In the realm of financial markets, investors navigate a vast landscape brimming with opportunities and risks. With a plethora of investment vehicles at their disposal, from stocks to forex to commodities, selecting the most suitable path can be a daunting task. This article aims to demystify these asset classes, empowering investors to make informed decisions that align with their financial goals and risk tolerance. Join us on a journey to unravel the complexities of these markets and discover the path that best suits your investment preferences.

Image: www.livingfromtrading.com

Understanding Stocks: Ownership and Long-Term Growth

Stocks represent a share of ownership in a publicly traded company. When you invest in stocks, you become a partial owner of that business, entitled to a portion of its profits and growth. The value of your investment fluctuates with the performance of the company, increasing if its value rises and decreasing if it falls. Stocks offer the potential for substantial long-term growth, making them a popular choice for patient investors seeking capital appreciation.

Forex: Thrilling World of Currency Exchange

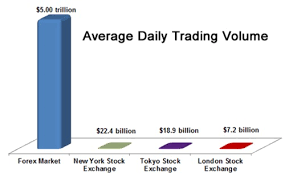

The foreign exchange (forex) market deals with the trading of currencies. In this dynamic arena, investors speculate on the value of one currency against another, seeking to profit from fluctuations in exchange rates. The forex market is the largest and most liquid financial market globally, offering traders opportunities for short-term gains. However, it’s essential to note that forex trading involves significant risk and requires a deep understanding of market dynamics and risk management techniques.

Commodities: Natural Resources and Raw Materials

Commodities are physical goods such as oil, gold, silver, and wheat. They serve as the building blocks of our economy, used in various industries ranging from energy to manufacturing. Investing in commodities provides diversification benefits and can act as an inflation hedge. The value of commodities is influenced by global demand and supply dynamics, as well as geopolitical events.

Image: surgetrader.com

Choosing the Best Investment Path: Navigating Your Risk-Reward Profile

The optimal investment path depends on your financial objectives, risk tolerance, and investment horizon. Here’s a simplified guide to help you navigate these factors:

High Risk, High Reward: If you’re willing to embrace higher volatility and have a long-term investment horizon, stocks or forex trading may align with your risk-reward profile. These options offer the potential for significant gains but carry the potential for substantial losses as well.

Moderate Risk, Moderate Reward: For those looking for a balance between risk and reward, commodities can provide diversification benefits and the potential for steady growth. While less volatile than stocks, commodities still carry some risk and should be carefully evaluated.

Low Risk, Low Reward: If your primary objective is capital preservation with minimal risk, consider investing in less volatile assets such as bonds or real estate. These options offer lower potential returns but provide stability and can serve as a foundation for your investment portfolio.

Stocks Forex Or Commodity Which Is Best

https://youtube.com/watch?v=XtZbMzA1Nx4

Unlocking Your Investment Journey

Choosing between stocks, forex, and commodities is a journey of self-discovery, requiring a deep understanding of your financial preferences and goals. Embark on this journey with a wealth of knowledge and a dose of caution, seeking guidance from trusted sources and experts along the way. Whether you seek long-term wealth accumulation or thrilling short-term gains, the financial markets offer a path for every investor. With patience, perseverance, and a well-informed approach, you can navigate the complexities of these asset classes and unlock your financial potential.