The Art of Analyzing a Single Candlestick for Exceptional Trading Opportunities

Immerse yourself in the captivating world of forex trading, where the art of analyzing a single candlestick pattern holds the key to unlocking exceptional trading opportunities. This article will delved deep into the enigmatic world of candlestick charting, helping you master the intricacies of the single candle effect. Through a comprehensive exploration of its history, meaning, and significance, we will empower you with a profound understanding of this powerful trading tool.

Image: scalpingforexquees.blogspot.com

Candlesticks have graced the annals of trading for centuries, originating in 18th century Japan as a means to forecast rice prices. Over the years, they have evolved into invaluable tools for traders, providing a visual representation of market sentiment and price action. Each candlestick captures the drama and dynamics of price movement during a specific time frame, illuminating the intricate interplay of bulls and bears.

Deciphering the Language of Candlesticks: A Comprehensive Guide

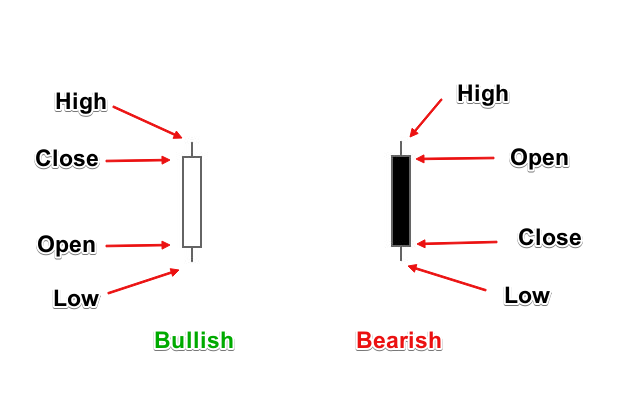

The single candle effect in forex trading refers to the profound impact that a single candlestick can have on a trader’s decision-making process. By carefully dissecting the body, shadows (wicks), and position of the candlestick, traders can glean insights into market sentiment, potential trend reversals, and areas of support and resistance. Mastering candlestick charting is akin to unraveling a cryptic language, granting traders the ability to derive valuable information from seemingly innocuous price action.

The body of a candlestick represents the price range between the open and close prices, revealing whether buyers or sellers dominated during that specific period. A large body indicates a significant price swing, while a small body suggests a more subdued market. The shadows (wicks) extending beyond the body depict the highest and lowest prices reached during the period, providing essential information about price volatility and momentum.

Harnessing the Power of Single Candle Patterns for Profitable Trading

Recognizing the significance of single candlesticks and their patterns is the key to unlocking the hidden potential in forex trading. A solitary candlestick, when viewed in isolation, can serve as a powerful indicator of market sentiment. For instance, a long bullish candle with a small lower shadow and a wick extending above the body may suggest a strong upward trend. Conversely, a bearish candle with a long upper shadow and a wick extending below the body may signal a potential trend reversal or profit-taking.

Traders must also consider the context of the single candlestick within the overall market trend. A bullish candle appearing during an uptrend may reinforce the continuation of the trend, while the same candle appearing during a downtrend may hint at a possible reversal. By carefully assessing the relationship between individual candlesticks and the prevailing market sentiment, traders gain valuable insights into potential trading opportunities.

The Single Candle Effect: A Practical Guide for Identifying Profitable Trades

The single candle effect offers a versatile and adaptable tool for forex traders, catering to a diverse range of trading styles. Scalpers can capitalize on short-term price movements by identifying and trading on the basis of single candlestick patterns. Day traders can utilize single candlesticks to refine their entries and exits, maximizing profit potential while minimizing risk. Swing traders can leverage single candlesticks to pinpoint potential reversal points, enhancing their ability to capture larger market moves.

To maximize the effectiveness of the single candle effect, traders must carefully consider the following tips:

- Avoid relying solely on a single candlestick pattern for decision-making. Integrate it with other technical analysis tools and indicators for a comprehensive assessment.

- Understand the context of the candlestick within the broader market trend. A single candle pattern may have different implications depending on the prevailing market sentiment.

- Exercise patience and discipline. Analyzing single candlesticks requires an astute eye for detail and a thorough grasp of price action. Do not rush into trades based on impulsive decisions.

Image: homecare24.id

Frequently Asked Questions on the Single Candle Effect

Q: Can a single candlestick provide reliable trading signals?

A: While a single candlestick can offer valuable insights, it is essential to consider the context of the overall market trend and incorporate other technical analysis tools for a well-rounded analysis.

Q: How can I identify the most significant single candlestick patterns?

A: The most significant single candlestick patterns are those that occur during key points in the market, such as trend reversals or breakouts. Look for candlesticks with large bodies, long shadows, and distinct open-close relationships.

Q: Can I use the single candle effect for all forex pairs and time frames?

A: The single candle effect can be applied to any forex pair and time frame. However, it is essential to adjust your trading strategy based on the specific characteristics of the pair and time frame you are trading.

Single Candle Effect In Forex Trading

Embracing the Single Candle Effect: A Path to Enhanced Trading Performance

In the dynamic and ever-evolving world of forex trading, the single candle effect stands out as a powerful and versatile tool. By mastering its intricacies, traders can gain a deeper understanding of market sentiment, identify potential trading opportunities, and refine their trading strategies for enhanced performance. Remember, the pursuit of knowledge and continuous learning is the key to unlocking the true potential of the single candle effect in forex trading.

Are you ready to delve into the captivating world of candlestick charting and unlock the secrets of the single candle effect? The path to exceptional trading performance awaits!