In the realm of global financial markets, retail forex trading has witnessed an unprecedented surge in popularity over the past decade. This burgeoning industry has reshaped the landscape of currency exchange, empowering individual traders to participate in the once-exclusive domain of institutional investors. To delve into the dynamics of this remarkable growth, let us embark on a journey through statistics, exploring the transformative trajectory of retail forex trading between the years 2000 and 2016.

Image: proper-cooking.info

A Decade of Meteoric Ascent

The dawn of the 21st century marked a pivotal moment for retail forex trading. With the advent of online trading platforms, the barriers to entry for individual traders dwindled, opening the door to a world of limitless opportunities. From 2000 to 2004, the industry experienced a steady incline, gradually laying the foundation for its future explosive growth.

The year 2005 proved to be a turning point, igniting a period of exponential expansion. The total retail forex volume, initially hovering around $100 billion per day, surged to an astounding $250 billion by 2007. This remarkable growth trajectory continued unabated, with volume exceeding $500 billion per day by 2010 and eclipsing the $1 trillion mark in 2012.

Factors Fueling the Boom

The meteoric rise of retail forex trading can be attributed to a confluence of factors. The widespread adoption of broadband internet and the proliferation of sophisticated trading platforms played a pivotal role, making it easier than ever for individuals to access the global forex market.

Furthermore, the financial crisis of 2008 inadvertently contributed to the industry’s growth. As traditional investment avenues suffered losses, traders sought alternative sources of revenue, and many turned to retail forex trading, drawn by the promise of higher returns and the potential to hedge against market volatility.

Technological Advancements and Regulatory Innovations

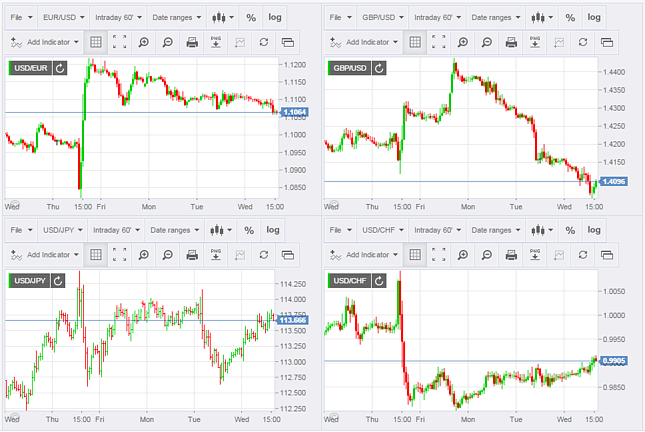

Technological advancements have been a driving force behind the surge in retail forex trading. The development of mobile trading applications has enabled traders to execute trades from anywhere at any time. Advanced charting tools and real-time market analysis have also empowered traders with greater insight and precision.

In parallel with technological innovations, regulatory frameworks have evolved to safeguard the interests of retail traders. The establishment of regulatory bodies such as the National Futures Association (NFA) in the United States and the Financial Conduct Authority (FCA) in the United Kingdom has instilled confidence among traders and fostered a more transparent and stable trading environment.

Image: www.bank2home.com

Statistics About Retail Forex Volume Between 2000 And 2016

The Future of Retail Forex Trading

As we stand at the cusp of a new era in retail forex trading, the future holds immense promise. Ongoing technological innovations, such as the advent of artificial intelligence and blockchain technology, are expected to further propel the industry forward. The democratization of financial markets will continue, empowering more individuals to participate in the global economy.

Regulatory frameworks will likely become even more stringent, ensuring the protection of traders and maintaining market integrity. The convergence of technology, regulation, and trader demand will undoubtedly shape the future of retail forex trading, creating even greater opportunities in this dynamic and ever-evolving financial landscape.