Introduction

Forex trading in St. Vincent and the Grenadines (SVG) has experienced significant growth in recent years. With a robust regulatory framework and a stable economic environment, SVG has become an attractive destination for forex brokers.

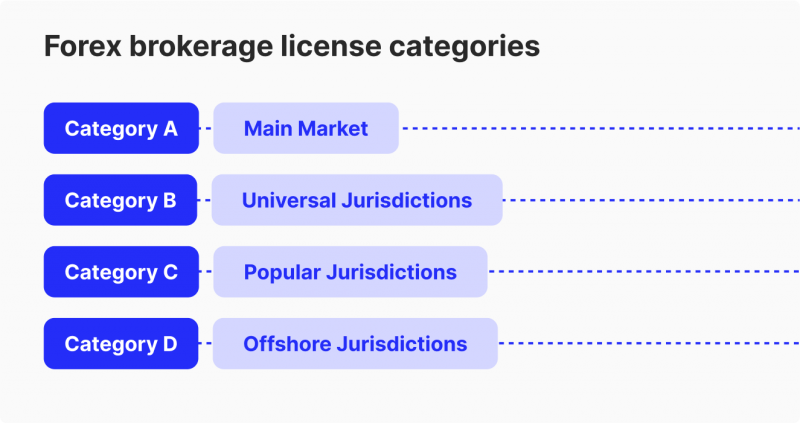

Image: b2broker.com

This detailed guide will explore the regulatory landscape of forex activities in SVG, providing a comprehensive overview of the benefits, requirements, and key considerations for brokers and traders.

SVG Financial Services Authority (FSA)

Regulatory Body

The SVG Financial Services Authority (FSA) is the chief regulatory body responsible for overseeing the financial services industry in SVG, including forex trading. The FSA is tasked with fostering market integrity, protecting consumers, and preventing financial crime.

Forex Regulation Framework

To operate as a forex broker in SVG, entities must obtain a Broker-Dealer license from the FSA. The licensing process entails rigorous due diligence, including financial background checks, fit and proper assessments, and a review of the broker’s operations and risk management framework.

Image: digitalcashpalace.com

Benefits of Forex Regulation in SVG

- Enhanced Credibility and Trust: FSA regulation signifies high standards of transparency, operational efficiency, and adherence to best practices.

- Investor Protection: Regulation safeguards investors by ensuring brokers meet minimum capital requirements, follow ethical trading practices, and segregate client funds from their own.

- Stable Regulatory Environment: SVG’s political and economic stability provides a favorable environment for long-term business operations and sustainable growth.

- Tax Advantages: SVG offers tax incentives to businesses, including forex brokers, creating a cost-effective operational structure.

Due Diligence for Forex Brokers

To obtain an FSA Broker-Dealer license in SVG, applicants must undergo a thorough due diligence process that entails:

- Financial Stability: Demonstrating sufficient capital reserves and a healthy financial position.

- Operational Structure: Outlining a robust organizational structure, risk management policies, and trading platform.

- Compliance Measures: Implement comprehensive compliance programs to prevent money laundering, terrorist financing, and other financial crimes.

- Segregation of Client Funds: Ensuring strict segregation of client funds from broker assets, promoting investor confidence and fund protection.

Latest Trends and Developments

Enhanced Focus on Cybersecurity

Recognizing the evolving threat landscape, the FSA encourages brokers to prioritize cybersecurity measures, such as robust firewall systems, encryption protocols, and regular security audits.

Formal Education and Certification

Professional certification programs for forex brokers have gained traction in SVG. These certifications ensure brokers possess the necessary knowledge and skills to navigate regulatory requirements and best industry practices.

Tips and Expert Advice

- Choose a Regulated Broker: Operating with an FSA-licensed broker provides the highest level of regulatory protection.

- Understand the Market: Educate yourself about forex markets, trading strategies, and risk management principles.

- Manage Risk Prudently: Employ appropriate risk management techniques, such as stop-loss orders and position sizing, to minimize potential losses.

- Practice Responsible Trading: Avoid excessive leverage, chase losses, or fall prey to trading scams.

- Stay Informed: Monitor regulatory updates, market trends, and industry developments to stay abreast of changes.

Frequently Asked Questions

Q: Is SVG a safe jurisdiction for forex trading?

A: Yes, with the FSA’s robust regulation and stable economic environment, SVG is a reputable and reliable jurisdiction for forex activities.

Q: What are the benefits of using an SVG-based forex broker?

A: FSA regulation ensures credibility, investor protection, a stable regulatory environment, and tax advantages.

Q: Is it easy to obtain an FSA Broker-Dealer license?

A: Acquiring an FSA license entails a rigorous due diligence process, ensuring financial stability, a robust operational structure, compliance measures, and segregation of client funds.

St Vincent’S Forex Regulation

Conclusion

St. Vincent’s forex regulation offers a secure and transparent environment for both brokers and traders. By adhering to high regulatory standards and providing essential investor protections, SVG has established itself as an advantageous jurisdiction for engaging in forex activities.

Are you interested in exploring the opportunities and benefits of forex trading in SVG? Conduct thorough research, choose a reputable FSA-regulated broker, and follow sound trading