In the dynamic world of forex trading, swap points play a crucial role in determining the profitability of trades that span overnight. Understanding these points is essential for traders of all levels, as they can significantly impact profit margins.

Image: blog.milliva.com

What Are Swap Points?

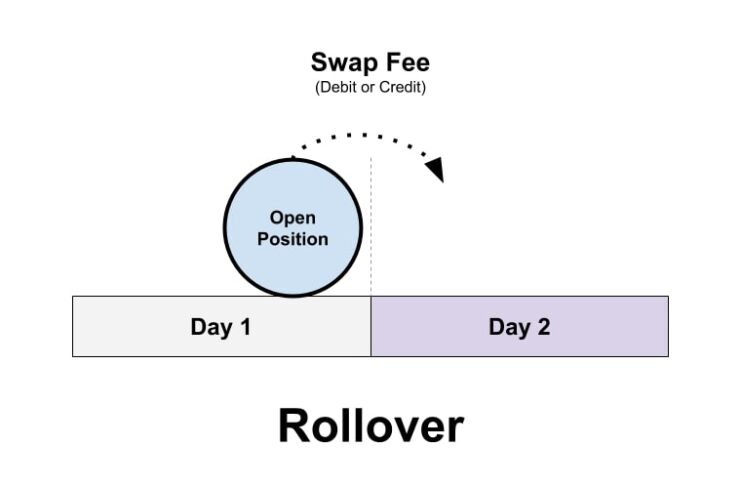

Swap points, also known as rollover points or interest rate differentials, are fees charged or credited to forex traders when they hold positions overnight. These points arise from the exchange rate differences between the two currencies involved in the trade. When a trader opens a position, they borrow one currency to buy another. If the interest rate of the borrowed currency is higher than that of the bought currency, the trader will incur a swap fee. Conversely, if the interest rate of the bought currency is higher, the trader will receive a credit.

The Mechanics of Swap Points

Swap points are calculated based on the difference between the interbank interest rates for the two currencies involved in the trade. These rates are published daily by major banks and brokers and change frequently in response to market conditions. For example, if the USD/JPY currency pair is traded and the USD has a higher interest rate than the JPY, the trader will pay swap points for holding the trade overnight.

Typically, swap points are credited or debited to the trader’s account at the end of the trading day at 5 PM EST. The amount of swap points earned or paid is determined by the trade size and the number of days the position is held overnight.

How Swap Points Impact Profitability

Swap points can have a significant impact on the profitability of forex trades, especially for trades held overnight. If the swap points are unfavorable, they can erode the trader’s profits or even lead to losses. For example, if a trader holds a position with a negative swap rate, they will incur a daily fee that must be factored into their profit calculations.

On the other hand, if the swap points are favorable, they can provide an additional source of income. Traders who hold positions with positive swap rates will earn a credit each day, which can offset losses or increase profits. Swap points can be particularly advantageous in carry trades, where traders aim to profit from the interest rate differential between two currencies.

Image: pipsedge.com

Factors Influencing Swap Points

Several factors can influence swap points, including:

- Interest rate differential: The main determinant of swap points is the difference in interest rates between the two currencies involved in the trade.

- Market volatility: Swap points can fluctuate in response to market conditions and events that affect interest rates or currency valuations.

- Broker fees: Some forex brokers charge a spread on the swap points, which is an additional cost that traders need to consider.

Mitigating the Impact of Swap Points

Traders can take several steps to mitigate the impact of swap points on their trading strategies:

- Trading within a short timeframe: Holding positions for only intraday trading can minimize swap point exposure.

- Choosing currency pairs with small swap rate differentials: Pairs with similar interest rates will have lower swap costs.

- Hedging positions: Using opposite trades can offset the swap points, but it requires careful management.

- Checking broker fees: Comparing swap point spreads offered by different brokers can save on costs.

Swap Points In Forex Swaps

Conclusion

Understanding swap points in forex swaps is crucial for maximizing trading profitability. By considering the factors that influence these points and implementing proper risk management strategies, traders can minimize their impact and increase their chances of success. Whether engaged in short-term trading or carry trades, a clear understanding of swap points will empower traders to make informed decisions and position themselves for success in the dynamic world of forex trading.