When navigating the turbulent waters of forex trading, discerning support and resistance levels becomes an indispensable skill, akin to a mariner’s compass guiding their ship through treacherous storms. These levels serve as critical thresholds that influence market behavior, often triggering price reversals or continuations. Master their significance, and you’ll gain a formidable advantage in this dynamic realm.

Image: smithnighty.blogspot.com

The Guiding Light: What Defines Support and Resistance?

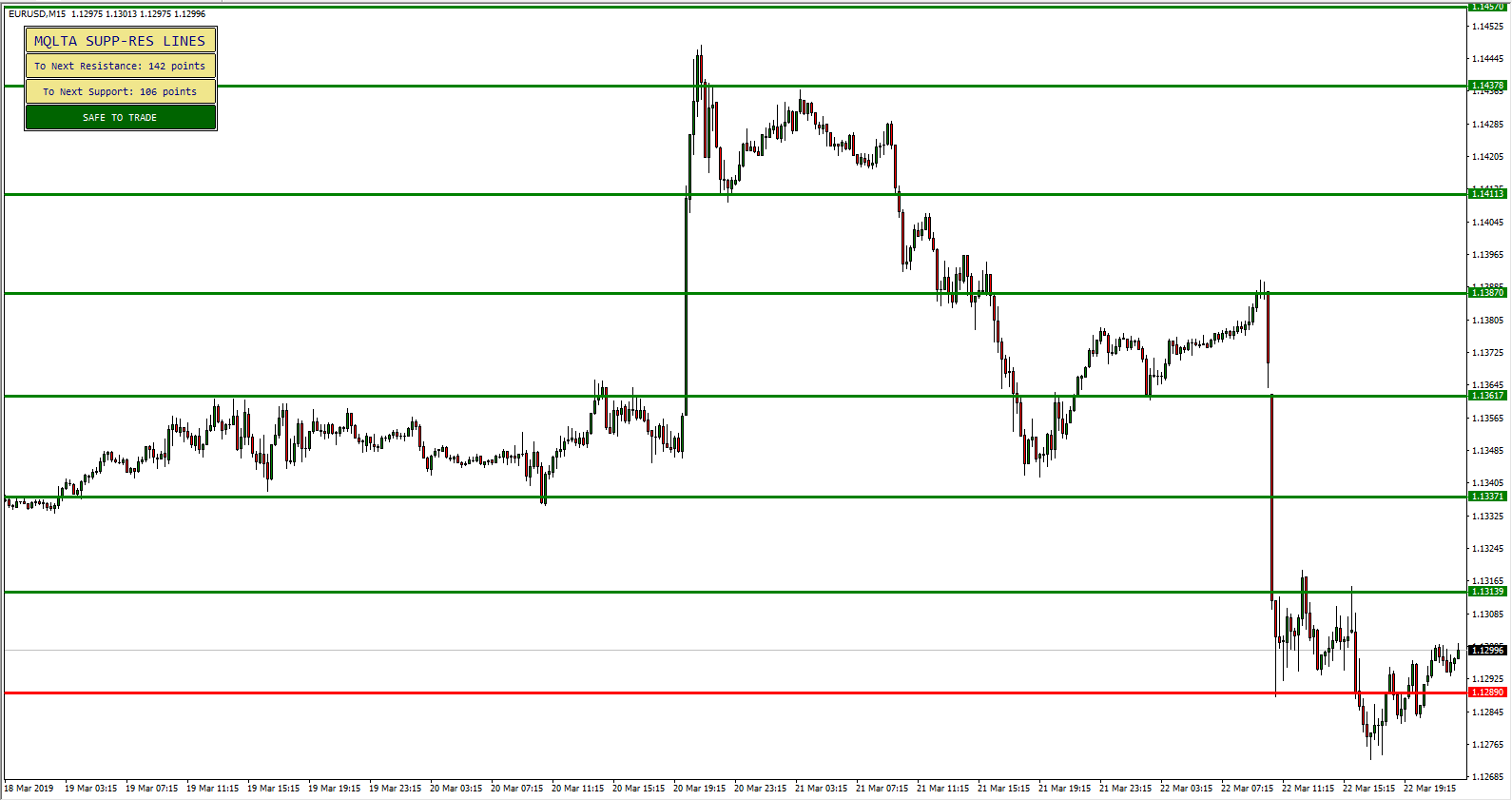

In the forex arena, support refers to a price level beneath the current market value where buying pressure is expected to outweigh selling pressure, creating a temporary barrier to further price declines. Conversely, resistance signifies a price level above the prevailing market value where selling pressure is anticipated to surpass buying pressure, potentially stalling upward momentum. These levels are dynamic, constantly shifting in response to market forces.

Navigating the Market Currents: How to Identify Support and Resistance

Identifying support and resistance levels requires a keen eye and a comprehensive understanding of market dynamics. Technical analysis, the art of deciphering market patterns, provides invaluable tools to uncover these crucial levels. Chart patterns, such as double tops and bottoms, head and shoulders, and triangles, often offer clues about potential support and resistance zones. Additionally, moving averages, trend lines, and Fibonacci retracement levels can serve as reliable indicators of these pivotal thresholds.

Unleashing the Potential: How Support and Resistance Enhance Your Trading Strategy

Harnessing the power of support and resistance enables traders to make informed decisions, optimizing their entry and exit points in the market. When the price approaches a support level, it presents a potential buying opportunity, as buyers anticipate a price bounce. Conversely, if the price nears a resistance level, it signals a potential selling opportunity, as sellers expect a price decline. By recognizing these levels, traders can position themselves strategically to capture market movements.

Image: fxpipsgainer.com

Expert Insights: Harnessing Support and Resistance for Trading Success

Renowned forex trader Michael J. Huddleston emphasizes the crucial role of support and resistance in his trading strategy. “These levels serve as magnets for price action,” he asserts. “By adeptly identifying and exploiting them, traders can navigate market fluctuations with greater confidence and precision.”

Actionable Tips: Leveraging Support and Resistance to Empower Your Trading

-

Identify Support and Resistance Zones: Utilize technical analysis tools and chart patterns to pinpoint potential support and resistance levels accurately.

-

Confirm Levels with Volume Analysis: Assess the volume of trading at support and resistance zones to corroborate their validity. High volume typically indicates stronger levels.

-

Set Stop-Loss and Take-Profit Orders: Place stop-loss orders below support levels and take-profit orders above resistance levels to manage risk and lock in profits.

Support And Resistance Indicator The Forex Army

Conclusion: Unlocking the Secrets of Support and Resistance

Support and resistance levels, the cornerstones of forex trading, provide invaluable guidance in navigating market movements. By honing your ability to identify and harness these levels, you’ll transform into a formidable forex navigator, equipped to capitalize on market opportunities and steer your trading towards success. Embrace the wisdom of support and resistance, and let it illuminate your path to trading mastery.