For every seasoned trader, timing is everything, and the realm of forex trading is no different. Understanding the optimal times to enter and exit the market can significantly enhance your chances of success. This comprehensive guide will unravel the secrets of identifying the special time to trade forex, leading you on a path toward maximizing your trading potential.

Image: payehuvyva.web.fc2.com

Why Timing Matters in Forex Trading

The forex market is a dynamic and ever-changing landscape, influenced by a myriad of global economic and political factors. By skillfully navigating the ebb and flow of market activity, traders can position themselves to capture profitable opportunities while minimizing potential losses. Identifying the special time to trade forex empowers traders to capitalize on market trends, predict price fluctuations, and optimize their trading strategies.

When is the Special Time to Trade Forex?

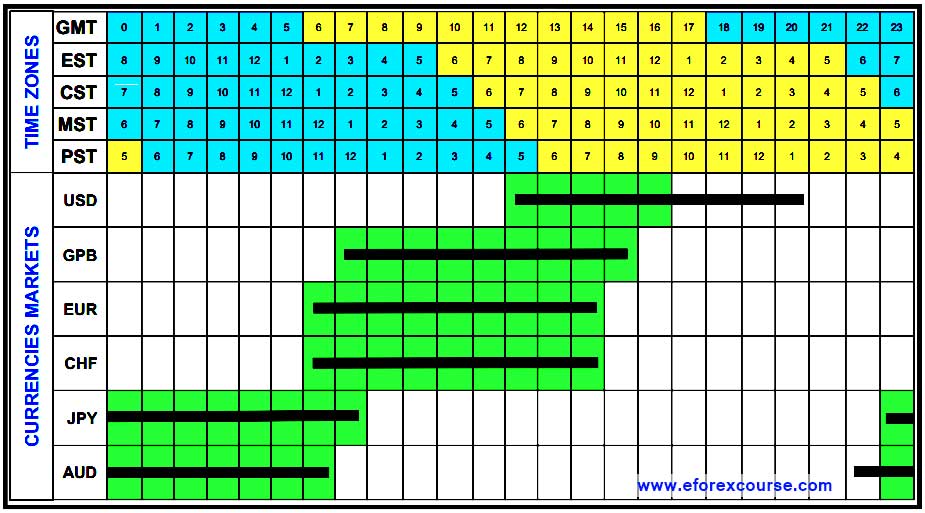

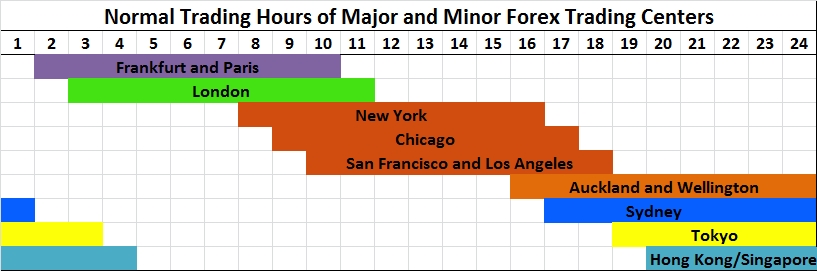

Determining the most favorable time to trade forex requires consideration of various factors, including currency pairs, trading style, and risk tolerance. However, certain time periods consistently emerge as prime targets for profitable trading.

Early London Session (London Open)

From 7:00 AM to 9:00 AM GMT, the London open marks the convergence of trading activity from Europe, Asia, and the UK. As one of the largest financial centers globally, London’s opening provides an influx of liquidity and volatility, creating ideal conditions for trend trading and scalping.

Image: bank2home.com

New York Close (US Close)

As the New York trading session concludes at 5:00 PM ET, major currency pairs tend to showcase distinct price patterns and trends. This period is particularly suited for technical traders utilizing end-of-day strategies, as it offers ample opportunities for range trading and capturing pullbacks.

Peak Asian Session (Tokyo Open)

From 12:00 AM to 4:00 AM GMT, the Tokyo open signals the commencement of trading in the Asia-Pacific region. During this time, volatility typically remains subdued, providing opportunities for breakout strategies and longer-term position trading.

Choosing the Right Time Zone for Your Trading

While identifying specific trading times is crucial, tailoring your approach to your preferred time zone is equally important. Forex traders can adjust their schedules to align with these special trading hours, ensuring they capitalize on the optimal market conditions while fitting within their personal routines.

Unlocking the Benefits of Trading During Special Time

Understanding and leveraging the special time to trade forex unlocks a host of advantages that can elevate your trading performance:

-

Enhanced Liquidity: These prime trading hours attract a surge in market participants, resulting in higher liquidity levels. This increased liquidity facilitates smoother trades, eliminates slippage, and improves order execution.

-

Increased Volatility: During special trading times, increased market activity leads to greater price volatility. Traders can utilize this volatility to maximize profits through trend trading and breakout strategies.

-

Correlation with Global Events: Important economic releases and news announcements often coincide with special trading hours, providing traders with valuable insights that can anticipate market reactions.

-

Trading Psychology: Psychological effects play a significant role in forex trading. Trading during optimal times can boost confidence and reduce anxiety by aligning with the rhythm of the market.

Tips for Success

To maximize your success when trading during special times, consider the following tips:

-

Risk Management: Always prioritize risk management by determining appropriate position sizes and employing stop-loss and take-profit orders.

-

Technical Analysis: Technical indicators and chart patterns can provide valuable insights during special trading times. Study price behavior, identify trends, and make informed decisions.

-

News and Analysis: Stay abreast of market news and fundamental analysis to anticipate potential price movements and make well-informed trades.

-

Consistency: Establishing a consistent trading routine and adhering to a disciplined approach can improve your outcomes and enhance trading performance.

Special Time To Trade Forex

Conclusion

Mastering the art of identifying the special time to trade forex equips you with a powerful tool to enhance your profitability. By aligning your trading with these optimal periods, you can harness increased liquidity, volatility, and invaluable market insights. Remember to tailor your approach to your time zone, implement sound risk management practices, and stay informed of market news. Embrace the power of timing in forex trading and unlock the path to unlocking your full potential as a successful trader.