In the realm of foreign exchange (forex) trading, the question of “high margins” versus “low margins” has been a constant debate among traders. While both strategies have their merits, the optimal choice depends on your risk tolerance, financial objectives, and trading style. Embark on this enlightening journey as we delve into the intricacies of forex margins and explore the factors that should guide your decision-making process.

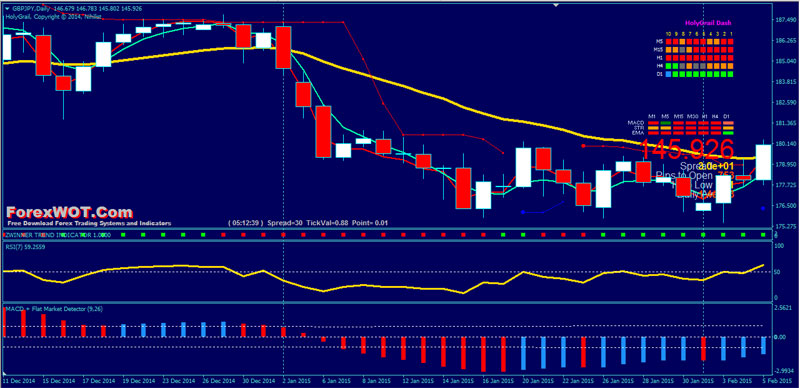

Image: forexwot.com

Unveiling the Concept of Forex Margins

Imagine stepping into a dance with an unseen partner—forex margins are akin to that initial step, determining the space you’ll occupy in the currency arena. They represent the minimum amount of capital you must set aside to control a specific value of currency in the market. High margins demand substantial capital, while low margins allow you to trade with a smaller financial cushion. The choice between the two hinges on a delicate balance of risk and reward.

High Margins: A Conservative Approach

Traders seeking to navigate the forex market with a conservative mindset often opt for high margins. The ample capital backing their trades acts as a buffer, absorbing potential losses and safeguarding their positions. This strategy proves particularly valuable during market volatility, as traders can endure fluctuations without facing margin calls. However, the downside of high margins is the limited leverage they offer, potentially restricting profits if the market moves in your favor.

Low Margins: Embracing the Thrill

Adventure-loving traders who relish the thrill of high leverage and potentially explosive returns gravitate towards low margins. With less capital tied up, they can control a larger volume of currency trades, amplifying their potential gains. Nevertheless, this strategy carries inherent risks. Without sufficient capital to withstand market fluctuations, low margins can lead to significant losses, including the dreaded margin call.

Image: www.hsb.co.id

The Path to Finding Harmony

Deciding on the ideal margin level is a personal choice, influenced by a symphony of factors. Aspiring traders should meticulously consider their risk tolerance, financial goals, and trading style before making a decision. For those new to forex, starting with higher margins may provide a safety net while they hone their trading skills. As their expertise flourishes, they can gradually reduce margins to access greater leverage and profit potential.

Empowering Strategies for Prudent Traders

In the dynamic realm of forex trading, knowledge is the key to success. Seek guidance from experienced traders, attend webinars, and devour educational resources to enhance your understanding of market dynamics. Practice diligently with a demo account, testing different strategies and margins to discover what resonates with your trading style. A well-informed and well-prepared mind is your most potent weapon in the forex arena.

Should Forex Be High Or Law

Closing Remarks: A Wise Choice for Triumph

Whether you embrace the prudence of high margins or the exhilaration of low margins, remember that the path to forex trading success is paved with knowledge, discipline, and adaptability. By aligning your margin strategy with your financial goals and risk tolerance, you can unlock the gateway to profitable opportunities in the ever-evolving currency market.