Learn the Secrets of Forex Spread: The Key to Trading Success

Image: tradingelliottwave.com

Introduction:

In the fast-paced and lucrative world of forex trading, the spread is the lifeblood of every trader’s strategy. It’s a hidden force that can make or break your profits, yet it often remains shrouded in mystery. This comprehensive guide will unravel the secrets of forex spread, empowering you with the knowledge and confidence to navigate the markets like a pro.

Defining Forex Spread: A Key Concept

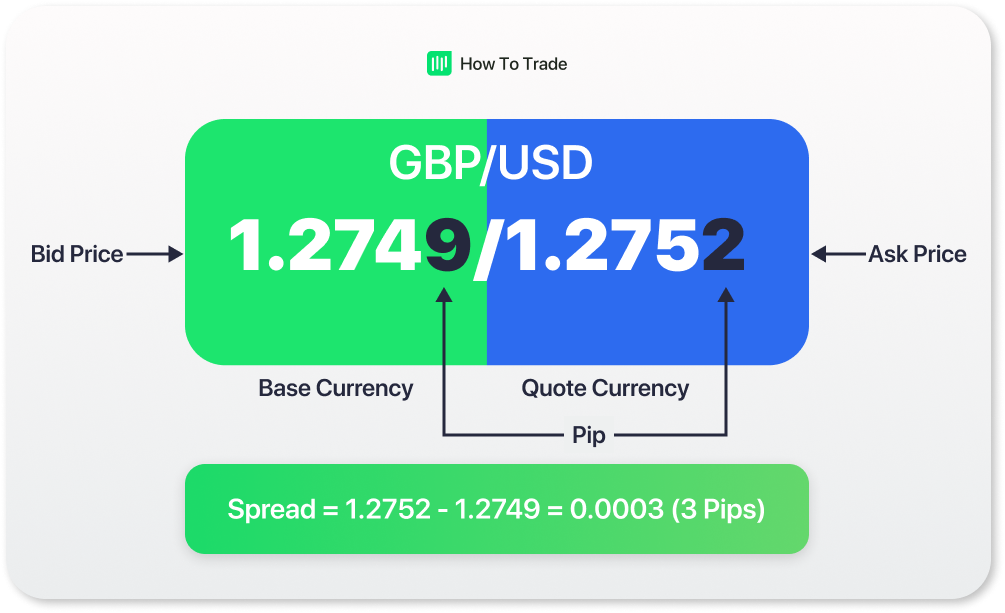

Forex spread refers to the difference between the bid price and the ask price of a currency pair. When you place a buy order, you’ll transact at the ask price, while a sell order executes at the bid price. This spread represents the broker’s commission or transaction fee for facilitating your trade.

Types of Spreads: Fixed vs. Variable

Forex brokers offer two main types of spreads: fixed and variable. Fixed spreads remain constant throughout the day, providing consistency but potentially higher costs during volatile markets. Conversely, variable spreads fluctuate with market conditions, offering tighter spreads in quiet periods but risking wider gaps during periods of high trading activity.

Factors Influencing Spread: A Deeper Dive

Several factors can impact the spread of a currency pair:

-

Market Conditions: Spread tends to widen during periods of low liquidity, such as during weekends or overnight sessions.

-

Currency Pair’s Liquidity: More liquid currency pairs, like EUR/USD, typically have tighter spreads than exotic pairings.

-

Brokerage Fees: Different brokers charge varying commissions or markups on spreads. Choose brokers with competitive spreads to minimize transaction costs.

-

Account Type: Premium account holders often enjoy tighter spreads compared to standard or demo accounts.

Impact of Spread on Trading: The Ripple Effect

Spread directly impacts your trading profitability. Tight spreads lead to higher profits, while wider spreads can erode your returns. Hence, choosing a broker with competitive spreads is crucial for long-term success.

Expert Insights: Navigating Spread in Trading

Renowned forex expert, Mark Hanson, emphasizes the importance of choosing the best trading hours to minimize spread. He recommends trading during high-volume periods when spreads tend to be tighter. Avoid trading against the prevailing trend, as this can exacerbate spread costs.

Actionable Tips: Optimizing Your Spread

-

Shop Around: Compare spread offerings from multiple brokers before signing up.

-

Negotiate a Better Deal: Reach out to brokers and inquire about lower spreads, especially if you trade significant volumes.

-

Understand Market Conditions: Stay abreast of economic news and events that can affect market volatility and spreads.

-

Time Your Trades Wisely: Trade during peak market hours when spreads are typically tighter.

Conclusion: Mastering Forex Spread

Understanding the forex spread and its key factors can empower you to make informed trading decisions. By choosing brokers with competitive spreads, trading during optimal hours, and considering market conditions, you can minimize transaction costs and maximize your profitability. Remember, Forex spread is not just a fee – it’s a potential ally that can unlock a world of success.

Image: howtotrade.com

Spread In Forex Quote Wiki