In the diverse financial market landscape, choosing the ideal trading instrument is crucial for achieving long-term success. For savvy investors looking to leverage fluctuations in asset prices, Contracts for Difference (CFDs) and spread betting emerge as viable options. While both carry unique advantages and drawbacks, understanding their key differences empowers traders to select the strategy that aligns best with their objectives and risk tolerance.

Image: forexrobotexpert.com

CFDs: A Versatile Trading Instrument with Contractual Obligations

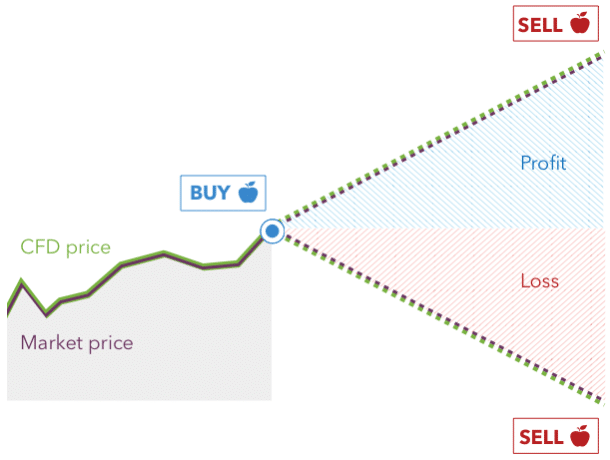

CFDs are financial contracts that track the price movement of underlying assets, mirroring their gains and losses. They do not involve the physical exchange of an asset but instead represent a legal agreement between the trader and the broker. This format offers several benefits to traders:

- Flexibility: CFDs provide access to a wide range of underlying assets, including stocks, indices, commodities, and forex. Traders can speculate on various market movements without the need to own the underlying asset directly.

- Leverage: CFDs allow traders to use leverage, magnifying their potential profits. However, it’s important to note that leverage also amplifies losses, making it crucial to manage risk effectively.

- Speculation on Both Directions: With CFDs, traders can speculate on price movements in both directions. They can profit from both rising and falling markets, providing greater trading flexibility.

Spread Betting: A Tax-efficient UK-centric Trading Mechanism

Spread betting, primarily popular in the United Kingdom, is a type of financial wagering that revolves around predicting the future price direction of an underlying asset. It is different from CFDs in several key aspects:

- No Physical Ownership: In spread betting, traders do not own the underlying asset and simply wager on its price movements.

- Tax Advantages: In the UK, spread betting winnings are exempt from income tax and capital gains tax, providing a significant advantage for many traders.

- Simple Structure: Spread betting involves a simpler trading structure than CFDs, making it more accessible for beginners.

Choosing Between CFDs and Spread Betting: A Tale of Risk, Objectives, and Taxation

When selecting between CFDs and spread betting, traders should carefully consider their individual circumstances and trading objectives. CFDs offer greater flexibility and access to a wider range of assets, while spread betting provides tax advantages and a simpler structure.

- Risk Management: Traders with a higher risk appetite and a good understanding of leverage may find CFDs more appealing. On the other hand, those prioritizing capital preservation and simplicity may prefer spread betting.

- Trading Objectives: CFDs are more suited for traders seeking to scalp the markets or engage in short-term trading strategies. Spread betting, with its tax advantages, may be more suitable for medium- to long-term traders looking to capitalize on directional trends.

- Tax Considerations: In the UK, spread betting offers significant tax advantages, especially for profitable traders. However, non-UK traders should consider the tax implications in their jurisdiction before engaging in spread betting.

Image: www.accendomarkets.com

Spread Betting Cfds And Forex

Conclusion: A Prudent Decision Based on Personal Circumstances

Ultimately, choosing between CFDs and spread betting is a personal decision that depends on individual risk tolerance, trading goals, and tax considerations. By understanding the nuances of each instrument, traders can select the strategy that aligns best with their objectives and financial profile. Remember, prudent decision-making is key to navigating the complexities of the financial markets and achieving long-term trading success.