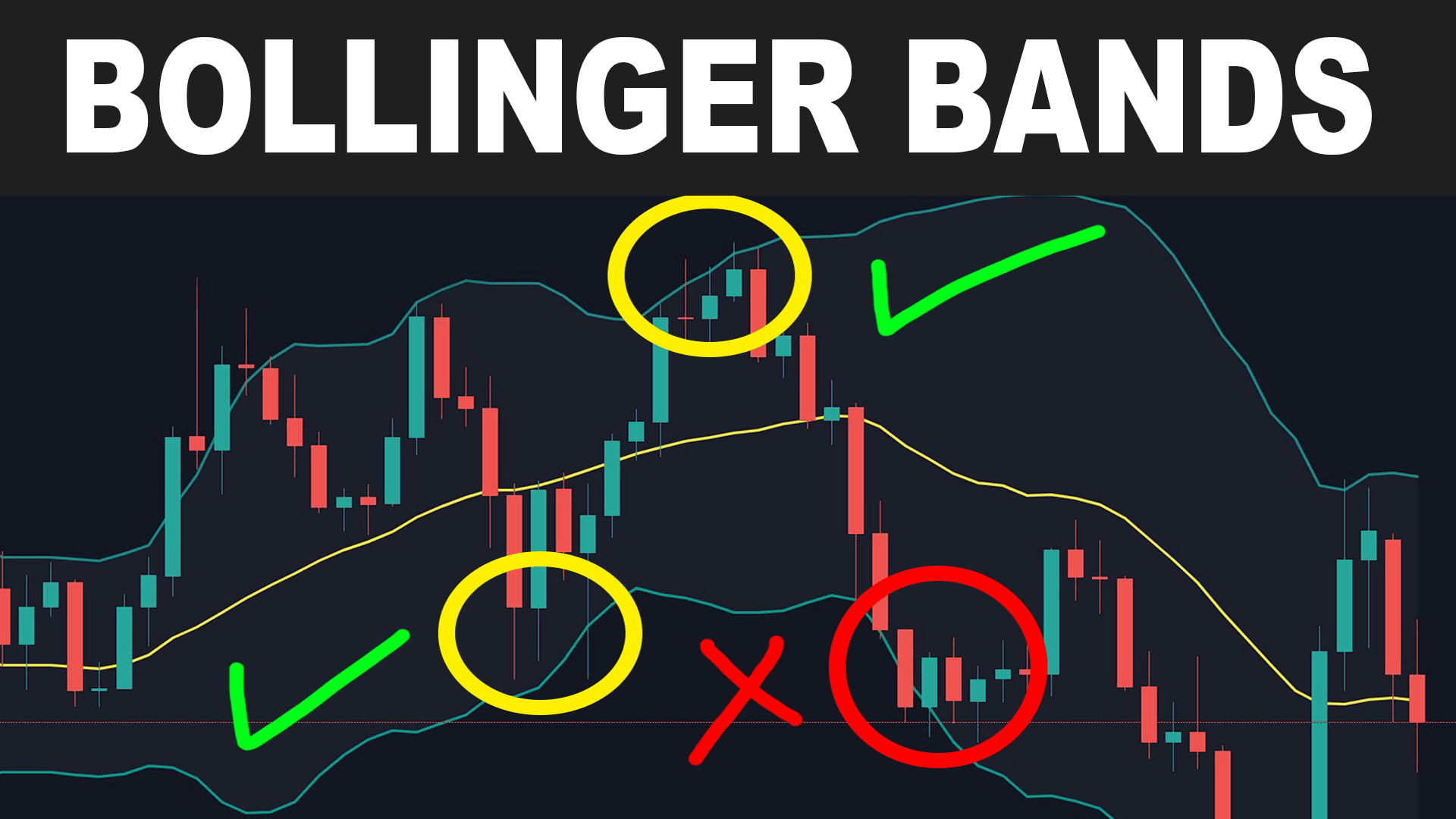

In the fast-paced world of Forex trading, navigating market volatility is paramount. One powerful tool that traders often rely on for this purpose is Bollinger Bands. These technical indicators provide a visual representation of market behavior, helping traders identify trends, overbought and oversold conditions, and potential trading opportunities.

