the appropriate risk-reward ratio for your trades and implement stop-loss orders.

- Market News and Analysis: Stay informed about economic news, events, and market sentiment to make informed decisions.

FAQs on Symbols and Time Frames

- Q: What is the most important time frame for forex trading?

A: The best time frame depends on the trader’s individual goals, time horizon, and trading strategy.

- Q: How do I choose the right currency pair for my trading strategy?

A: Consider factors such as correlation, volatility, and liquidity, and align your choice with your risk tolerance.

- Q: Can I change my time frame during a trade?

A: Yes, you can adjust the time frame of a chart while a trade is open to gain a different perspective on market movements.

Symbols And Their Time Frames In Forex Trading

Conclusion

Mastering the symphony of symbols and time frames empowers forex traders to make informed decisions in the face of market uncertainty. By harnessing the power of these variables, traders can fine-tune their trading strategies, optimize their risk management, and seize opportunities in the ever-evolving forex landscape.

Are you ready to elevate your forex trading journey? Explore the intricate world of symbols and time frames, embrace the expert insights shared within, and embark on a transformative trading experience.