In the ever-connected world of today, international travel and business transactions have become more commonplace than ever before. With the rise of digital banking and fintech solutions, managing your finances overseas has never been easier. Among the most convenient and cost-effective options for managing your currency needs is the Standard Chartered Forex Card Single Currency. In this comprehensive guide, we’ll explore the ins and outs of this innovative financial tool, empowering you to navigate the world of international finance with confidence.

Image: www.sc.com

What is a Standard Chartered Forex Card Single Currency?

The Standard Chartered Forex Card Single Currency is a prepaid card that allows you to load a specific foreign currency onto the card and use it for transactions in that currency. Unlike traditional credit or debit cards, which convert your home currency into the local currency at the prevailing exchange rate, the Forex Card Single Currency eliminates the need for multiple currency conversions, saving you money on transaction fees. Additionally, the card is widely accepted at ATMs and merchants worldwide, ensuring convenient access to your funds whenever you need them.

Benefits of Using a Forex Card Single Currency

The Standard Chartered Forex Card Single Currency offers a range of benefits that make it an attractive option for frequent travelers and global businesspeople:

-

Significant Cost Savings: By eliminating multiple currency conversions, Forex Card Single Currency users can save up to 5% on foreign exchange fees compared to traditional credit or debit cards.

-

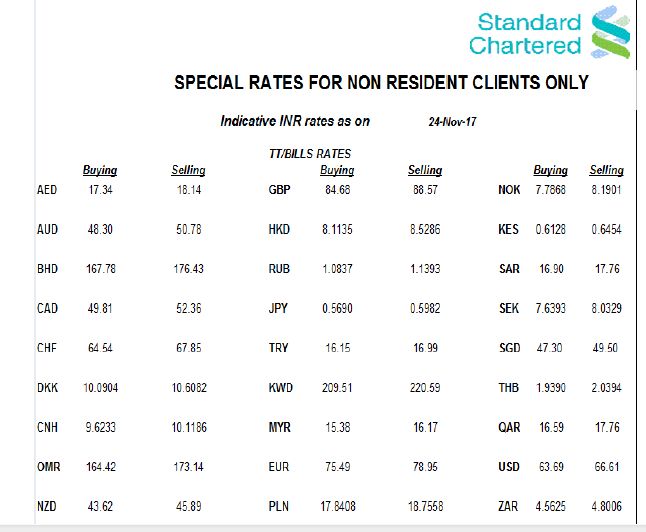

Competitive Exchange Rates: Standard Chartered offers competitive exchange rates, ensuring that you get the most value for your money.

-

Wide Acceptance: Forex Card Single Currency is accepted at millions of ATMs and merchants worldwide, providing you with easy access to your funds.

-

Security and Convenience: The card is equipped with chip-and-PIN technology and backed by Standard Chartered’s robust security measures, giving you peace of mind while traveling.

How to Use a Forex Card Single Currency

Using the Standard Chartered Forex Card Single Currency is simple and straightforward:

-

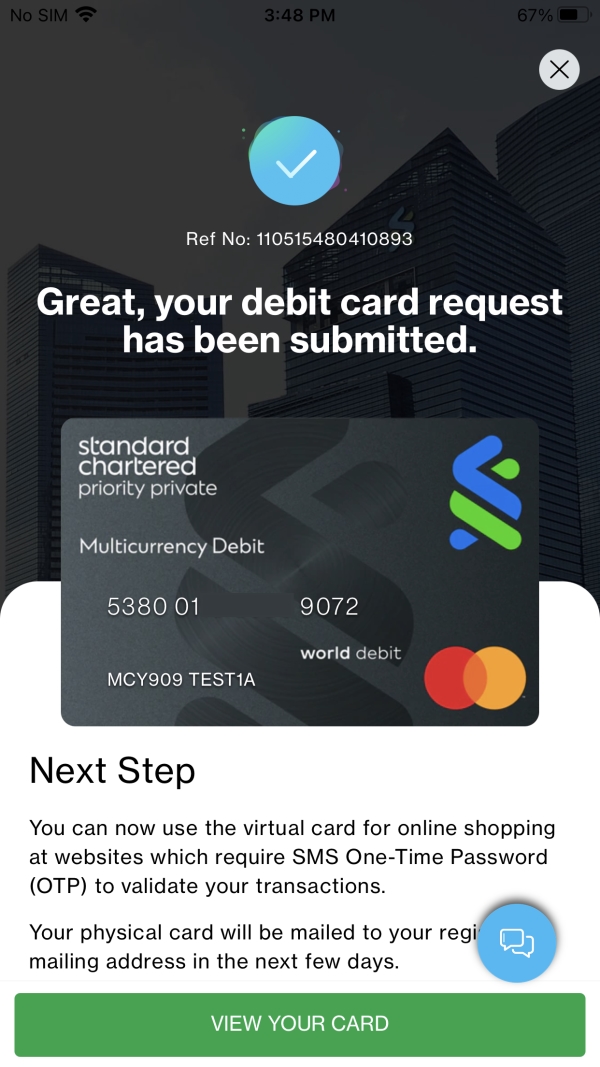

Load Your Card: Visit a Standard Chartered branch or use the Standard Chartered mobile app to load the desired foreign currency onto your card.

-

Make Transactions: Use the card to make purchases or withdraw cash in the local currency wherever you see the Visa or Mastercard logo.

-

Monitor Your Balance: Track your account balance and transaction history through the Standard Chartered mobile app or online banking portal.

Image: eduvark.com

Expert Insights and Tips

To maximize the benefits of using a Standard Chartered Forex Card Single Currency, consider these insights from financial experts:

-

Plan Ahead: Determine the currencies you will need for your trip or business transaction and load the appropriate currencies onto your card before leaving home.

-

Lock in Rates: If you know the exact amount of foreign currency you will need, consider using the ‘Rate Alert’ feature in the Standard Chartered mobile app to lock in favorable exchange rates.

-

Minimize Withdrawals: ATM withdrawals incur additional fees, so plan to withdraw larger amounts less frequently to save on fees.

Standard Chartered Forex Card Single Currency

Conclusion

The Standard Chartered Forex Card Single Currency is an indispensable tool for frequent travelers and global businesspeople, offering significant cost savings, convenience, and security. By understanding how to use this innovative card, you can empower yourself to manage your finances overseas seamlessly, unlocking the world’s possibilities with ease and confidence.