Image: tradingrush.net

Unveiling Bollinger Bands: A Technical Trailblazer

Bollinger Bands consist of three lines: an upper Bollinger Band (UBB), a middle Bollinger Band (MBB), and a lower Bollinger Band (LBB). The MBB, also known as the moving average, typically represents a simple moving average (SMA) of a financial instrument’s closing prices over a specified period, usually 20 days. The UBB and LBB are set at a certain number of standard deviations above and below the MBB, respectively.

Standard Deviation: A Metric of Market Volatility

Standard deviation, a statistical measure, determines the range of prices within which the majority of price action occurs. The higher this deviation, the more volatile the instrument’s price movements tend to be.

Trading with Bollinger Bands: A Window into Market Dynamics

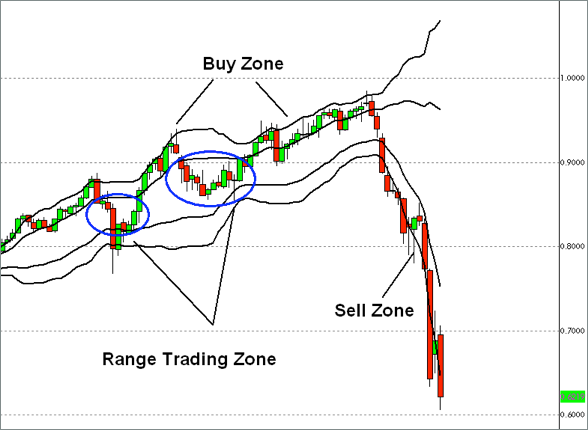

Traders utilize Bollinger Bands to assess market conditions and identify potential trading opportunities.

- Overbought and Oversold Conditions: When market prices trade above the UBB or below the LBB, it may indicate overbought or oversold conditions, respectively, signaling a potential reversal in trend.

- Trend Identification: Breakouts beyond the Bollinger Bands may provide traders with clues about the market’s direction. For instance, a breakout above the UBB suggests bullish momentum, while a breakout below the LBB indicates bearish activity.

- Volatility Assessment: The Bollinger Bands themselves capture market volatility. Wider bands signify greater volatility, making it useful for adjusting trading parameters and managing risk.

Image: trenujjakbyswalczyl.pl

Tips and Expert Advice for Enhanced Trading with Bollinger Bands

Bollinger Bands offer traders a valuable tool, but their application requires finesse and an understanding of market dynamics.

- Confirm with Multiple Indicators: While Bollinger Bands are highly effective, using them in conjunction with other technical indicators provides a more comprehensive market view.

- Respect Market Trends: Bollinger Bands can help traders identify potential trading opportunities, but ultimately, it is crucial to respect the current market trend and trade in line with it.

- Consider Band Width: Monitoring the width of the Bollinger Bands is as important as observing their position. Narrow bands indicate low volatility, while wide bands suggest high volatility.

FAQs: Empowering Traders with Answers

Q: What do Bollinger Bands measure?

A: Bollinger Bands measure price action relative to its recent standard deviation.

Q: How do Bollinger Bands help traders identify overbought and oversold conditions?

A: Bollinger Bands identify overbought and oversold conditions when prices move outside the upper and lower Bollinger Bands, respectively.

Q: How can traders use Bollinger Bands to gauge market volatility?

A: Wider Bollinger Bands indicate higher market volatility, while narrower bands suggest lower volatility.

Strategy Use Bollinger Bands In Forex Trading

https://youtube.com/watch?v=23QuKSxcG0o

Conclusion: Empowering Traders with Bollinger Bands

Bollinger Bands empower Forex traders with a powerful tool to navigate market volatility and identify potential trading opportunities. By understanding their construction and application, as well as incorporating expert advice, traders can enhance their trading decisions and achieve long-term success in this dynamic and competitive market. Whether you are new to Bollinger Bands or a seasoned trader, their versatility makes them an invaluable asset in your trading arsenal.

As an experienced blogger, I encourage you to explore the world of Bollinger Bands and delve deeper into their application to maximize your trading potential. If you have any further questions or wish to discuss this topic further, please feel free to engage in the comments section.